Featured SpeakerAlex Thorn

Head of Firmwide AnalysisGalaxy

Hear Alex Thorn share his tackle “Bitcoin and Inflation: It’s Difficult” at Consensus 2023.

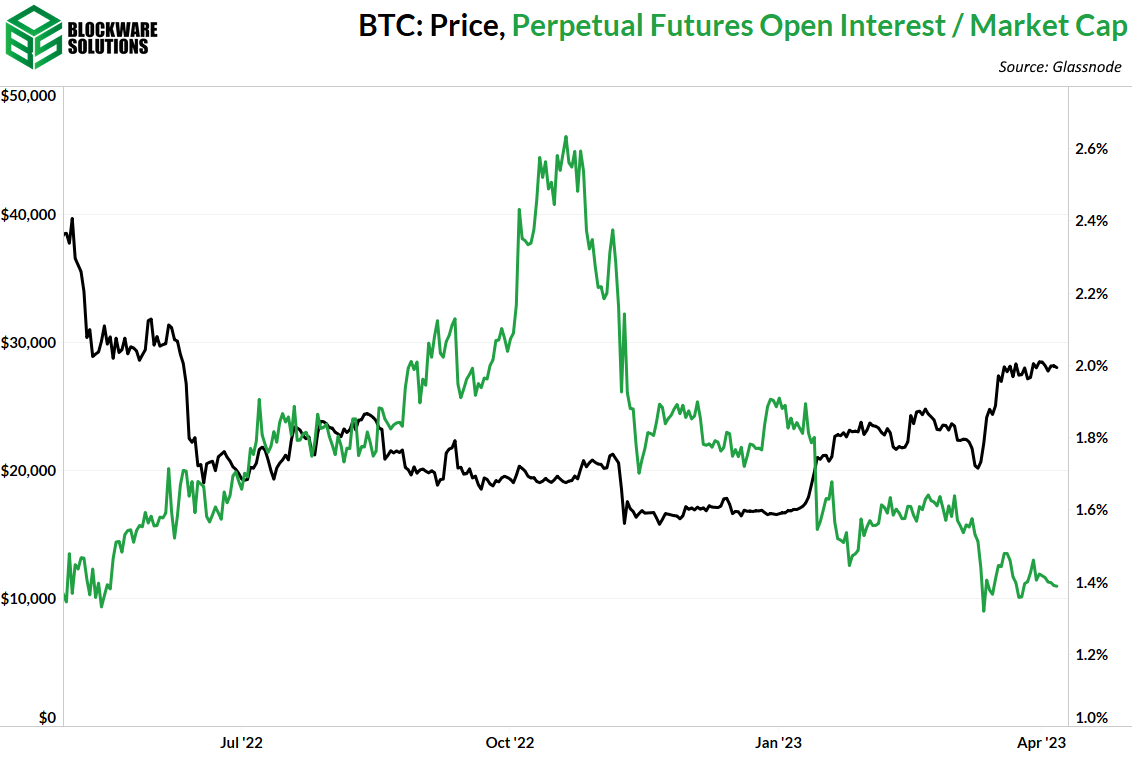

Bitcoin (BTC) has surged 70% this yr, hitting nine-month highs of over $29,000. Whereas the sharp rally has introduced the derivatives market again to life, the general use of leverage stays muted, suggesting a low danger of “liquidations-induced” wild value swings.

Liquidations seek advice from the compelled closure of bullish lengthy and bearish brief positions in leveraged perpetual futures markets, which permit merchants to open positions price way more than the cash deposited as margin. The compelled closure for money or money equal occurs when the buying and selling entity fails to fulfill the margin scarcity stemming from the market shifting towards its bullish/bearish guess.

When the diploma of leverage available in the market – measured by the ratio between the greenback worth locked in perpetual futures (open curiosity) and the cryptocurrency’s market capitalization – is excessive, brief liquidations are inclined to exacerbate bullish strikes. That, in flip, shakes out extra shorts, resulting in a brief squeeze. Equally, lengthy liquidations exacerbate bearish strikes, resulting in an extended squeeze.

Lengthy/brief squeezes have been fairly widespread in the course of the 2021 bull run and early bear market days of 2022 when the quantity of leverage excellent relative to the dimensions of the market was fairly excessive and value strikes would shake out billions of {dollars} price of leveraged buying and selling positions. Up to now this yr, the ratio has continued to drop.

“Excessive open curiosity relative to market cap means the market may very well be susceptible to a short-squeeze or liquidation cascade, which might lead to a value swing being extra unstable than it in any other case would have been because of compelled shopping for or promoting, respectively,” analysts at Blockware Options mentioned in a weekly e-newsletter.

“The medium-term pattern of lowering open curiosity/market cap has not been damaged, which is reassurance that, even within the occasion of downward volatility, value is most certainly not going to lower to the extent it was at to start the yr,” analysts added.

Open curiosity relative to market capitalization continues to drop, signaling low odds of a liquidations cascade. (Blockware Options, Glassnode) (Blockware Options, Glassnode)

The perpetual futures open curiosity to market ratio has been falling since FTX, previously the third-largest cryptocurrency change and one of many most popular avenues to commerce perpetual futures, went bust in early November.

The ratio has stayed low regardless of the current value consolidation, an indication of low investor danger urge for food, in accordance with Blockware Options.

“BTC has primarily traded sideways for the previous three weeks, but, we haven’t seen a build-up in open curiosity. This can be a sign that the market continues to be in a risk-off mode,” Blockware’s analysts famous, saying the non-expiring perpetual futures are usually in demand in periods of sideways value motion, as seen forward of FTX’s implosion.

Bitcoin has been locked within the slender vary of $29,000 to $27,000 since March 21, in accordance with CoinDesk knowledge.

Edited by Parikshit Mishra.