Yesterday, Bitcoin had certainly one of its most bullish days in historical past, skyrocketing previous its all-time excessive to achieve $76,990. This new milestone has ignited widespread pleasure and confidence amongst traders, who now see the potential for additional beneficial properties.

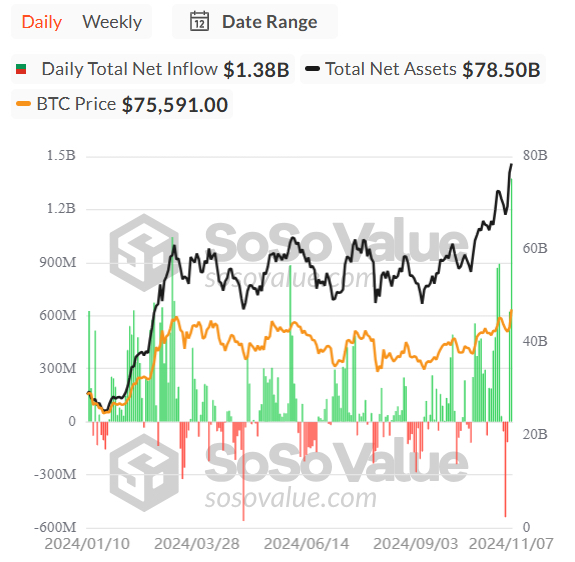

Key information from Carl Runefelt reveals that Bitcoin ETFs skilled a historic surge, with $1.38 billion in internet every day inflows. This record-breaking determine highlights institutional demand for Bitcoin, as main gamers like BlackRock are shopping for BTC in anticipation of long-term development.

Associated Studying

The inflow into Bitcoin ETFs underscores a broader pattern of institutional adoption, with growing curiosity from monetary giants as they acknowledge Bitcoin’s potential as a retailer of worth and hedge in opposition to financial uncertainty. Runefelt’s evaluation means that this stage of demand is unprecedented, marking a turning level that would maintain Bitcoin’s bullish momentum.

The current surge is not only a technical breakout but additionally a basic shift pushed by institutional confidence, setting Bitcoin up for potential additional highs as large-scale traders proceed to enter the market.

Bitcoin Hits New ATH

Bitcoin has surged into uncharted territory, breaking its earlier all-time highs as soon as once more to achieve a brand new peak that has captivated the crypto group. This historic rally comes on the heels of the U.S. election, which noticed Donald Trump emerge victorious.

Market sentiment means that Trump’s pro-crypto stance may have performed a task in driving renewed confidence amongst U.S. traders, who wish to Bitcoin as a hedge amid altering financial insurance policies.

Including to this momentum, conventional traders more and more pour into Bitcoin by way of ETFs, marking a major shift in institutional curiosity. In response to key information from SoSo Worth, shared by distinguished analyst Carl Runefelt on X, Bitcoin ETFs skilled record-breaking every day inflows yesterday, totaling an astounding $1.38 billion.

This historic influx underscores the rising urge for food from institutional gamers who’re viewing Bitcoin as a vital asset for his or her portfolios.

The current bullish shift amongst establishments follows a chronic 7-month accumulation section that had solid shadows of doubt over Bitcoin’s potential to interrupt new highs this yr. Many traders remained cautious, with market volatility and uncertainty testing their confidence.

Associated Studying

With institutional backing at document ranges, Bitcoin’s current rally may signify the start of an prolonged bullish section. As massive gamers like BlackRock buy-in by way of ETFs, the market sees this as a sign of renewed energy. All eyes at the moment are on Bitcoin’s subsequent strikes, with analysts suggesting the current worth motion could solely be the start of a bigger bull run for the world’s largest cryptocurrency.

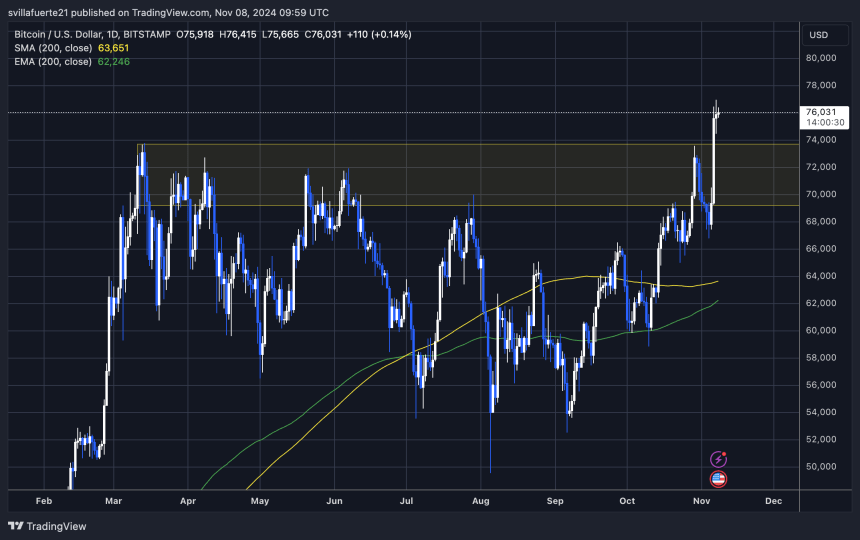

BTC Pushing Up: Robust Worth Motion

Bitcoin is buying and selling at $76,000 after reaching new all-time highs. BTC is coming into a powerful consolidation section above the earlier document stage of $73,800. This worth zone is essential for bulls, as holding above it may present stability for Bitcoin’s rally to proceed. Analysts are carefully watching this stage; if BTC can respect it, the bullish momentum could persist, encouraging additional beneficial properties.

Nonetheless, the current euphoria may result in a consolidation section just under $77,000—a stage some specialists determine as a short-term native high. This resistance may take time to beat because the market digests current beneficial properties and awaits recent catalysts for an additional breakout.

Associated Studying

Regardless of potential consolidation, demand stays strong, and on-chain information displays robust shopping for strain that would proceed driving the value upward. The technical outlook suggests additional upside potential if Bitcoin can keep above $73,800 over the approaching days. Bulls are optimistic, because it may set up a strong basis for the subsequent leg up in Bitcoin’s ongoing rally.

Featured picture from Dall-E, chart from TradingView