Bitcoin is displaying resilience, holding agency above the $69,000 mark after a slight pullback from current native highs at $73,600. Following weeks of bullish momentum and nearing its all-time excessive, BTC has settled just under the essential $73,794 resistance, a key degree that, if surpassed, would push the cryptocurrency into worth discovery mode.

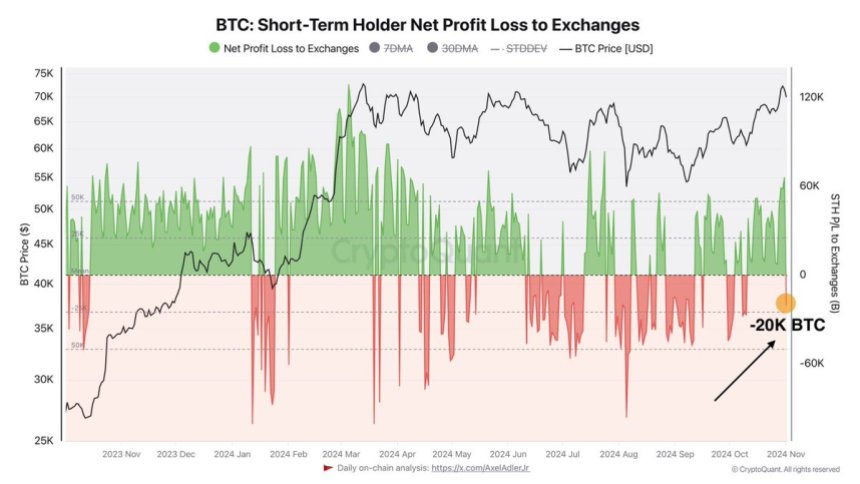

In response to information from CryptoQuant, short-term holders are experiencing a internet profit-to-loss of damaging 20 BTC, indicating a wave of panic promoting amongst retail traders. Such a conduct, typically pushed by worry, uncertainty, and doubt (FUD), can precede a major worth surge as stronger arms accumulate BTC at decrease costs.

Associated Studying

Traditionally, related sell-offs by retail traders have been adopted by renewed upward momentum as longer-term holders seize the chance to enter or reinforce their positions. If Bitcoin can preserve assist above $69,000, the percentages of a breakout previous its all-time excessive enhance considerably.

Market watchers at the moment are carefully monitoring the resistance degree, as surpassing it may set off a wave of shopping for curiosity and push BTC into new highs. The approaching days could show essential, setting the stage for Bitcoin’s subsequent massive transfer.

Bitcoin Weak Arms Promoting

Bitcoin not too long ago tried a breakthrough to new heights however didn’t breach its all-time excessive of $73,794, coming into a consolidation section because the market eyes key occasions: subsequent week’s U.S. election and the Federal Reserve’s anticipated rate of interest choice.

CryptoQuant’s current information, shared by analyst Axel Adler on X, factors to a noteworthy development amongst short-term BTC holders. The web profit-to-loss ratio for these holders reveals a damaging steadiness of -20 BTC, indicating a wave of panic promoting following Bitcoin’s battle to ascertain new highs. This sell-off amongst short-term traders, who are inclined to react extra shortly to market volatility, suggests some warning amid uncertainty.

Adler emphasizes that in such turbulent instances, a long-term “HODL” (maintain on for expensive life) method might be essentially the most helpful technique. Holding sturdy by market noise has traditionally rewarded BTC traders who preserve their positions intact in periods of retracement and heightened volatility.

With Bitcoin’s all-time excessive in sight, a profitable breakout would doubtless sign the start of a broad market bull run. The approaching days are essential as Bitcoin sits at a pivotal level in its cycle, balancing between sturdy consolidation and the potential for explosive progress.

Associated Studying

The affect of the Federal Reserve’s choice on rates of interest, paired with potential election outcomes, may create the market circumstances wanted for BTC to push previous its all-time excessive. If this degree is breached, it will not solely affirm a bullish outlook for BTC however doubtless set off a rally throughout the complete cryptocurrency market.

BTC Holding Above Key Help

Bitcoin is at the moment buying and selling at $69,620 following a retrace from its current excessive close to $73,600. Regardless of this pullback, bulls stay in management as BTC holds firmly above the essential $69,000 assist degree—a worth level that acted as resistance since late July. This degree has now reworked into sturdy assist, bolstering bullish sentiment available in the market.

If Bitcoin holds above $69,000, a renewed push above all-time highs appears doubtless. Breaking this resistance would propel BTC into uncharted territory, probably sparking a contemporary wave of bullish momentum and worth discovery. Nevertheless, if the value dips beneath this mark, it may sign a necessity for a extra important correction to assemble sufficient shopping for energy for the subsequent transfer up.

Associated Studying

The $69,000 degree serves as a key indicator of market confidence, as shedding it will indicate that BTC may briefly search decrease assist ranges to draw new consumers and stabilize earlier than one other try at new highs. For now, Bitcoin’s worth construction stays sturdy, and so long as this assist holds, the market anticipates additional upside momentum within the coming days. Bulls are carefully watching this degree, as it could outline the subsequent section of Bitcoin’s bull run.

Featured picture from Dall-E, chart from TradingView