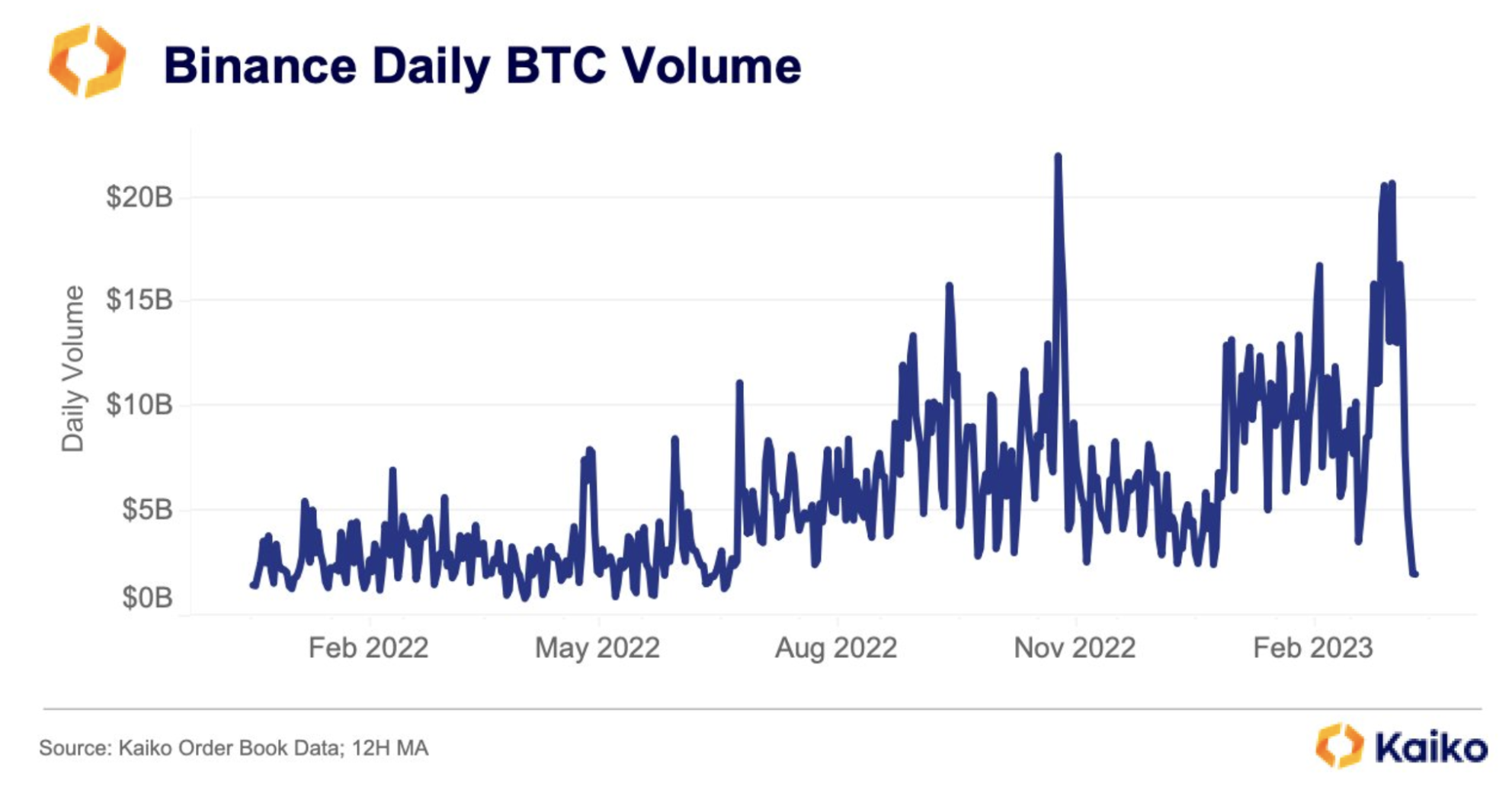

Binance, the world’s largest crypto change by buying and selling quantity, recorded its lowest bitcoin (BTC) buying and selling quantity on Sunday since July 4, 2022, in accordance with knowledge from Kaiko.

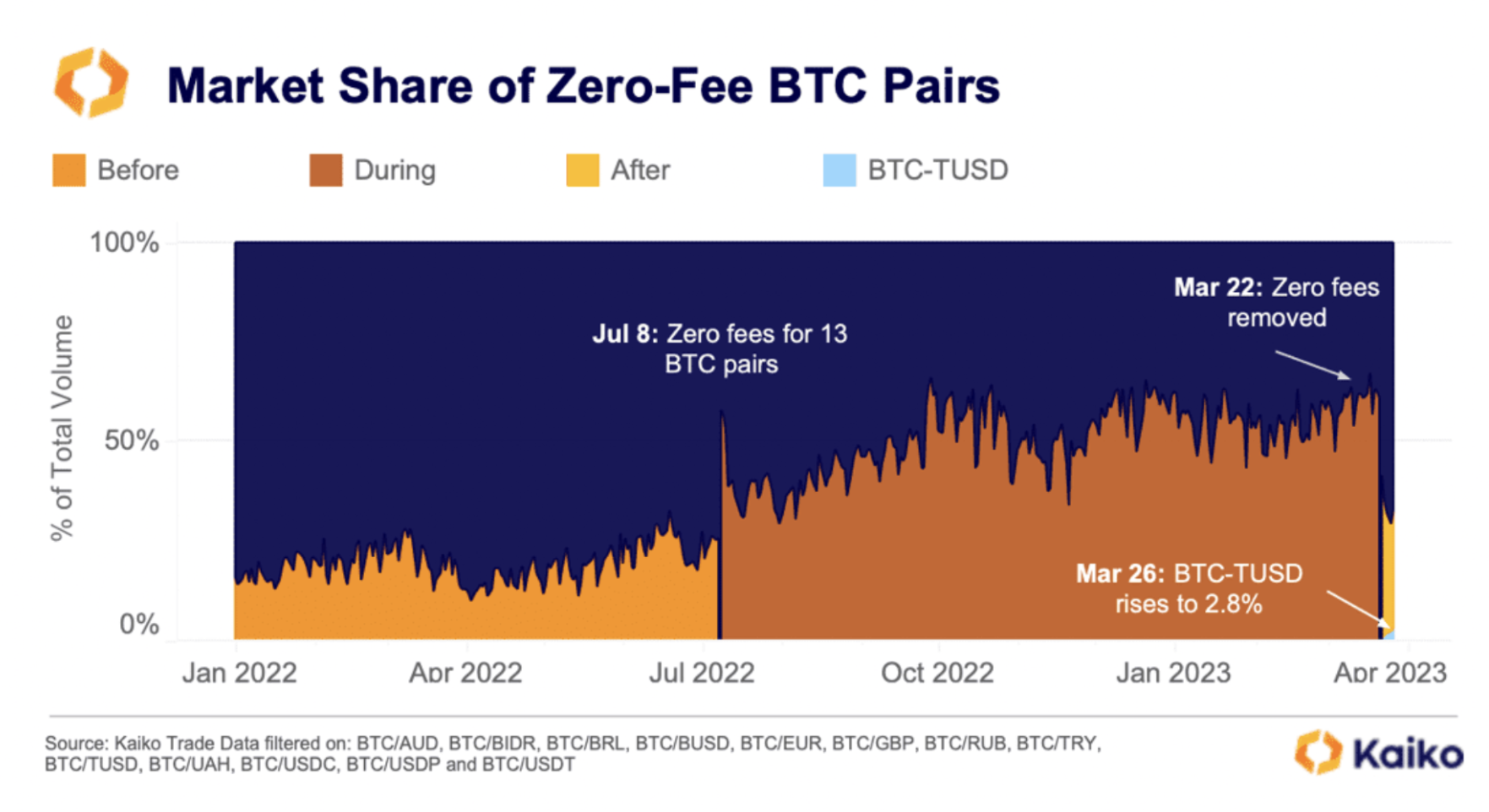

Quantity for 13 buying and selling pairs, which as soon as accounted for roughly half of the change’s quantity, has dropped to about 30%. The change’s international market share, which peaked at over 70%, has dropped to about 58%.

Common volumes of the BTC-USDT buying and selling pair have plummeted 90%, Kaiko famous.

The declines come after the change halted its no-fee buying and selling promotion for the 13 bitcoin spot buying and selling pairs, together with BTC-USDT, on March 22. Binance known as the promotion short-term. In an e-mail to CoinDesk final week, Clara Medalie, analysis director at Kaiko, wrote that with out zero-fee, she anticipated “a short-term drop in market share.”

Binance’s zero-fee buying and selling promotion on July 8 elevated quantity for each tether USD (USDT) and binance USD (BUSD) and helped Binance improve its market share to 72% from 50%, in accordance with Kaiko analysis analyst Riyad Carey.

As of mid-March, zero-fee commerce quantity accounted for 66% of Binance’s buying and selling quantity.

Binance phased out zero-fee buying and selling final week, except for the trueUSD (TUSD) stablecoin. “It’s unclear why Binance has chosen to advertise its TUSD pair, though it seems the change has chosen the stablecoin as a successor to BUSD, which is being phased out due to regulatory actions within the U.S,” the report from Kaiko mentioned.

Earlier than zero charges began, Binance’s buying and selling market share for the 13 BTC pairs was simply 25% earlier than greater than doubling. “It has now been simply 5 days since charges have been reinstated, and market share has halved and is at the moment beneath 30%,” Kaiko mentioned.

Binance’s international market share is down 10% since final week. The change suffered a two hour outage final week, the results of a pc bug that pressured it to droop spot market buying and selling and will have contributed to the drop.

In latest weeks, Binance has additionally endured elevated regulatory scrutiny. On Monday, the U.S. Commodity Futures Buying and selling Fee sued the change and founder Changpeng Zhao on allegations the corporate knowingly provided unregistered crypto derivatives merchandise within the U.S. in opposition to federal regulation.

Market share of tether-USD on the change has dropped from 81% to 68%, however TUSD volumes have had a small improve, climbing to $5 million. The BTC-TUSD pair, nonetheless, accounts for less than 2.8% of the change’s complete quantity.