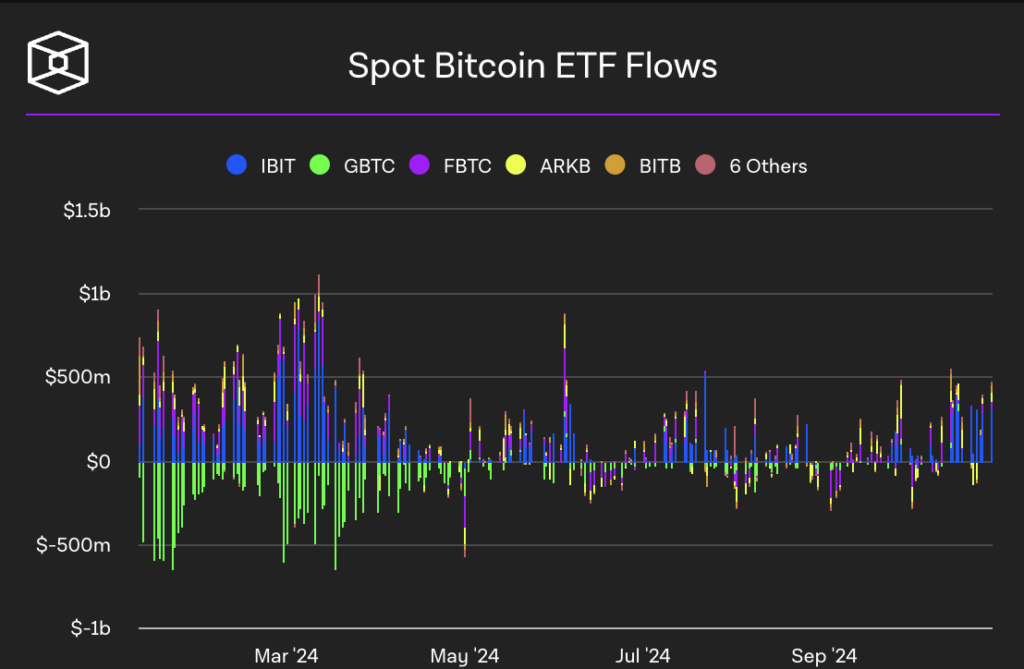

Bitcoin reached $73,500 on Oct. 29, coming inside $200 of its all-time excessive of $73,700. On the identical day, Bitcoin exchange-traded funds (ETFs) recorded whole inflows of $870.1 million, indicating a major improve in funding exercise.

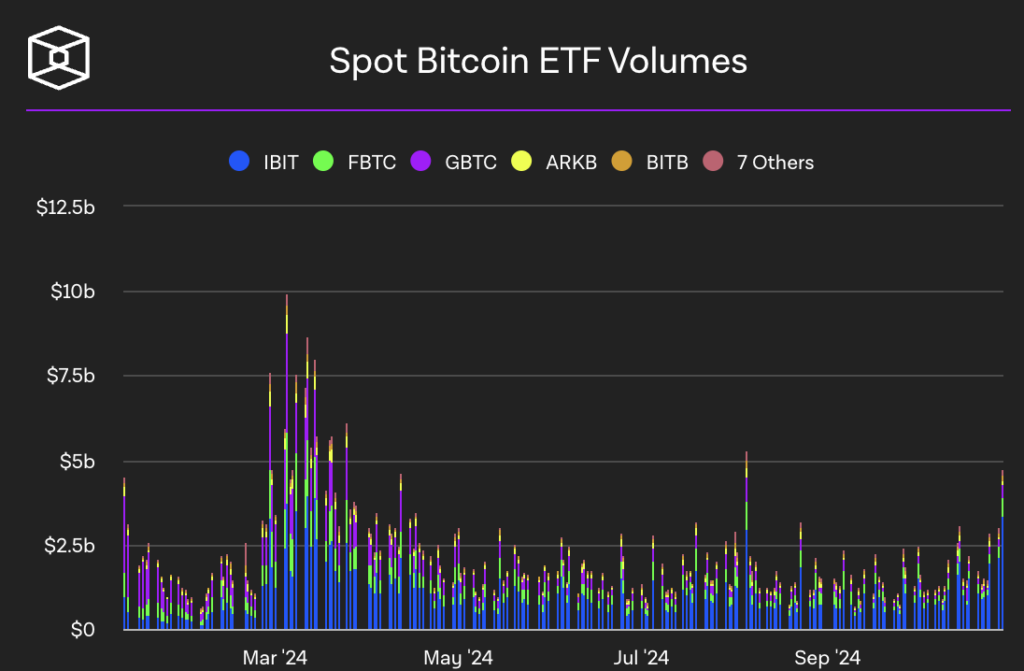

The Block historic information exhibits that with nearly $5 billion in quantity, yesterday was additionally inside the prime 10 days for the reason that spot ETFs launched in January and the very best since August.

The iShares Bitcoin Belief (IBIT) led the inflows with $642.9 million, reinforcing its place available in the market. Constancy’s FBTC adopted with $133.9 million, whereas Bitwise’s BITB attracted $52.5 million. ARK’s Bitcoin ETF (ARKB) noticed inflows of $12.4 million, and Grayscale’s BTC fund added $29.2 million regardless of earlier outflows.

As of press time, the Block information has not been up to date to incorporate Oct. 29. Nevertheless, the visualization under illustrates that the $870 million influx was solely surpassed on eight different days since launch.

These substantial inflows align with Bitcoin’s worth surge, suggesting elevated investor confidence. The proximity to its all-time excessive might have spurred extra curiosity, particularly with the US election simply days away.

Market analysts are watching to see if this momentum will push Bitcoin previous its earlier peak. The numerous capital flowing into ETFs like IBIT and FBTC signifies a robust urge for food for Bitcoin publicity by way of conventional funding automobiles.