Bitcoin has confirmed unstoppable, breaking all-time highs 5 instances in six days and surging previous the $82,000 mark. This newest milestone cements Bitcoin’s momentum because it pushes into uncharted territory, capturing the bulls’ consideration and sparking new ranges of optimism available in the market.

In line with latest information from CryptoQuant, the variety of bullish buyers is rising quickly, but there’s purpose to consider Bitcoin’s rally is way from over.

Associated Studying

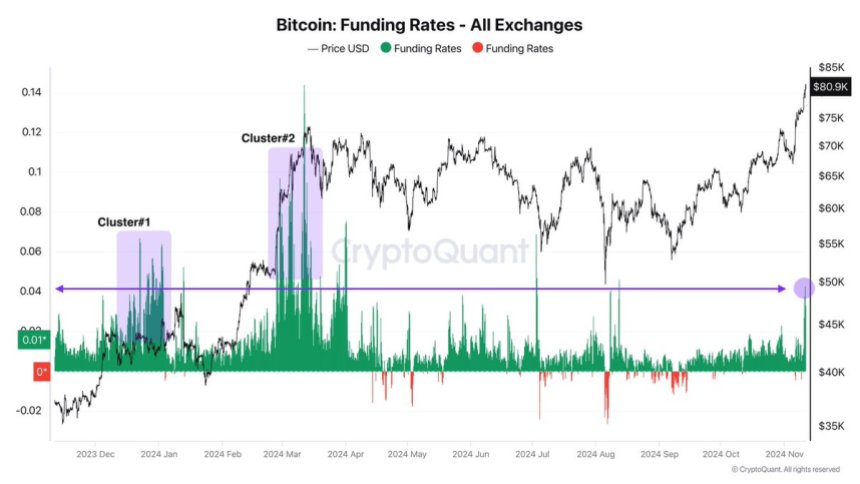

CryptoQuant’s insights point out that BTC stays considerably beneath its March 2024 peak in a number of key metrics, which means that Bitcoin should have room to climb inside this cycle. This hole highlights that, regardless of the spectacular positive aspects, Bitcoin may nonetheless be constructing towards a real cycle peak, with potential positive aspects but to be realized.

As investor sentiment strengthens and Bitcoin reveals resilience at every new degree, the market watches intently for indicators of continued upward momentum. The subsequent few days will probably be essential in figuring out simply how far Bitcoin can go because it solidifies its place within the subsequent part of this bull run.

Bitcoin Bulls Enter The Room

Bitcoin bulls have returned after eight months of sideways consolidation and vital promoting stress. With Bitcoin now buying and selling 11% above its earlier all-time excessive from March, market sentiment has turned decisively bullish, marking the beginning of a brand new development.

In line with information from CryptoQuant analyst Axel Adler, the variety of bullish buyers available in the market is steadily rising, signaling rising confidence. Nonetheless, regardless of this uptick, the present rally lacks the frenzied demand seen throughout the March 2024 rally, when each retail and institutional curiosity reached euphoric ranges.

Adler’s information signifies that whereas bulls have a robust foothold available in the market, the tempo of accumulation by new retail and institutional members remains to be comparatively modest. This hole between the present market dynamics and people seen in March means that Bitcoin’s newest surge could also be just the start moderately than the top of its upward trajectory on this cycle.

Associated Studying

The slower however regular rise in shopping for curiosity may point out that Bitcoin remains to be within the early phases of this bullish part, with room for additional progress earlier than reaching a cycle peak.

For buyers, this might current a promising alternative. The subdued retail and institutional pleasure degree means that Bitcoin has but to seize mainstream consideration because it did throughout earlier peaks. If demand rises regularly, Bitcoin could expertise sustained progress over the approaching months, doubtlessly reaching new highs as momentum builds.

BTC Setting New Excessive

Bitcoin just lately set a brand new all-time excessive above $82,000, which many buyers beforehand seen as a possible native high. Nonetheless, BTC’s worth motion stays strong, and it might be too quickly to name for a definitive peak.

Regardless of this upward momentum, a possible pullback to $77,000 could possibly be on the horizon, as there’s an unfilled hole within the CME futures market between $77,000 and $81,000—a technical degree that usually attracts worth motion as merchants look to shut the hole.

This week will possible carry vital volatility as bulls management the market. With Bitcoin in uncharted territory, some buyers could seize the chance to lock in income, which may introduce promoting stress.

Associated Studying

Nonetheless, the dominant development is bullish, and a short correction to $77,000 may present a basis for additional upside. Bitcoin’s energy stays intact for now, however all eyes will probably be on the way it responds to the volatility and whether or not it could keep this excessive vary or dip barely earlier than resuming its climb.

Featured picture from Dall-E, chart from TradingView