Key Takeaways

- Bitcoin dominance measures the ratio of the Bitcoin market cap to the cumulative cryptocurrency sector market cap

- It’s at the moment at 58%, the best mark since April 2021

- Market dynamics are altering as establishments think about Bitcoin, whereas remainder of crypto market nonetheless struggles amid tight financial coverage setting

- Regulatory clampdown has additionally declared many tokens as securities, whereas Bitcoin seems to be carving out its personal area of interest

The Bitcoin market isn’t boring.

Having mentioned that, the yr 2023 has (so far not less than) has not thrown up mayhem on the dimensions of what we noticed in previous years. In 2022, Bitcoin freefell because the world transitioned to tight financial coverage, whereas scandals such because the Terra collapse and the staggering deception at FTX coming to gentle. This got here after the pandemic years of 2020 and 2021, when crypto surged into mainstream consciousness, Bitcoin printing dizzying features and galvanizing dinner desk dialog across the globe as to what this mysterious Web cash was all about.

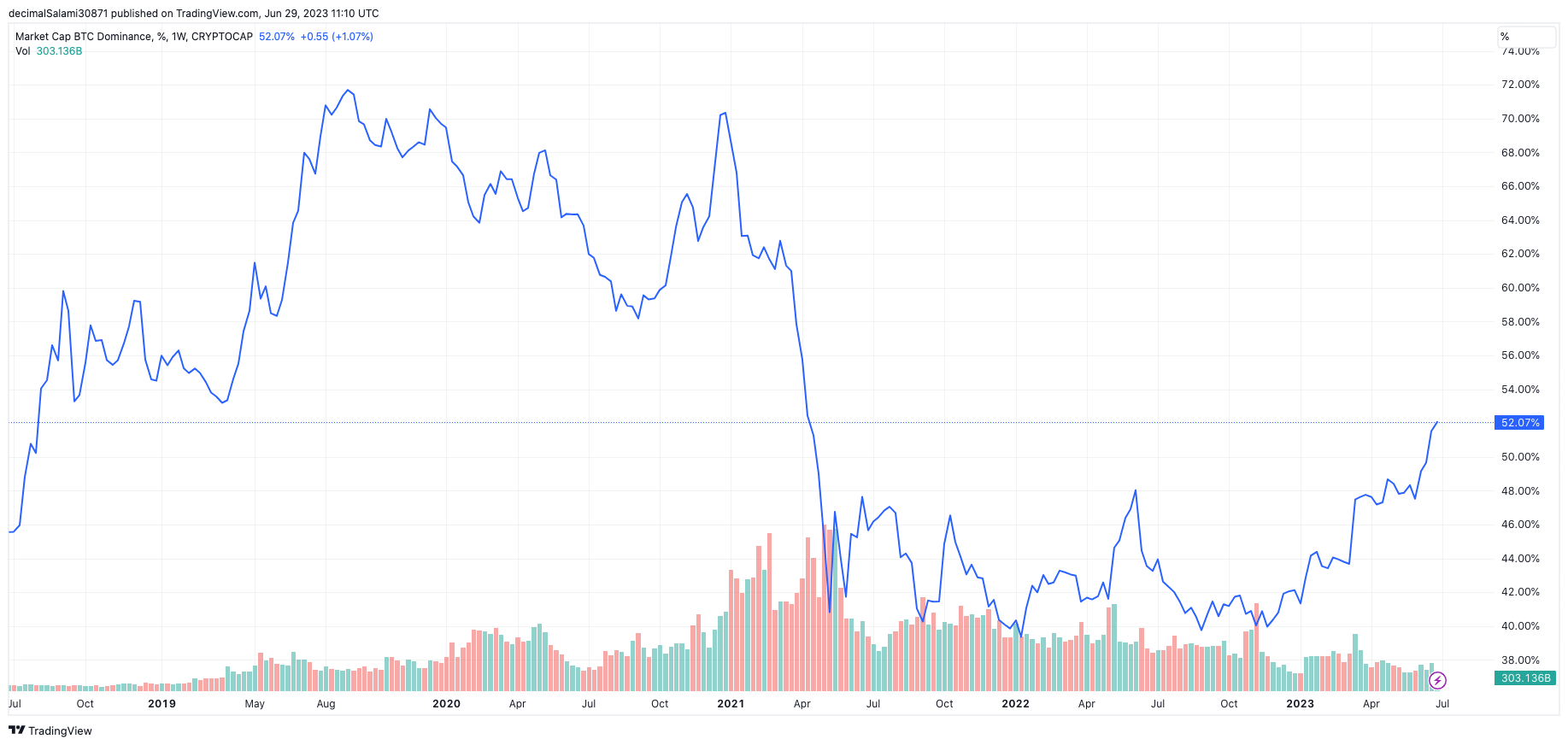

So, 2023 can not match the dimensions of that drama. However there’s something very intriguing taking place to the market dynamics of Bitcoin, not less than relative to different cryptocurrencies. Bitcoin dominance, which measures the ratio of the Bitcoin market cap to the cumulative market cap of all cryptocurrencies, is at its highest degree in over two years, at 52%. In different phrases, 52% of the cryptocurrency market cap, at the moment at $1.18 trillion, is Bitcoin.

Dominance fell within the years 2020 and 2021

Dominance fell within the years 2020 and 2021

The above chart exhibits that Bitcoin opened the yr 2020 with a dominance of about 70%. Over the course of the subsequent 12 months, it bounced round a bit and trickled all the way down to the excessive 50s. Nonetheless, it was the ultimate quarter of 2020 when Bitcoin started to make critical strikes, rising from $10,000 to $28,000. On this time interval, the dominance ratio rose from 59% again to 70%, the place it closed at, roughly the identical dominance ratio it opened the yr at twelve months earlier.

The next yr, 2021, noticed altcoins catch up. Bitcoin’s dominance plunged like a stone, falling faster than it ever had earlier than. The broader cryptocurrency market exploded as stimulus cheques, lockdown-driven Robinhood buying and selling and basement-level rates of interest pushed capital into something and every part remotely related to a blockchain.

The overall cryptocurrency market cap touched $3 trillion in November 2021, whereas Bitcoin’s market cap peaked at $1.28 trillion. Bitcoin dominance, due to this fact, was all the way down to 43%. Nonetheless, the worst inflation disaster for the reason that Nineteen Seventies pressured central banks into one of many quickest fee mountaineering cycles in latest reminiscence, following years of zero (and even damaging in some instances) charges.

For danger belongings, this spelled bother. And make no mistake, the complete crypto market is as far out on the danger spectrum because it will get. Capital flooded out of the area as charges continued rising, inflation obtained hotter, and a number of other nefarious scandals struck the crypto sector (taking a look at you, Do Kwon, Sam Bankman-Fried and Alex Mashinsky).

Which brings us to now. Whereas inflation peaked in This fall final yr, the macro local weather continues to be unsure. Employment is tight, the economic system continues to be sizzling and inflation, whereas dropping, is effectively north of the Federal Reserve’s 2% goal. In Europe, inflation is even hotter (and don’t even ask in regards to the UK, if that also counts as Europe anyway).

In crypto, nonetheless, one thing is altering. Bitcoin’s dominance has risen and seems to be in an uptrend once more. It’s at the moment as much as 58%, the best mark since April 2021. On the one hand, that is typical of what we now have seen previously: cash begins to circulate into Bitcoin after a protracted and seismic pullback (2022), seeing dominance rise earlier than it will definitely filters into altcoins and the remainder of the market catches up.

Nonetheless, there are two factors to counter why this time might be completely different, and will give pause for thought to these assuming that altcoins will comply with this time round. The primary is, effectively, apparent: previous cycles aren’t indicative of future ones, and that is very true for Bitcoin.

The asset was solely launched in 2009, and it’s only within the final 5 years that it has traded with any kind of cheap liquidity (though even at that, it’s skinny). It could be silly to place an excessive amount of weight into earlier years, due to this fact, particularly as its whole existence has, till final yr, coincided with a outstanding bull market within the wider economic system. That is Bitcoin, and crypto’s, first rodeo in a high-interest fee setting, so all bets are off.

However other than that blindingly apparent caveat, there’s extra proof to recommend that there might have been a structural shift with regard to the market within the final six months, or one thing which will change the dominance development going ahead. What I’m referring to is regulation and, extra not too long ago, institutional strikes.

The regulatory clampdown within the US has been brutal for the crypto sector, with a lot of tokens being confirmed as securities by the SEC in latest instances, together with Solana, Polygon, Cosmos, BNB and Cardano. Bitcoin, alternatively, seems to be carving out its personal area of interest. Or, as Coinbase CEO Brian Armstrong mentioned when discussing the lawsuit levelled in opposition to his alternate by the SEC, “we sort of obtained this info from the SEC that, effectively truly, every part apart from Bitcoin is a safety”.

Due to this fact, it feels silly to declare this rise in dominance over the previous few months as non permanent. If something, it’s shocking that it has not risen extra, though a variety of this regulatory bother might have been priced in already, whereas the most important non-Bitcoin token, Ether, appears to have evaded the dreaded safety label so far.

Nonetheless, there’s additionally the fact of what has been taking place on the institutional facet in latest weeks. Blackrock and Constancy, two of the world’s largest asset managers, have each filed for spot ETFs. These are Bitcoin ETFs, not crypto ETFs.

In a sector the place regulation is so hazy and the intimidation issue of really shopping for bodily Bitcoin is so excessive (the fact is that wallets and seed phrases usually are not splendid for brand spanking new customers or institutional funds, irrespective of how seductive the promise of self-custody is), this might do wonders for liquidity – one of many massive components holding Bitcoin again proper now. It might additionally assuage concern across the lack of transparency and reliability of centralised exchanges, as establishments can merely bypass actors like Binance and go straight in the direction of a (regulated) Bitcoin ETF. After all, these ETFs usually are not authorised but, however we’re a hell of quite a bit nearer to a Bitcoin ETF than every other kind of crypto ETF.

The macro local weather continues to be unsure: inflation might have peaked however continues to be elevated, and with financial coverage notoriously working with a lag, the total ache of a Fed fee north of 5% has but to be felt. There are quite a few challenges nonetheless to return. The regulatory crackdown might worsen, whereas who is aware of what goes behind the scenes at a few of these crypto corporations. However it feels plain that as dangerous as issues are for crypto, Bitcoin has its head and shoulders above the remainder of the gang.

With all this in thoughts, the rising dominance is smart. And whereas I don’t know what occurs subsequent (on the finish of the day, crypto goes to crypto), I definitely see nothing that will make me assured that Bitcoin dominance, which is now at a two-year excessive, is certain to inevitably retreat quickly.

Share this text

Classes

Tags

https://coinjournal.internet/information/bitcoin-dominance-surging-amid-changing-market-dynamics-and-regulatory-crackdown/