In keeping with a latest Quicktake submit by CryptoQuant analyst abramchart, short-term Bitcoin (BTC) traders are incurring losses, suggesting that the crypto market might have hit its backside and a development reversal may very well be on the horizon.

Has Bitcoin Bottomed?

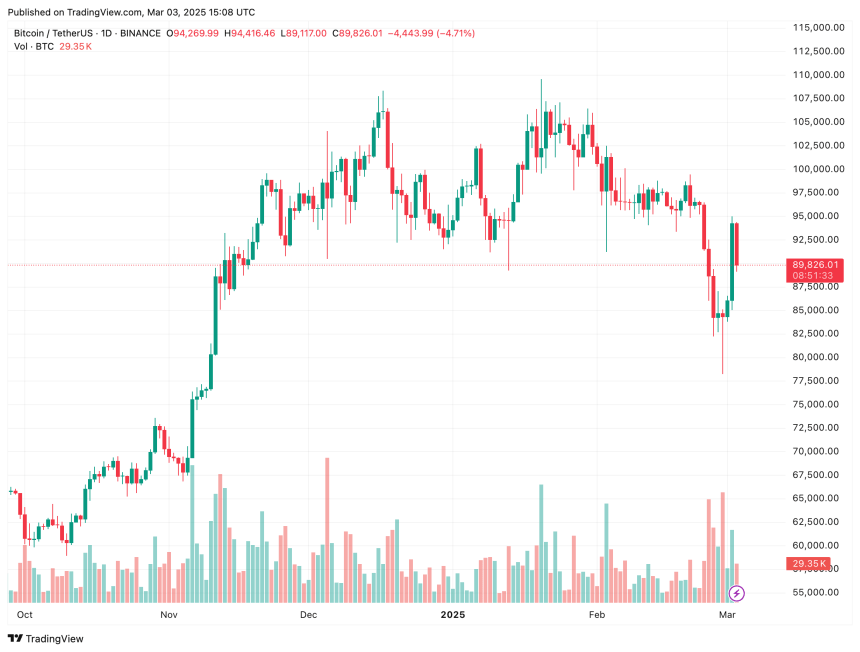

Bitcoin skilled important volatility over the previous week, dropping from $96,000 on February 23 to $78,258 on February 27. Nevertheless, it recovered most of its losses yesterday, rebounding to as excessive as $95,000.

Associated Studying

Within the Quicktake submit, abramchart highlighted the declining Spent Output Revenue Ratio (SOPR) for BTC holders. For these unfamiliar, the SOPR measures the proportion of BTC wallets which have held the cryptocurrency for multiple hour however lower than 155 days.

In keeping with SOPR, any worth better than 1 signifies that short-term traders are promoting at a revenue. Conversely, a worth under 1 means that short-term traders are incurring losses.

Whereas a worth below 1 might point out bearish sentiment, it may also be seen as an indication of market capitulation, usually adopted by a possible development reversal. The overall crypto market cap surged by greater than $200 billion yesterday, pushed by US President Donald Trump’s announcement concerning the creation of a crypto reserve.

As of as we speak, the SOPR sits at 0.95, the bottom it has been since August 2024 when BTC was buying and selling inside a consolidation zone across the mid-$50,000 vary. The submit concludes:

Now we have possible reached good accumulation zones for Bitcoin and are near the underside of the present wave.

BTC Exhibiting Indicators Of Pattern Reversal

Whereas predicting crypto markets could be troublesome, some indications counsel that Bitcoin could also be on the verge of a development reversal after extended promoting over the previous month.

Associated Studying

For instance, throughout its potential native backside at $78,258, BTC partially stuffed a long-standing CME hole between $78,000 and $80,000. CME gaps usually act as worth magnets, and as soon as stuffed, BTC usually strikes in the wrong way.

Moreover, seasoned crypto analyst Ali Martinez pointed out that BTC has reached its most oversold stage since August 2024. Martinez prompt that the excessive promoting strain on BTC is perhaps nearing its finish, probably signaling a development reversal.

In associated information, Andre Dragosch, European Head of Analysis at Bitwise, famous that regardless of the market pullback, BTC is flashing an enormous contrarian purchase sign, presenting a lovely risk-reward alternative at present costs.

Alternatively, Geoff Kendrick of Commonplace Chartered predicted that BTC should still expertise additional draw back earlier than resuming its bullish momentum. At press time, BTC is buying and selling at $89,826, up 5.3% previously 24 hours.

Featured picture from Unsplash, Charts from CryptoQuant and TradingView.com