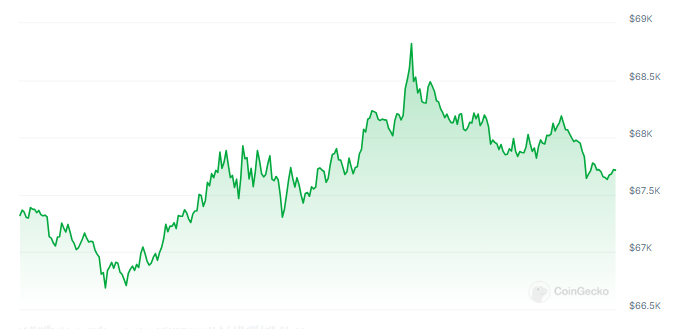

Microsoft is getting ready for a crucial shareholder assembly on December 10, throughout which the way forward for Bitcoin as a possible funding might be a heated subject. At current, Bitcoin is buying and selling at roughly $68,115, which represents a rise of roughly 1.22%.

The rise in curiosity aligns with fixed debates across the cryptocurrency as an inflation hedge, which some Microsoft buyers discover interesting.

Associated Studying

Microsoft’s Place On Bitcoin

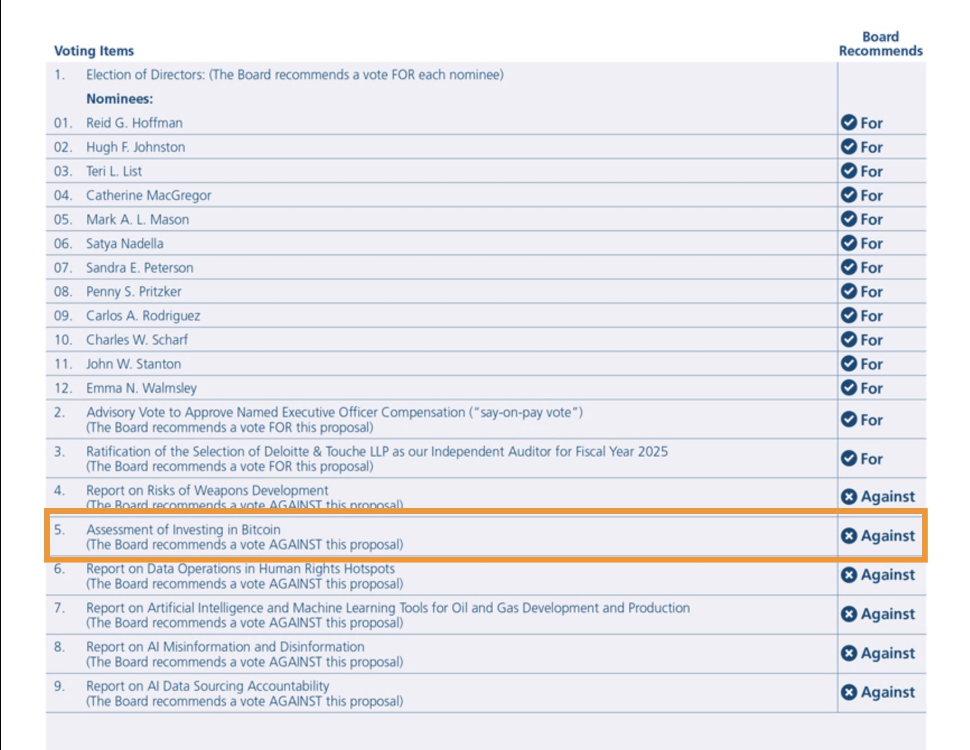

Microsoft revealed in a current software to the US Securities and Trade Fee that it’ll suggest evaluating Bitcoin funding through the forthcoming convention.

The Nationwide Heart for Public Coverage Analysis (NCPPR) says that Bitcoin has performed higher than conventional investments and could possibly be a great way to defend towards inflation.

JUST IN: Per an SEC submitting, Microsoft can have a proposed board decision for an “Evaluation of Investing in Bitcoin”.

The board is recommending that shareholders vote AGAINST the proposal. pic.twitter.com/0WveygitH9

— TFTC (@TFTC21) October 24, 2024

Microsoft’s board, however, needs shareholders to vote towards this plan as a result of the corporate has already checked out a variety of investable property, together with cryptocurrencies.

In keeping with a spokesperson for the corporate:

“Volatility is without doubt one of the necessary points for all of the investments in cryptocurrencies for company treasury”

This emphasizes the cautious technique that Microsoft has adopted so far as the administration of its company treasury is anxious in addition to for the good thing about enhancing the shareholders worth for the long run.

The board is of the opinion that the requested public appraisal is pointless, as they already monitor traits and developments within the cryptocurrency sector.

Large-Wig Stockholders

Microsoft’s main shareholders embody a variety of main institutional buyers, resembling Vanguard, BlackRock, and State Avenue. These organizations personal a big proportion of the corporate and have appreciable energy to have an effect on its coverage path.

Though some shareholders are advocating for Bitcoin investments, others could also be extra consistent with the board’s cautious stance.

It is very important notice that BlackRock has been actively rising its Bitcoin holdings via its ETFs. BlackRock’s iShares Bitcoin Belief ETF has registered inflows to the tune of over $317 million in a 24-hour timeframe, in response to current reviews.

This pattern implies that there’s an rising institutional curiosity in Bitcoin, regardless of Microsoft’s reluctance to implement comparable measures.

The Street Forward

Because the December convention will get prepared, the controversy about Bitcoin’s significance in Microsoft’s funding plan will get extra intense.

The NCPPR argues that companies ought to commit not less than 1% of their complete property to Bitcoin to assist to cut back inflation dangers. Regardless of this mission, Microsoft insists that its current company treasury distribution insurance policies are enough.

Associated Studying

Bitcoin has skilled a virtually twofold improve in worth prior to now yr and has recorded a outstanding 414% improve over the previous 5 years. Though Microsoft will not be fully ready to spend money on cryptocurrency investments presently, the rising curiosity from institutional buyers resembling BlackRock means that the discourse surrounding Bitcoin is way from over.

Microsoft’s upcoming shareholder assembly would be the focus of all consideration, and it’s unsure whether or not the tech big will alter its place on cryptocurrencies or keep its dedication to stability in its funding technique.

Featured picture created with Dall.E, chart from TradingView