Within the newest version of the Capriole Investments e-newsletter dated August 20, 2024, Charles Edwards, founder and CEO, attracts placing parallels between the present market habits of Bitcoin and the historic efficiency of Gold, significantly throughout its 2008 rally.

Bitcoin Mirrors 2008 Gold Rush

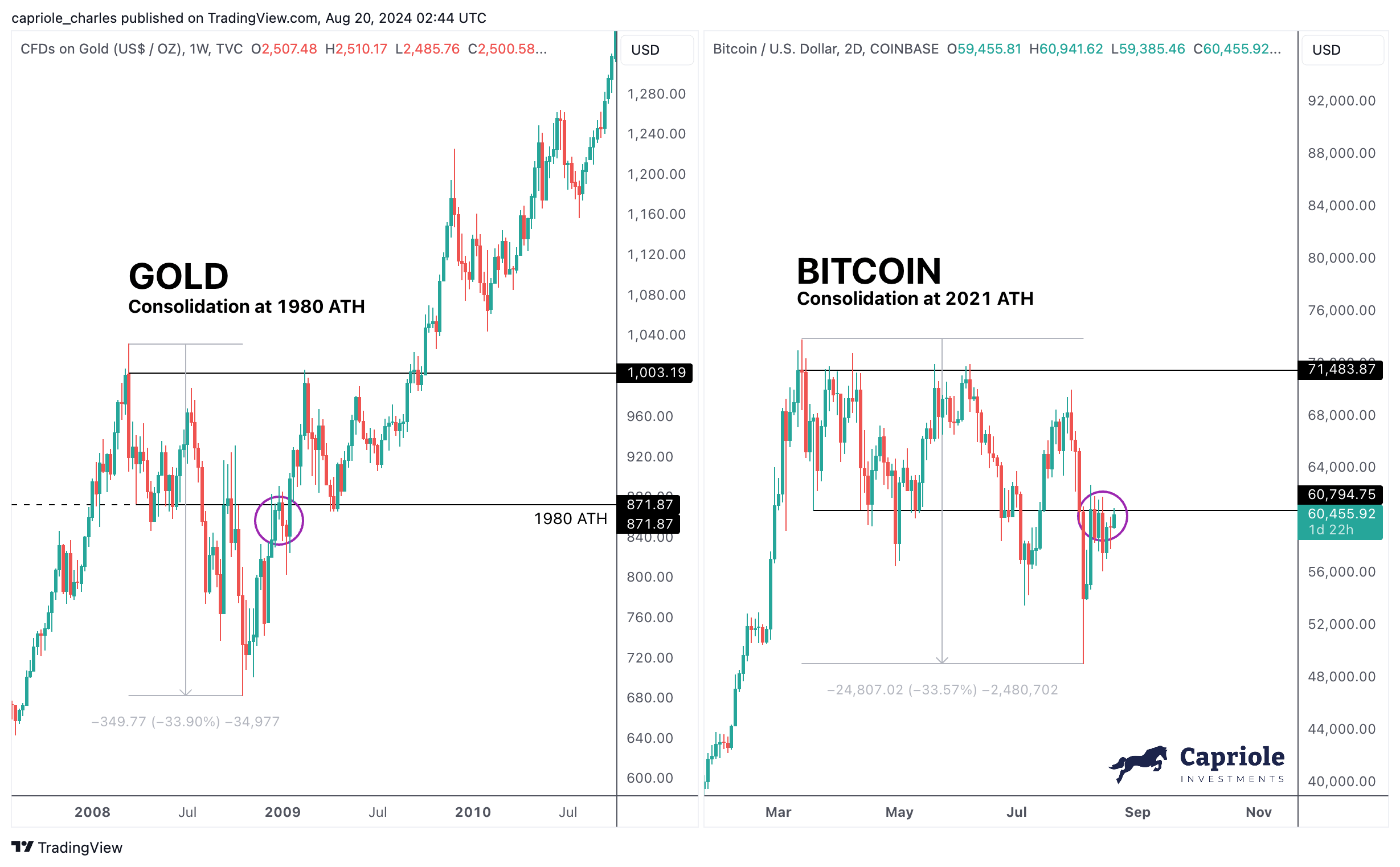

Edwards factors out that Bitcoin has been consolidating round $60K, echoing the sample Gold adopted earlier than its important rally. “Bitcoin is below strain, mirroring the longest interval of consolidation at any ATH in its historical past,” Edwards notes, suggesting that this may very well be a precursor to a big breakout. In line with him, this sample intently mirrors that of Gold within the late 2000s, when it consolidated for 9 months round its 1980 ATH earlier than launching a big two-year rally in 2008.

Edwards elaborates on the technical similarities, noting, “Gold’s first important consolidation post-ETF launch preceded a rally that noticed its worth climb by 180% in simply over two years. Right this moment, Bitcoin displays related market habits within the aftermath of its personal ETF launches and consolidations.”

Associated Studying

Edwards notes that in Gold’s consolidation section in 2008, the asset underwent a -33% drawdown, ultimately marking what many traders take into account a generational backside. Bitcoin’s latest dip to $48,000—a -33% crash—strikingly aligns with this facet of Gold’s historic value motion. “The July 2024 Bitcoin dip noticed a -28% drop to $53K, and the more moderen August 2024 dip mirrored Gold’s remaining plunge, falling a mere half a p.c quick,” Edwards states, highlighting the precision of those parallels.

Based mostly on these historic parallels, Edwards predicts that Bitcoin value may very well be “ripping straight to $140K with no dips by round Might 2025.” Whereas he acknowledges {that a} single datapoint doesn’t imply that gold’s historical past has to repeat for Bitcoin, he believes that it’s “essentially the most comparable asset on the most comparable time in its historical past.”

Associated Studying

Regardless of the bullish sign from the historic and technical evaluation, Edwards stays solely cautiously optimistic. He acknowledges ongoing discrepancies in elementary knowledge alerts and suggests a conservative stance till additional bullish confirmations may be noticed.

“We’re nonetheless awaiting the Month-to-month shut; the conservative place can be to await additional bullish confirmations (and doubtlessly This fall) to completely clear what is usually essentially the most bearish interval of every calendar 12 months for Bitcoin and threat property,” Edwards notes.

If Bitcoin can shut above the month-to-month assist, Edwards sees a “very engaging technical setup.” He concludes, “I consider this era of market consolidation is coming to a detailed as we exit summer time, and I keep sturdy conviction that the subsequent 12 months would be the greatest day trip of the final 3 years to be allotted to this asset class.”

At press time, BTC traded at $60,712.

Featured picture created with DALL.E, chart from TradingView.com