Coinbase’s newly launched wrapped Bitcoin product, cbBTC, has seen fast adoption inside its first 24 hours, with a market capitalization nearing $100 million.

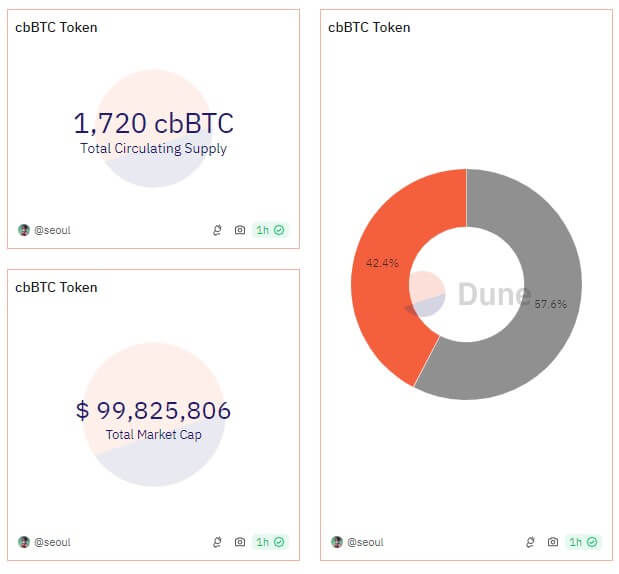

Knowledge from Dune Analytics reveals the circulating provide of cbBTC has reached 1,720 tokens, valued at $99.8 million. Of this, 43% is on Base, whereas 57% resides on Ethereum.

Base’s DeFi development

Business analysts have famous that Coinbase’s cbBTC development might considerably increase DeFi actions on the change’s layer-2 community, Base.

Luke Youngblood, a contributor to Moonwell DeFi, highlighted the product’s influence. He identified that cbBTC’s fungibility with Bitcoin on Coinbase would allow retail BTC holdings exceeding $20 billion and institutional holdings over $200 billion to seamlessly combine with Base’s on-chain ecosystem.

Nansen CEO Alex Alealso praised the token’s fast adoption and predicted that it will considerably improve complete property on the Base community.

Additional, He shared that Coinbase at present holds about 36% of the availability, whereas market maker Wintermute ranks among the many high holders. Svanevik remarked:

“[It appears] Wintermute is the #1 market maker. [It will] be a strong enterprise for them.”

Solar FUDs cbBTC

Regardless of cbBTC’s early success, not everyone seems to be optimistic.

TRON founder Justin Solar voiced skepticism, dubbing cbBTC “central financial institution BTC” on account of its lack of Proof of Reserve audits and potential authorities intervention.

He acknowledged:

“cbbtc lacks Proof of Reserve, no audits, and might freeze anybody’s stability anytime. Primarily, it’s simply ‘belief me.’ Any US authorities subpoena might seize all of your BTC. There’s no higher illustration of central financial institution Bitcoin than this. It’s a darkish day for BTC.”

Solar additional claimed that integrating cbBTC into DeFi might introduce safety dangers, as authorities subpoenas might immediately freeze on-chain Bitcoin, undermining decentralization. He mentioned:

“I’m associates with many DeFi protocol founders, however integrating cbbtc will pose main safety dangers to decentralized finance. A single authorities subpoena might freeze on-chain Bitcoin immediately, making decentralization a joke.”

Some have advised Solar’s criticisms could stem from issues that Coinbase’s cbBTC might encroach in the marketplace share of BitGo’s WBTCa undertaking with which Solar has ties. Notably, his involvement with WBTC has sparked debate inside the crypto group, as some now search alternate options.