Huge Tech’s dominance is increasingly coming into query, and yesterday, the CFPB took intention at its monopolization of the Faucet-to-Pay trade.

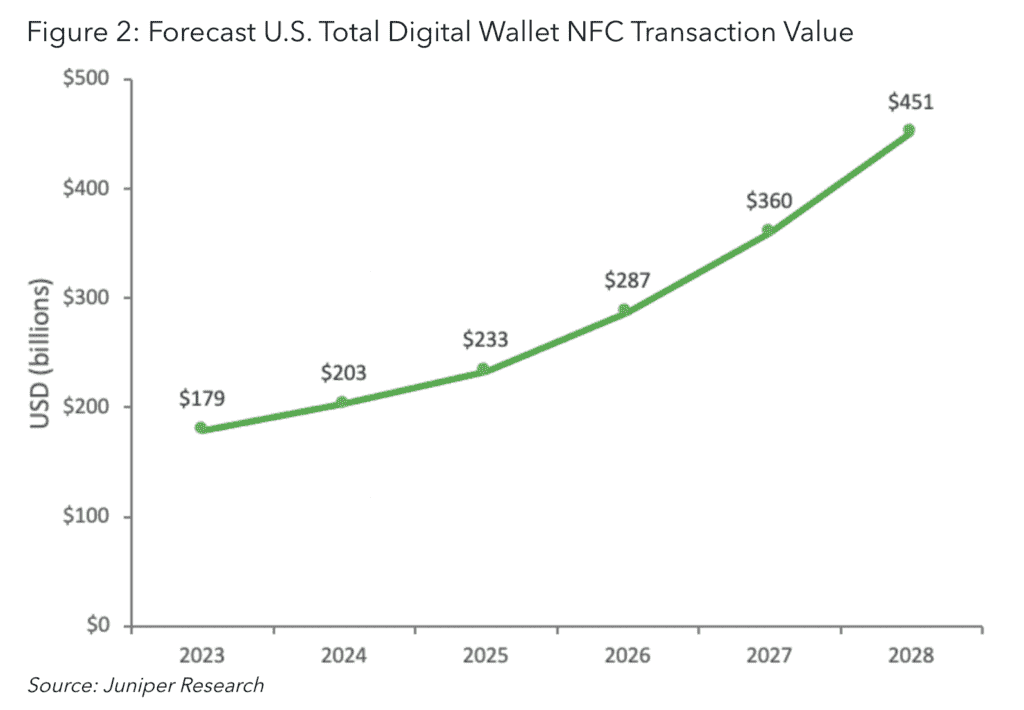

Faucet-to-pay has elevated in significance to the funds trade, enabling a forecasted $179 billion of transactions in 2023. Analysts count on this quantity to develop significantly, rising by 150% by 2028.

Though the Close to Subject Communication (NFC) expertise underlying tap-to-pay emerged in 2010, the usage of cell funds has elevated considerably in recent times, driving its reputation additional. This yr, Visa reported that one in each three Individuals has used tap-to-pay, seven occasions the quantity three years earlier.

CFPB Director Rohit Chopra defined throughout his speech on the Federal Reserve Financial institution of Philadelphia’s Annual Fintech Convention that the pandemic had accelerated shifts in how customers make funds at level of sale.

“The pandemic had a pronounced impact on how we interact in digital transactions… use of digital wallets, bank cards, and debit playing cards grew, with digital pockets use leaping by round 40 %,” he stated. “All of us noticed the acceleration in e-commerce, however whilst Individuals returned to in-person purchasing, customers and retailers additional embraced contactless funds.”

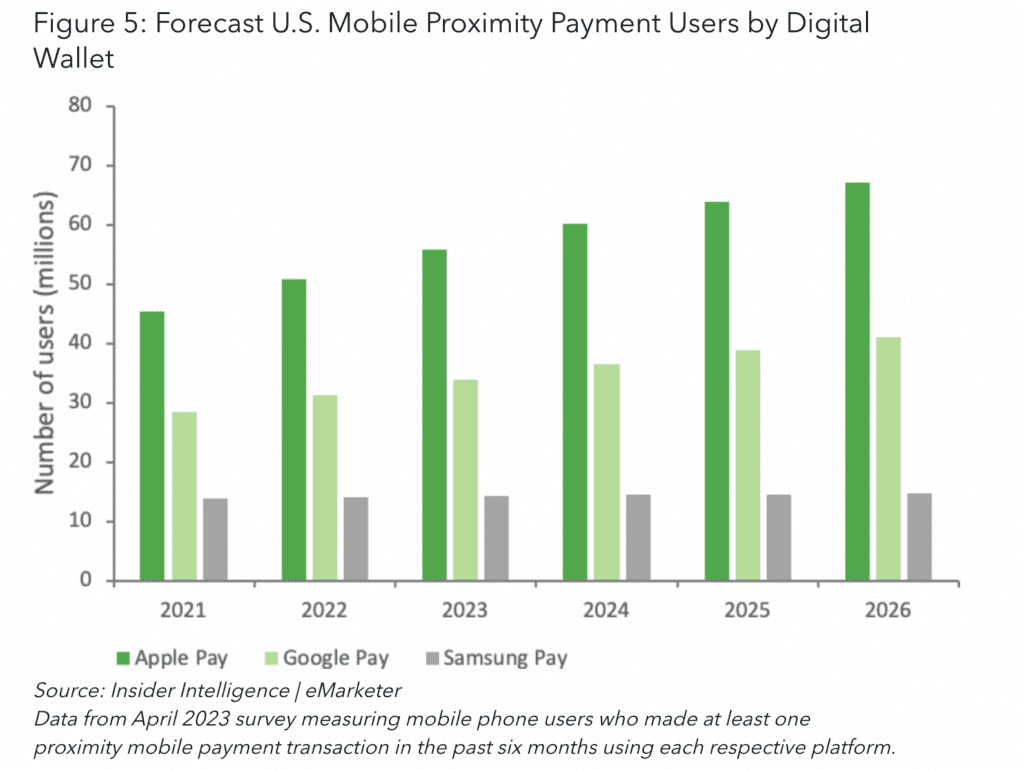

The CFPB’s argument towards Huge Tech’s energy over the tap-to-pay area was centered on Apple and Google, which dominate the marketplace for cell working programs. Presently, Apple iOS is put in on round 55% of telephones shipped to the US, Google’s Android system is put in on 45%.

The businesses’ monopolization of the working system market has given them vital clout over the regulation of the tap-to-pay trade. Apple, specifically, has carried out restrictive phrases of use that don’t enable third-party apps to make use of the NFC expertise on iOS programs with out registering with Apple Pay and incurring charges. In 2022, Apple Pay alone enabled $199.41 billion in US point-of-sale funds.

“Rules imposed by Huge Tech corporations have a huge impact on whether or not customers and companies could make funds utilizing third-party apps,” stated Chopra. “If an app doesn’t adjust to Apple’s or Google’s rules, the app could possibly be denied entry or face removing from the App Retailer and Play Retailer, making it inaccessible as an app to almost each cell gadget.”

Huge Tech’s dominance might stand in the best way of an open, decentralized fee system

Chopra defined that because the US makes steps in the direction of open finance, Huge Tech corporations’ energy over the funds area might work towards innovation.

“Apple and Google dominate the smartphone working system market,” he stated. “As adoption of contactless funds on cell phones continues to extend, these two corporations, and the enterprise fashions and selections they make use of, can have profound impacts on the competitiveness of the funds market and the way forward for open banking.”

The disruptive innovation of startups has proved itself repeatedly within the funds trade, driving improvement ahead. Chopra defined that for tap-to-pay, this innovation could possibly be stilted by Huge Tech’s dominance.

“In a extra open and decentralized funds market, we’d count on that there could be a plethora of gamers leveraging tap-to-pay functionalities,” he stated. “We would count on to see a number of corporations and monetary corporations working to combine tap-to-pay expertise into their current cell apps, the identical approach we now have seen so many apps combine our cell gadget’s digicam or GPS capabilities. Nevertheless, we don’t discover this in any respect.”

Google differs from Apple’s totalitarian method, leaving the NFC expertise open to be used by third-party apps. Consequently, the CFPB famous an elevated stage of competitors and innovation on Android gadgets. Nevertheless, Google has confronted plenty of allegations of abuse of its energy over third-party apps, inserting preferential circumstances to manage their entry to the market.

“We all know that the prevailing monetary market construction is filled with chokepoints and toll cubicles imposed by giant corporations appearing as mini-governments that may privately regulate markets and warp outcomes, significantly concerning funds,” stated Chopra.

He said that the CFPB’s proposed laws authorizing elevated private information rights might assist curb the businesses’ energy. Nevertheless, Huge Tech posed a problem to reaching the purpose of a extra open monetary system.

“Whereas I agree that robust challenges to the dominant Wall Road banks and card networks are vital,” he continued. “There’s actual concern that the massive expertise corporations will be capable of erect much more gates and toll cubicles that may stop small corporations from rising and succeeding, even once they supply superior merchandise.”

He said {that a} “shut examination” of Huge Tech could be important to avoiding this consequence.