The on-chain analytics agency Santiment has revealed the potential cause behind the corrections that Dogecoin and Apecoin have confronted just lately.

Dogecoin & Apecoin Are Amongst Memecoins That Fell Prey To FOMO Not too long ago

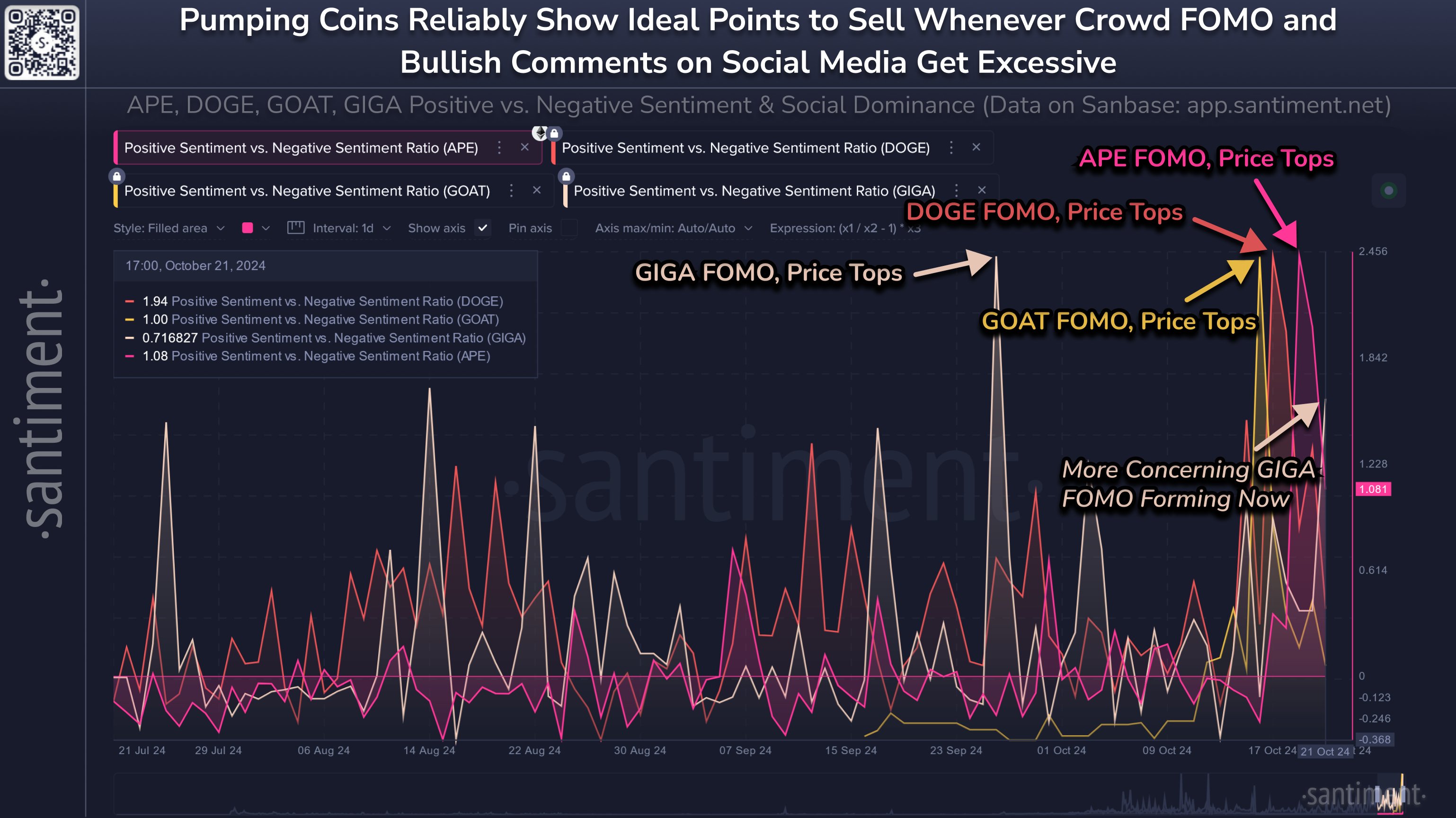

As defined by Santiment in a brand new put up on X, the Optimistic Sentiment vs. Damaging Sentiment Ratio has seen a spike for Dogecoin and different memecoins just lately.

The “Optimistic Sentiment vs. Damaging Sentiment Ratio” right here refers to an indicator that tells us whether or not main social media platforms are leaning in direction of constructive or destructive feedback proper now.

This indicator makes use of a machine-learning mannequin designed by the analytics agency to separate between feedback pertaining to destructive and constructive sentiments.

When the worth of the metric is larger than zero, it means the entire variety of constructive posts/threads/messages is outweighing that of the destructive ones. However, the indicator being below this threshold suggests the dominance of bearish sentiment on social media.

Now, right here is the chart shared by Santiment that exhibits the development on this indicator for 4 property over the previous few months:

As displayed within the above graph, Dogecoin and Apecoin each witnessed spikes within the Optimistic Sentiment vs. Damaging Sentiment Ratio just lately, implying a considerable amount of constructive feedback associated to those cash had been made on social media.

Apparently, because the analytics agency has identified, these spikes coincided with tops within the DOGE and APE costs. The opposite two memecoins listed within the chart, GIGA and GOAT, additionally witnessed an identical sample, though their tops got here earlier than that of the previous two.

Whereas constructive sentiment can recommend perception available in the market, a considerable amount of it may be a sign of extreme hype, which is one thing that has traditionally led to tops for not simply memecoins however cryptocurrencies usually.

“Costs usually all the time go the other way of the group’s expectations, and when the group will get excessive on both the bullish or bearish finish, it turns into extremely predictable to purchase or promote,” explains Santiment.

Given the timing of the current constructive spikes within the indicator, it might seem potential that the Concern Of Lacking Out (FOMO) that developed among the many buyers was the explanation behind the corrections that Dogecoin and others have confronted.

The Optimistic Sentiment vs. Damaging Sentiment Ratio might now be to observe within the coming days, as any cooldowns in its worth might pave method for bullish momentum to restart for these cash.

DOGE Worth

Dogecoin had neared the $0.150 stage a couple of days in the past, however with the correction that has adopted since then, its worth has retraced again to the $0.136 mark.