After a historic rally, Bitcoin has confronted its first main setback, pulling again 7% from its all-time excessive of $99,800. This comes after a powerful surge from $67,500 on November 5, marking a virtually 50% climb in just some weeks. The value motion has largely been “solely up,” attracting vital consideration from merchants and traders alike.

Associated Studying

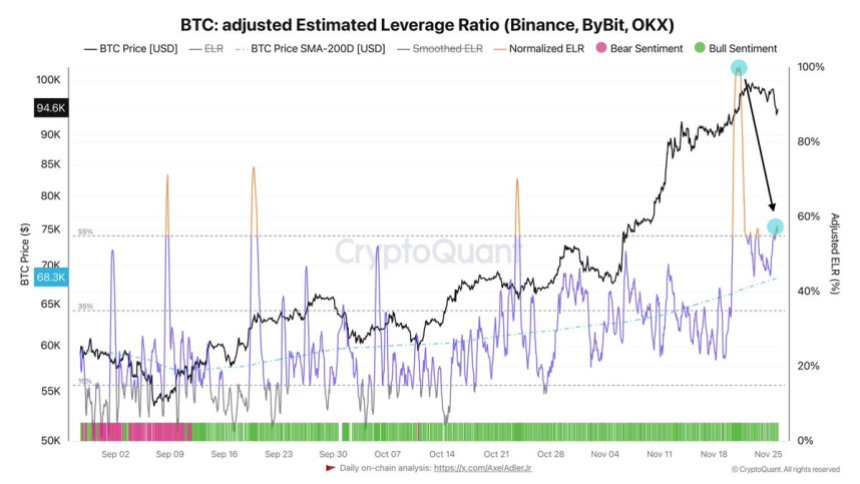

Nonetheless, the present pullback highlights rising warning available in the market. Market warning stated leverage ranges stay elevated regardless of current deleveraging efforts. Adler’s evaluation reveals that rising quick positions and consolidation beneath the psychological $100,000 mark have contributed to the retracement.

Whereas Bitcoin’s efficiency stays robust within the broader context, this dip alerts a possible shift in market sentiment. The query is whether or not BTC can collect sufficient momentum to interrupt previous the $100,000 barrier or if additional consolidation is on the horizon.

Many traders contemplate this pullback a wholesome pause in a bullish cycle, however the excessive leverage ranges recommend continued volatility. All eyes are on Bitcoin because it navigates this crucial part, with the subsequent few days more likely to decide its short-term course.

Bitcoin Bears Displaying Up

After three weeks of minimal resistance from bears, indicators of their resurgence emerge as Bitcoin struggles to interrupt previous the $100,000 degree. This crucial worth level, which many believed would act as a springboard for additional positive factors, has as a substitute highlighted rising bearish sentiment. In line with CryptoQuant analyst Axel Adler, the current worth motion marks a possible shift in momentum.

Adler’s evaluation on X reveals that regardless of a wave of current deleveraging, leverage ranges available in the market stay elevated. Many key lengthy positions had been established across the $93,000 mark, offering bears with a possibility to revenue as BTC didn’t push increased. This degree has now develop into a battleground, with Bitcoin’s incapacity to maintain upward momentum signaling the potential for additional draw back danger.

Bitcoin’s worth hovers round this key degree, elevating the chance of a correction towards $88,500 or extended sideways consolidation beneath $100,000. Such a state of affairs would impression Bitcoin and set the tone for altcoin efficiency within the coming weeks.

Associated Studying

The subsequent two weeks can be pivotal as market individuals intently watch Bitcoin’s worth motion. A decisive transfer, whether or not up or down, will form the broader cryptocurrency panorama and decide whether or not that is merely a pause in a bigger rally or the beginning of a deeper correction.

BTC Testing Contemporary Demand

Bitcoin is buying and selling at $93,500 as bears regained management after it hit an all-time excessive final Friday. This retracement marks a shift in momentum, however bulls nonetheless can reclaim dominance if the value stays robust above the crucial $92,000 help degree. Holding this degree would hold Bitcoin’s worth motion structurally bullish and sign resilience within the face of elevated promoting stress.

If Bitcoin sustains energy above $92,000, the outlook for the quick time period stays optimistic, with the potential for an additional try at breaking key resistance ranges. Nonetheless, a drop beneath this mark would sign short-term weak spot, probably triggering additional declines. The subsequent crucial degree to look at could be round $84,000, the place the 4-hour 200 EMA aligns as a help zone.

This degree represents a serious line within the sand for bulls. A breakdown beneath it may speed up bearish momentum, extending the correction and dampening market sentiment. Then again, holding above $92,000 would reinforce bullish confidence, setting the stage for a restoration and a possible pushback towards earlier highs.

Associated Studying

Merchants and traders are intently watching these ranges, as Bitcoin’s capability to remain above $92,000 will decide whether or not it stays in a short-term bullish construction or succumbs to bearish pressures.

Featured picture from Dall-E, chart from TradingView