The Head of Analysis on the on-chain analytics agency CryptoQuant has defined why Bitcoin could also be liable to seeing an additional drawdown.

Bitcoin Is Nonetheless On Verge Of Bear Market In This Indicator

In a brand new submit on X, CryptoQuant Head of Analysis Julio Moreno has mentioned the most recent development within the Bitcoin Bull-Bear Market Cycle Indicator. The “Bull-Bear Market Cycle Indicator” from CryptoQuant is an indicator primarily based on the P&L Index.

The P&L Index combines a number of well-liked BTC metrics associated to revenue and loss, so it sums up the market stability in a single worth. This indicator can verify whether or not the asset goes by means of a bullish or bearish interval by evaluating it in opposition to its 365-day shifting common (MA).

When the cryptocurrency breaks above its 365-day MA, it may be assumed to be inside a bull market. Equally, falling underneath this MA implies a transition towards a bear market.

The Bull-Bear Market Cycle Indicator, the precise metric of focus right here, exists to make this sample simpler to comply with; it retains monitor of the space between the P&L Index and its 365-day MA.

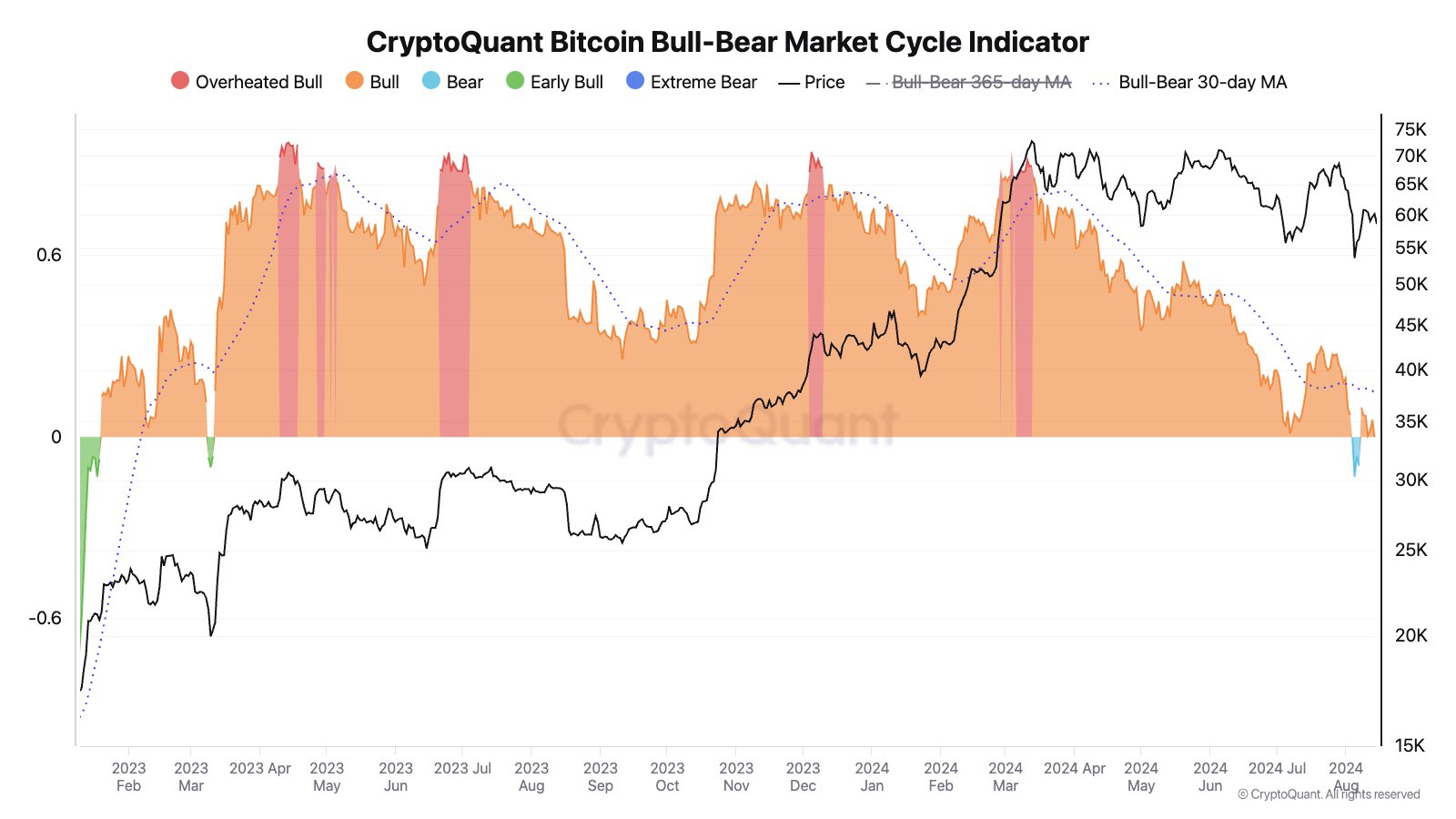

Now, here’s a chart that exhibits the development within the Bitcoin Bull-Bear Market Cycle Indicator over the previous couple of years:

As displayed within the above graph, the Bitcoin Bull-Bear Market Cycle indicator had reached excessive values throughout the worth all-time excessive (ATH) earlier within the yr (coloured in purple).

At these ranges, the P&L Index has fairly the hole over its 365-day MA, so the cryptocurrency’s bull rally has develop into overheated. The graph exhibits that the metric additionally gave this sign on a number of different events throughout the previous two years, and every time, the asset’s worth reached the highest.

Nonetheless, these earlier tops weren’t sufficient to carry the market again in the long run, because the Bull-Bear Market Cycle Indicator continued to take care of contained in the bull territory (shaded in orange), the place the P&L Index is above its 365-day MA.

Nonetheless, bull market momentum has lastly proven indicators of operating out, with the indicator even briefly plunging into the bear territory (mild blue) throughout the latest worth crash.

Whereas the metric has recovered again into the bull area with the surge that BTC’s worth has noticed, it’s nonetheless very near the impartial mark, that means it may doubtlessly sink again into the bearish zone shortly. Based mostly on this development, Moreno notes that BTC might nonetheless danger seeing an additional correction.

BTC Worth

Bitcoin has seen its restoration stall just lately, as its worth remains to be buying and selling across the $58,500 mark.