Chainlink is the main middleware, linking on-chain dapps with exterior knowledge securely. Whereas the platform is essential in lots of crypto sectors, particularly DeFi, LINK has not too long ago struggled for momentum.

LINK Holders Transferring Tokens From Exchanges: Are They Accumulating?

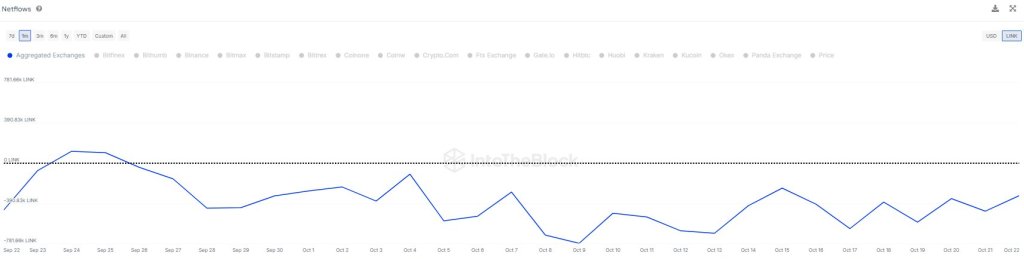

Nevertheless, on-chain streams from IntoTheBlock reveal that extra holders are transferring tokens from prime exchanges like Binance and Coinbase. In a submit on X, the analytics platform observes that trade circulation over the previous month has been adverse, signaling sustained withdrawals.

Normally, at any time when tokens are moved from exchanges, it may point out that house owners are assured of what lies forward. Since LINK, the ERC-20 token, is supported by many DeFi protocols, it may counsel that holders are excited about participating with these dapps, presumably incomes passive revenue.

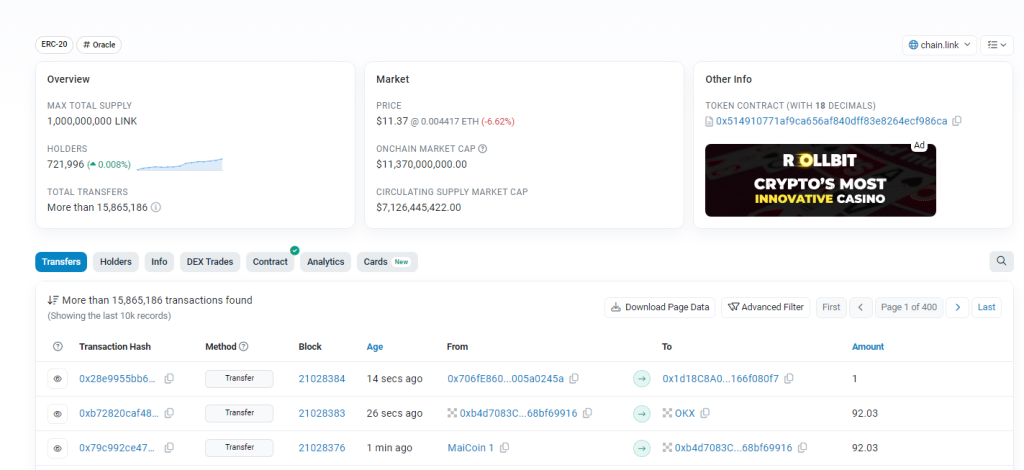

The extra transfers from centralized ramps, the upper the chance of costs increasing in tandem, which is a web optimistic for LINK bulls. In keeping with Etherscan, Chainlink has a prime provide of 1 billion LINK distributed to 721,996 distinctive addresses when writing on October 23.

These holders have, in flip, moved LINK over 15.8 million occasions. A stage deeper, onchain knowledge reveals that Binance controls greater than 4.2% of the whole provide. LINK underneath their management exceeds $479 million at spot charges.

Chainlink Constructing: Will Value Break Above $20?

With IntoTheBlock knowledge pointing to web outflows from exchanges, there’s a likelihood that LINK will discover help and resume the uptrend of the previous few buying and selling days. LINK has resistance at $12.3, and a double bar bear formation is printing out following the dip of early immediately.

Nevertheless, even when costs break increased, rejecting bears, bulls should decisively develop above the double prime at round $13. The eventual spike will open the door for LINK bulls to create a stable base for a rally to $20.

The tempo of this progress is dependent upon how prime altcoins, together with Ethereum, carry out. If Ethereum costs get well, hovering above $3,000, it may reinvigorate DeFi and NFT demand, lifting LINK.

Past this, worth drivers will embrace the group’s progress. Yesterday, October 22, Chainlink Labs launched the Cross-Chain Interoperability Protocol (CCIP) Personal Transactions. This characteristic allows knowledge privateness with out violating present legal guidelines guarding cross-chain transactions.

The answer makes use of the middleware’s Blockchain Privateness Supervisor. This fashion, associate banks and different monetary gamers can securely join personal chains with different ledgers at any time when they share delicate info.