As of Might 3, 2023, the Bitcoin blockchain has witnessed a staggering 3.35 million Ordinal inscriptions, and a brand new experimental token customary often known as “Bitcoin Request for Remark,” or BRC20, has garnered substantial consideration previously week. With 10,487 BRC20 tokens constructed utilizing Ordinals and a swelling market capitalization exceeding $95 million, this new growth has the crypto world buzzing.

Ordinals Protocol Witnesses 3 Million Inscriptions Whereas BRC20 Tokens Drive Bitcoin’s Mempool into Overdrive

The Bitcoin neighborhood is abuzz with conversations surrounding the BRC20 token customary after its introduction by a pseudonymous developer named Domo in March. BRC20 tokens leverage the Ordinals protocol, enabling creators to mint fungible crypto belongings onchain with ease. To create a BRC20 coin, people have to encode a JSON information object containing important token info. Like an ERC20 token contract on Ethereum, this information would embody basic particulars such because the token’s title, image, and complete provide.

EVERYTHING Ethereum can do IS BEING completed on BTC w/ blockspace & customized indexers

First Liquidity Pool for DEX on Bitcoin L1 w/ BRC-20

NO ONE thought it potential

Posting the SAME data that UNISWAP DEX would put up to make a transaction & reconciling it later w/ indexer pic.twitter.com/1IBuQ8e7A4

— trevor.btc @ NYC (@TO) Might 3, 2023

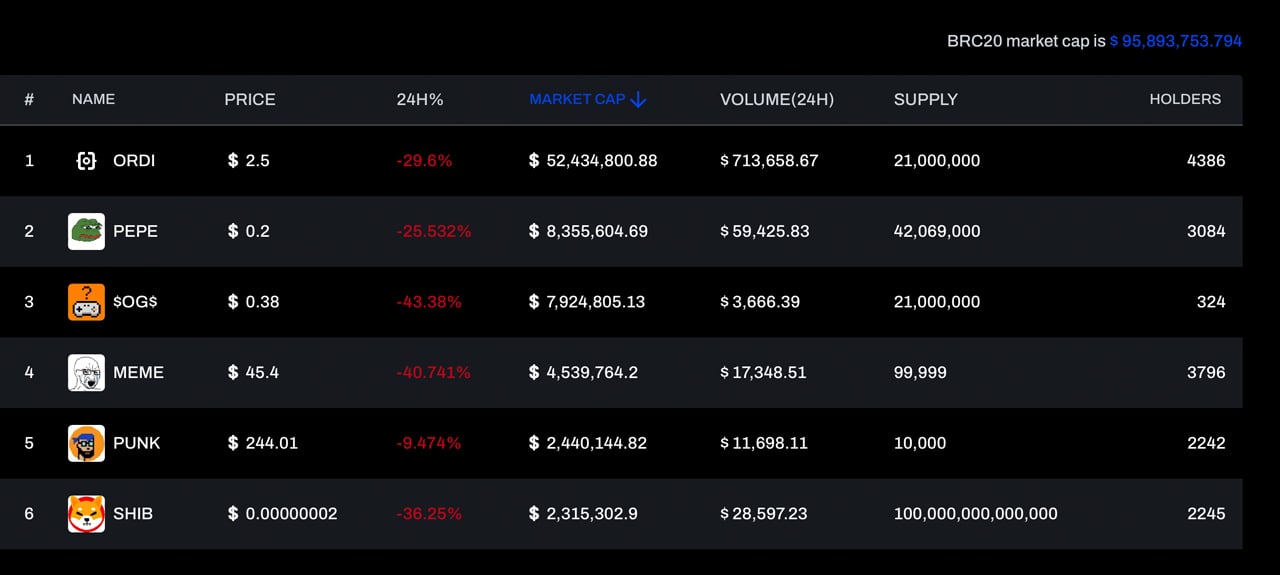

The spectacular issuance of over 10,500 BRC20 tokens — alongside the surge of Ordinal inscriptions surpassing 3 million — has led to a backlog of over 200,000 unconfirmed transactions in Bitcoin’s mempool. A complete checklist of those 10K+ BRC20 cash may be discovered at ordspace.org, displaying every token’s worth in US {dollars}. At the moment standing at a outstanding $95 million, the BRC20 token financial system has witnessed tokens skyrocketing with quadruple-digit positive factors.

Notable examples of those tokens embrace ordi, $OG$, PEPE, MEME, PUNK, SHIB, and DOMO. The ordi market cap immediately is hovering above $52 million; the $OG$ token market cap sits at $7.9 million, and the PEPE BRC20 coin’s market valuation rests at $8.3 million as of Might 3, 2023. This rise of BRC20 tokens and Ordinal inscriptions, predominantly comprised of textual content, has pushed Bitcoin’s common and median-sized charges to soar.

Knowledge from bitinfocharts.com on Might 3, 2023, reveals that the common onchain Bitcoin transaction charge is 0.00025 BTC or $7.05 per transaction, equating to roughly 0.0000011 BTC per byte. Moreover, the median-sized switch charge is 0.00012 BTC or $3.46 per transaction, in accordance with metrics compiled by bitinfocharts.com. The flood of BRC20s and Ordinal inscriptions has reignited a heated debate over whether or not the fungible tokens and non-fungible token (NFT) ideas constructed on BTC justify affirmation alongside monetary transactions.

What are your ideas on the rising pattern of making fungible tokens on the Bitcoin blockchain utilizing the Ordinals protocol? Do you suppose the surge in BRC20 tokens justifies the excessive transaction charges and the backlog of unconfirmed transactions in Bitcoin’s mempool? Share your opinions with us within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It isn’t a direct provide or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any injury or loss brought on or alleged to be brought on by or in reference to using or reliance on any content material, items or providers talked about on this article.