Avalanche (AVAX) has had a horrible Q2 2024 by a number of requirements, going by a major decline in market capitalization coupled with low income technology.

Associated Studying

Messari’s current report indicated that AVAX confronted a fierce correction after two quarters of progress on the trot. Market capitalization dipped by 40% throughout the final quarter to face at $11.6 billion. Nicely, regardless of this stoop, the ecosystem continues to be sound as AVAX nonetheless has a market cap of $4.5 billion — that’s a 157% surge in comparison with the identical interval in 2023.

State of @avax Q2

Key Replace: A number of partnerships introduced, notable ones embrace @stripe, @homium, and @konami.

QoQ Metrics 📊

– Staked AVAX ⬆️ 6%

– DeFi TVL (AVAX) ⬆️ 11%

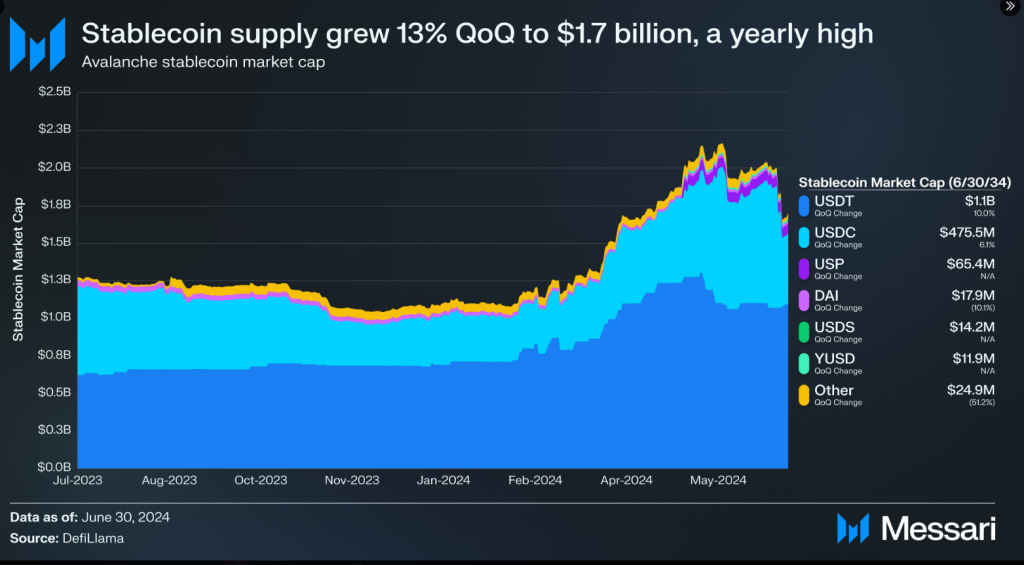

– Stables ⬆️ 13%Learn the complete report 🔗https://t.co/7xsKIj1ml3 pic.twitter.com/0dSZnfXOVE

— Messari (@MessariCrypto) September 13, 2024

Worth Forecast Shines By The Dip

The stoop is paining the bigger ecosystem, however the way forward for AVAX appears brighter. Actually, the value forecast of the token will shine hope for buyers. AVAX is seen going up 70.68% over the following three months, displaying a bounce from the current costs, evaluation from CoinCheckup exhibits.

This bullish sentiment is bolstered by long-term projections that counsel a 166% progress over the following yr. It appears AVAX is poised for restoration, making it an intriguing asset for merchants keeping track of the market.

Income Plunge And On-Chain Exercise

Income for the Avalanche ecosystem was one other supply of fear, as its worth went down from 176,700 AVAX in Q2 2024 to 96,200 AVAX throughout the identical interval. In greenback phrases, that translated into $7.5 million taking place to $3.5 million.

Pullback is because of slowed exercise throughout completely different on-chain platforms. Nevertheless, some analysts consider {that a} renewed curiosity in on-chain-based transactions might assist revive income progress within the brief time period.

Regardless of these drops, staking stays strong throughout the Avalanche ecosystem. There’s a 6% enhance within the variety of staked AVAX tokens resulting from new measures to spice up staking. Staking rewards proceed to draw new buyers regardless of a fall in energetic validator depend by 7%. This displays some unease amongst validators amidst these market situations.

Community Stability

Common transaction counts stay blended. With roughly 11,262 transactions and a median block time of 1.61 seconds, Avalanche is displaying stability. Greater than 2% of the full cash have been despatched from the Elliptic Curve Digital Signature Algorithm pockets. Regardless of the recorded drops, new initiatives are anticipated to spice up staking and future coin balances.

Associated Studying

Apparently, the place the community had a median transaction that depreciated by 57% from 495,000 to 201,500, some protocols on Avalanche refused to abide by this pattern. Tether (USDT) and GMX elevated transaction volumes, which indicated particular sectors within the system are doing properly regardless of this broad slowdown for the crypto market.

Since AVAX is getting ready for a possible rebound from the market, its buyers could possibly see renewed curiosity within the asset in case such forecasted progress in worth comes true.

The partial restoration within the transaction volumes for chosen protocols additionally suggests one thing extra is being concerned underneath the floor–an indication that Avalanche may choose up quick as soon as the crypto market picks up. For now, buyers are eager sufficient to watch how AVAX acts within the brief and medium phrases.

Featured picture from Durango.com, chart from TradingView