Open curiosity, the entire variety of excellent by-product contracts that haven’t been settled, is a vital metric for gauging market well being and sentiment. A rise in open curiosity means new cash coming into the market, displaying heightened buying and selling exercise and curiosity in Bitcoin. Conversely, a decline suggests closing positions, probably indicating a change in market sentiment or a consolidation part. Monitoring these tendencies is necessary for understanding the liquidity, volatility, and future worth expectations available in the market.

In a bullish market, a rise in open curiosity typically correlates with rising costs, suggesting that new cash is betting on additional worth appreciation. This situation sometimes displays a powerful market sentiment and investor confidence in Bitcoin’s upward trajectory. However, in a bearish context, rising open curiosity may point out that traders are hedging towards anticipated worth declines, revealing a extra cautious or damaging market outlook.

Moreover, the stability between name and put choices throughout the open curiosity offers deeper insights into market sentiment. A predominance of calls suggests a bullish market sentiment, with many traders anticipating worth rises, whereas a majority of places can point out bearish expectations.

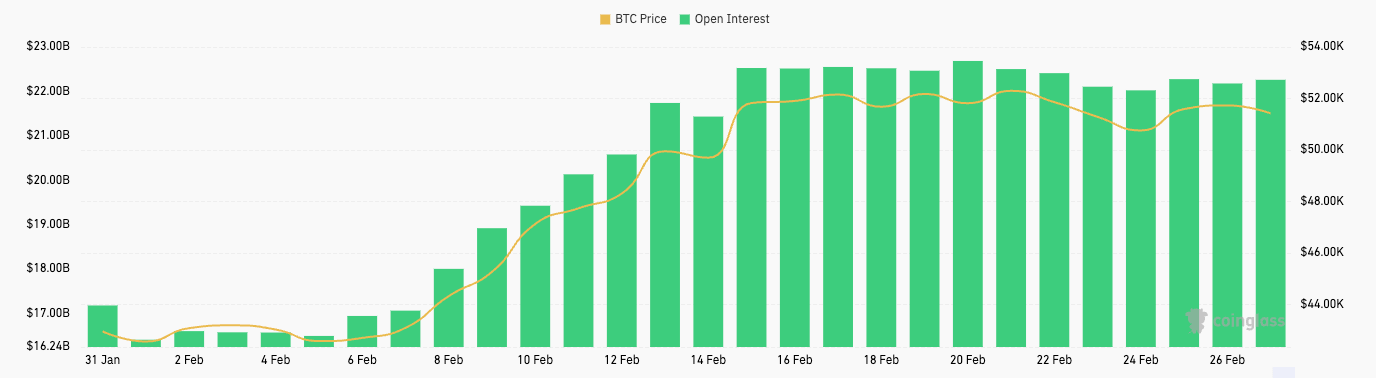

February noticed a big improve in open curiosity for Bitcoin futures and choices.

From Feb. 1 to Feb. 20, Bitcoin futures open curiosity grew from $16.41 billion to $22.69 billion. This substantial rise means that merchants had been more and more coming into into futures contracts, anticipating larger volatility or making directional bets on Bitcoin’s worth. Apparently, this era aligns with a notable improve in Bitcoin’s worth, from $42,560 to $52,303, suggesting a bullish sentiment amongst futures merchants. The slight lower in open curiosity by Feb.26 to $22.21 billion, alongside a marginal dip in Bitcoin’s worth to $51,716, may point out some merchants taking income or closing positions in anticipation of a consolidation part or to scale back publicity forward of potential volatility.

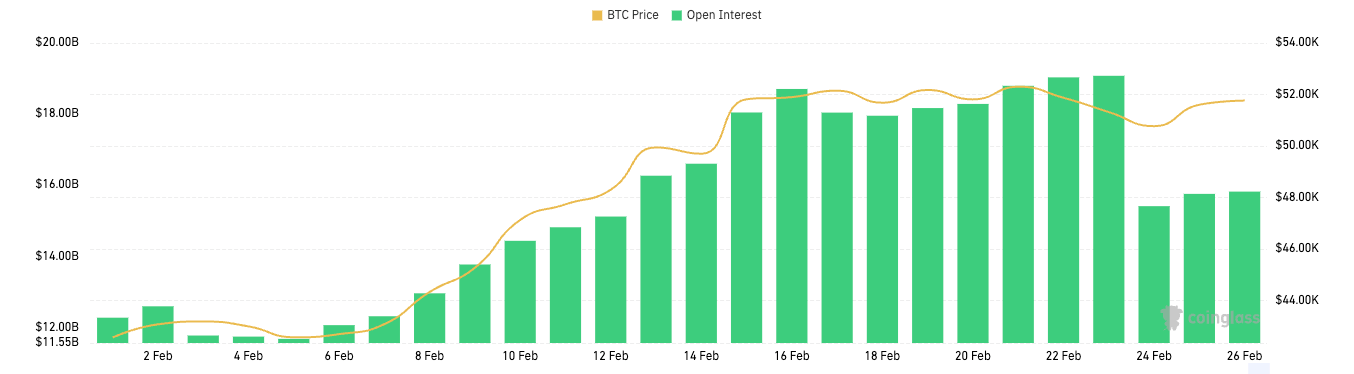

Equally, Bitcoin choices open curiosity noticed a dramatic improve from $12.27 billion at first of February to a peak of $19.08 billion by Feb.23 earlier than dialing again to $15.82 billion in direction of the month’s finish. Choices present the holder the appropriate, however not the duty, to purchase (name choice) or promote (put choice) Bitcoin at a specified worth, providing extra complicated methods for merchants to precise bullish or bearish views or to hedge current positions. The preliminary spike in choices open curiosity displays a sturdy engagement from traders, leveraging choices for directional bets on Bitcoin’s worth and protecting measures towards potential downturns.

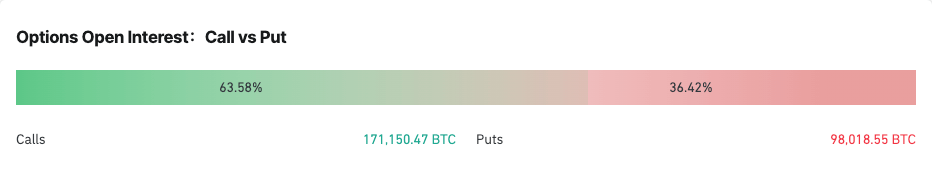

The ratio between calls and places for Bitcoin choices offers a deeper perception into market sentiment and potential expectations for Bitcoin’s worth route. The distribution between calls and places is a direct indicator of the market’s bullish or bearish inclinations, with calls representing bets on rising costs and places on falling costs.

As of Feb. 26, the open curiosity in Bitcoin choices was skewed in direction of calls, comprising 63.76% of the entire, in comparison with 36.24% for places. This distribution reinforces the bullish sentiment noticed by way of the rise in choices open curiosity earlier within the month. A predominance of calls within the open curiosity means that a good portion of market individuals had been anticipating Bitcoin’s worth to proceed rising or had been using calls to hedge towards different positions.

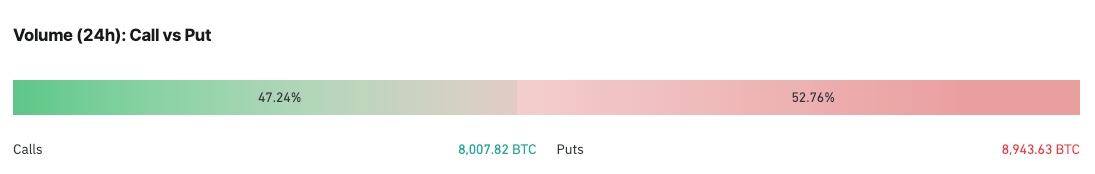

Nevertheless, the 24-hour quantity tells a barely totally different story, with calls accounting for 47.24% and places for 52.76%. In comparison with the general open curiosity, this shift in direction of places within the day by day buying and selling quantity may point out a short-term improve in warning amongst merchants. It means that throughout the final 24 hours, there was a noticeable pick-up in defensive methods or bearish bets.

The rapid implication for Bitcoin’s worth is a possible improve in volatility. The bullish sentiment, as evidenced by the rising open curiosity and excessive proportion of calls, helps a continued optimistic outlook amongst many market individuals. Nevertheless, the current uptick in places quantity might sign upcoming worth fluctuations as merchants alter their positions in anticipation of or in response to new data or market tendencies.

Contemplating these, the market seems to be at a crossroads, with a powerful bullish sentiment tempered by short-term warning. This situation typically precedes durations of heightened volatility as conflicting expectations play out by way of buying and selling actions.