Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

In a brand new publication titled The Mustard Seed, Joe Burnett—Director of Market Analysis at Unchained—outlines a thesis that envisions Bitcoin reaching $10 million per coin by 2035. This inaugural quarterly letter takes the lengthy view, specializing in “time arbitrage” because it surveys the place Bitcoin, expertise, and human civilization might stand a decade from now.

Burnett’s argument revolves round two principal transformations that, he contends, are setting the stage for an unprecedented migration of worldwide capital into Bitcoin: (1) the “Nice Move of Capital” into an asset with absolute shortage, and (2) the “Acceleration of Deflationary Know-how” as AI and robotics reshape total industries.

A Lengthy-Time period Perspective On Bitcoin

Most financial commentary zooms in on the following earnings report or the instant worth volatility. In distinction, The Mustard Seed pronounces its mission clearly: “In contrast to most monetary commentary that fixates on the following quarter or subsequent 12 months, this letter takes the lengthy view—figuring out profound shifts earlier than they turn into consensus.”

On the core of Burnett’s outlook is the statement that the worldwide monetary system—comprising roughly $900 trillion in complete property—faces ongoing dangers of “dilution or devaluation.” Bonds, currencies, equities, gold, and actual property every have expansionary or inflationary parts that erode their store-of-value perform:

- Gold ($20 trillion): Mined at roughly 2% yearly, growing provide and slowly diluting its shortage.

- Actual Property ($300 trillion): Expands at round 2.4% per 12 months on account of new growth.

- Equities ($110 trillion): Firm earnings are continuously eroded by competitors and market saturation, contributing to devaluation danger.

- Fastened Earnings & Fiat ($230 trillion): Structurally topic to inflation, which reduces buying energy over time.

Burnett describes this phenomenon as capital “looking for a decrease potential power state,” likening the method to water cascading down a waterfall. In his view, all pre-Bitcoin asset courses had been successfully “open bounties” for dilution or devaluation. Wealth managers might distribute capital amongst actual property, bonds, gold, or shares, however every class carried a mechanism by which its actual worth might erode.

Associated Studying

Enter Bitcoin, with its 21-million-coin exhausting cap. Burnett sees this digital asset as the primary financial instrument incapable of being diluted or devalued from inside. Provide is fastened; demand, if it grows, can immediately translate into worth appreciation. He cites Michael Saylor’s “waterfall analogy”: “Capital naturally seeks the bottom potential power state—simply as water flows downhill. Earlier than bitcoin, wealth had no true escape from dilution or devaluation. Wealth saved in each asset class acted as a market bounty, incentivizing dilution or devaluation.”

As quickly as Bitcoin grew to become widely known, says Burnett, the sport modified for capital allocation. Very like discovering an untapped reservoir far beneath current water basins, the worldwide wealth provide discovered a brand new outlet—one that can not be augmented or diluted.

For example Bitcoin’s distinctive provide dynamics, The Mustard Seed attracts a parallel with the halving cycle. In 2009, miners obtained 50 BTC per block—akin to Niagara Falls at full pressure. As of as we speak, the reward dropped to three.125 BTC, harking back to halving the Falls’ move repeatedly till it’s considerably lowered. In 2065, Bitcoin’s newly minted provide might be negligible in comparison with its complete quantity, mirroring a waterfall lowered to a trickle.

Although Burnett concedes that makes an attempt to quantify Bitcoin’s international adoption depend on unsure assumptions, he references two fashions: the Energy Legislation Mannequin which tasks $1.8 million per BTC by 2035 and Michael Saylor’s Bitcoin mannequin which suggests $2.1 million per BTC by 2035.

He counters that these projections may be “too conservative” as a result of they usually assume diminishing returns. In a world of accelerating technological adoption—and a rising realization of Bitcoin’s properties—worth targets might overshoot these fashions considerably.

The Acceleration Of Deflationary Know-how

A second main catalyst for Bitcoin’s upside potential, per The Mustard Seed, is the deflationary wave introduced on by AI, automation, and robotics. These improvements quickly improve productiveness, decrease prices, and make items and providers extra ample. By 2035, Burnett believes international prices in a number of key sectors might bear dramatic reductions.

Adidas’ “Speedfactories” minimize sneaker manufacturing from months to days. The scaling of 3D printing and AI-driven meeting strains might slash manufacturing prices by 10x. 3D-printed properties already go up 50x quicker at far decrease prices. Superior supply-chain automation, mixed with AI logistics, might make high quality housing 10x cheaper. Autonomous ride-hailing can probably scale back fares by 90% by eradicating labor prices and enhancing effectivity.

Burnett underscores that, below a fiat system, pure deflation is usually “artificially suppressed.” Financial insurance policies—like persistent inflation and stimulus—inflate costs, masking expertise’s actual affect on reducing prices.

Bitcoin, alternatively, would let deflation “run its course,” growing buying energy for holders as items turn into extra inexpensive. In his phrases: “An individual holding 0.1 BTC as we speak (~$10,000) might see its buying energy improve 100x or extra by 2035 as items and providers turn into exponentially cheaper.”

For example how provide development erodes a retailer of worth over time, Burnett revisits gold’s efficiency since 1970. Gold’s nominal worth from $36 per ounce to roughly $2,900 per ounce in 2025 seems substantial, however that worth acquire was constantly diluted by the annual 2% improve in gold’s total provide. Over 5 many years, the worldwide inventory of gold virtually tripled.

If gold’s provide had been static, its worth would have hit $8,618 per ounce by 2025, in response to Burnett’s calculations. This provide constraint would have bolstered gold’s shortage, presumably pushing demand and worth even greater than $8,618.

Associated Studying

Bitcoin, in contrast, incorporates exactly the fastened provide situation that gold by no means had. Any new demand won’t spur further coin issuance and thus ought to drive the value upward extra immediately.

Burnett’s forecast for a $10 million Bitcoin by 2035 would suggest a complete market cap of $200 trillion. Whereas that determine sounds colossal, he factors out that it represents solely about 11% of worldwide wealth—assuming international wealth continues to broaden at a ~7% annual charge. From this vantage level, allocating round 11% of the world’s property into what The Mustard Seed calls “the most effective long-term retailer of worth asset” may not be far-fetched. “Each previous retailer of worth has perpetually expanded in provide to fulfill demand. Bitcoin is the primary that can’t.”

A key piece of the puzzle is the safety finances for Bitcoin: miner income. By 2035, Bitcoin’s block subsidy might be all the way down to 0.78125 BTC per block. At $10 million per coin, miners might earn $411 billion in mixture income every year. Since miners promote the Bitcoin they earn to cowl prices, the market must soak up $411 billion of newly mined BTC yearly.

Burnett attracts a parallel with the worldwide wine market, which was valued at $385 billion in 2023 and is projected to succeed in $528 billion by 2030. If a “mundane” sector like wine can maintain that degree of shopper demand, an business securing the world’s main digital retailer of worth reaching comparable scale, he argues, is effectively inside purpose.

Regardless of public notion that Bitcoin is changing into mainstream, Burnett highlights an underreported metric: “The variety of individuals worldwide with $100,000 or extra in bitcoin is just 400,000… that’s 0.005% of the worldwide inhabitants—simply 5 in 100,000 individuals.”

In the meantime, research would possibly present round 39% of People have some degree of “direct or oblique” Bitcoin publicity, however this determine consists of any fractional possession—comparable to holding shares of Bitcoin-related equities or ETFs via mutual funds and pension plans. Actual, substantial adoption stays area of interest. “If Bitcoin is the most effective long-term financial savings expertise, we’d count on anybody with substantial financial savings to carry a considerable quantity of bitcoin. But as we speak, just about nobody does.”

Burnett emphasizes that the street to $10 million doesn’t require Bitcoin to supplant all cash worldwide—solely to “soak up a significant share of worldwide wealth.” The technique for forward-looking traders, he contends, is easy however non-trivial: ignore short-term noise, deal with the multi-year horizon, and act earlier than international consciousness of Bitcoin’s properties turns into common. “Those that can see previous the short-term volatility and deal with the larger image will acknowledge bitcoin as probably the most uneven and neglected guess in international markets.”

In different phrases, it’s about “front-running the capital migration” whereas Bitcoin’s consumer base remains to be comparatively minuscule and the overwhelming majority of conventional wealth stays in legacy property.

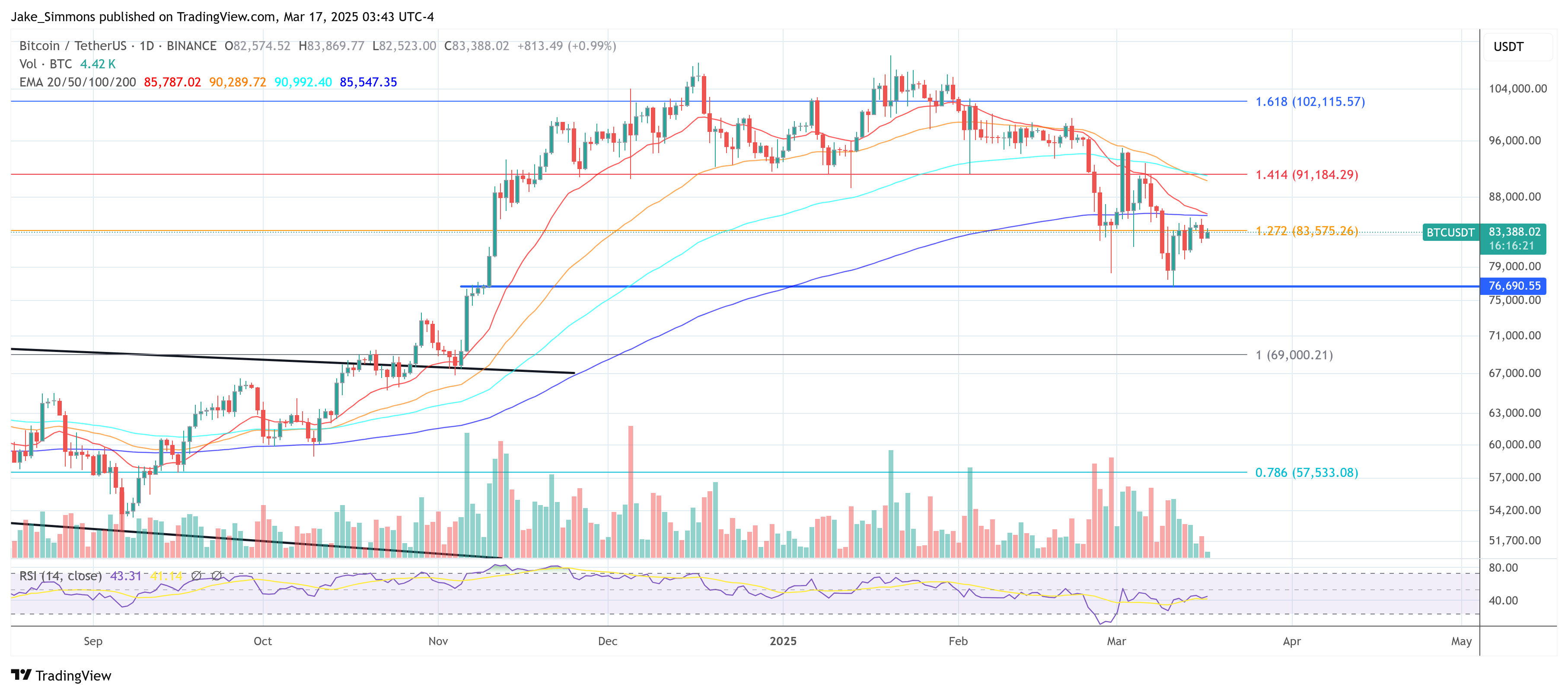

At press time, BTC traded at $83,388.

Featured picture created with DALL.E, chart from TradingView.com