Bitcoin recorded one other outstanding worth efficiency up to now week, gaining by 19.16% in line with knowledge from CoinMarketCap. The crypto market chief established a brand new all-time excessive at $93,434 on Wednesday, as odds of reaching a six-figure market worth by yr’s finish are actually increased than earlier than.

Amidst the present market euphoria, CryptoQuant analyst Amr Taha has shared some market insights that will point out an impending worth fall.

Bitcoin Enters Revenue-Taking Zone – Promote Or HODL?

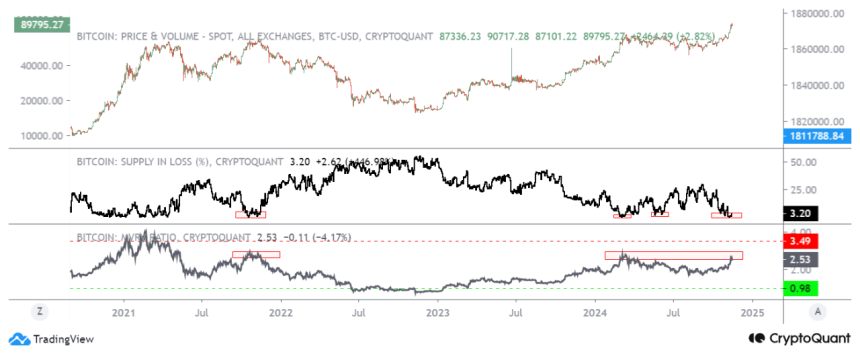

In a Quicktake put up on Friday, Amr Taha said many buyers could also be making ready for a cash-out because the Bitcoin MVRV ratio reached 2.64. Usually, the Market Worth to Realized Worth is a buying and selling indicator used to measure whether or not an asset is overvalued or undervalued or to establish market tops or bottoms.

Amr Taha explains {that a} Bitcoin MVRV ratio above 2 signifies that buyers at the moment maintain vital quantities of unrealized positive factors and are more likely to begin profit-taking. Nonetheless, historic knowledge from late 2021 and early 2022, reveals that profit-taking happens because the Bitcoin MVRV ratio strikes into a variety of two.5-3.5, and is accompanied by vital corrections.

Following the Bitcoin worth surge over the previous few weeks, an MVRV ratio of two.64 presents substantial potential for a serious worth correction, regardless of the minor worth drops up to now few days. This sentiment is additional backed by the asset’s relative energy index (RSI), which stays within the overbought zone.

Nonetheless, Ama Taha additional explains that Bitcoin could generally solely type a serious market prime when the MVRV ratio reaches as excessive as 4. Due to this fact, at 2.64, the premier cryptocurrency should maintain its present upward worth trajectory, if bullish market momentum persists. The analyst advises that buyers monitor the MVRV ratio as an increase in the direction of 3 would sign the potential for additional worth positive factors whereas a decline to a variety of 1.5-2 signifies an area market prime is forming.

Quick-Time period Holders Realized Cap Hits $30 Billion

Along with Bitcoin’s alarming MVRV ratio, Taha additionally famous that short-term holders have now amassed a realized market cap of over $30 billion, a degree final noticed in March 2024. The CryptoQuant analyst said Bitcoin has traditionally undergone vital worth corrections at any time when the STH realized cap reached related ranges, signaling one other warning for buyers of a possible worth dip.

On the time of writing, Bitcoin is buying and selling at $91,738 with a 3.97% achieve up to now 24 hours. Nonetheless, the asset’s buying and selling quantity is down by 7.42% and is valued at $80.73 billion.