Bitcoin began the month of October on a detrimental be aware, deviating from what many traders had anticipated main as much as the month. Bitcoin, which had been on a notable value improve earlier, began to face setbacks as September ended, main as much as the primary 24 hours of October.

The primary 24 hours of October have been riddled with outflows from the crypto business. Bitcoin, particularly, fell beneath $61,000, in line with Coinmarketcap, as tensions began to rise within the Center East. Going by this decline, it has raised questions as to the outlook for Bitcoin in the remainder of the month.

Present Bitcoin Value Motion

The excitement main into October centered round expectations that Bitcoin would lengthen its bullish momentum and break by means of key resistance ranges. In accordance with value information, Bitcoin ended the month of September 7.11% above the place it began, even peaking above $66,000 at one level.

Associated Studying

Nevertheless, on the time of writing, Bitcoin has fallen by nearly 7% from the September peak. Moreover, Coinmarketcap information reveals that Bitcoin has been down by 3.6% up to now 24 hours. The swift downturn has altered the market’s sentiment, with the once-bullish outlook giving approach to worry and uncertainty. The Worry and Greed Index, which gauges the market’s feelings and danger urge for food, now reads 39 and indicators “Worry.” It could appear crypto traders at the moment are panicking, with crypto analyst Kaleo even calling this to consideration on social media platform X.

After spending 5 minutes scrolling by means of the timeline you’d suppose we’re by no means going to see a inexperienced candle once more

— Ok A L E O (@CryptoKaleo) October 1, 2024

Bitcoin’s value motion is extremely delicate to occasions on the planet. Notably, the current decline within the value of Bitcoin may be attributed to geopolitical conflicts within the Center East. Its current efficiency within the face of geopolitical turmoil casts doubts on its position as a secure haven asset.

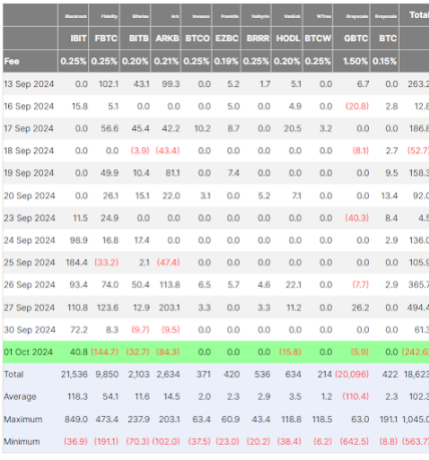

Spot Bitcoin ETFs, which are supposed to prop up the Bitcoin spot value, additionally ended eight consecutive days of inflows with large outflows on October 1, most definitely in response to the Center East tensions. In accordance with Spot Bitcoin ETF move information from Farside Buyers, institutional traders pulled out $246.2 million yesterday.

Is Uptober A Delusion?

The optimistic outlook appears to have light shortly amongst many crypto traders. Nevertheless, many contributors are nonetheless holding on to the bullish outlook, particularly contemplating the month nonetheless has a protracted approach to go earlier than its conclusion.

Associated Studying

Historical past reveals, most of the time, that October has at all times been a constructive month for Bitcoin. Most significantly, the constructive efficiency was principally within the second half of the month. Contemplating the month is barely at its starting, it’s extra logical to attend and look at how the value motion performs out for the remainder of the week earlier than drawing any conclusion on Uptober.

Within the face of those tensions, Bitcoin’s potential position as a secure haven asset much like gold may rise amongst market contributors in the remainder of the month and past.

Featured picture created with Dall.E, chart from Tradingview.com