Making processes extra accessible, sooner, and extra environment friendly: It’s one thing any enterprise desires to reap the benefits of whatever the occasions.

When a worldwide occasion resembling a pandemic shifts how issues are achieved, nevertheless, typically these efficiencies grow to be obligatory for stability and development.

Coping with paper behind the home, so acquainted in lots of an establishment, turned a substantial impediment, recounts Debbie Sensible, senior product marketer at Q2 Holdings.

“Bigger companies have been sort of in the identical boat as banks: that they had handbook processes that they handled, and I believe there was an emphasis on making an attempt to enhance these processes and create extra automation, but it surely was tolerable the way it was till the pandemic hit,” mentioned Sensible is a principal writer of Q2’s annual business banking report together with Gita Thollesson, supervisor of strategic advisory companies for the company.

“(It) additionally created a swap to extra digital funds as a result of issuing checks was laborious, particularly after they needed to be cosigned. Folks have been assembly within the park to get the opposite signature.”

Pair of key fintech takeaways

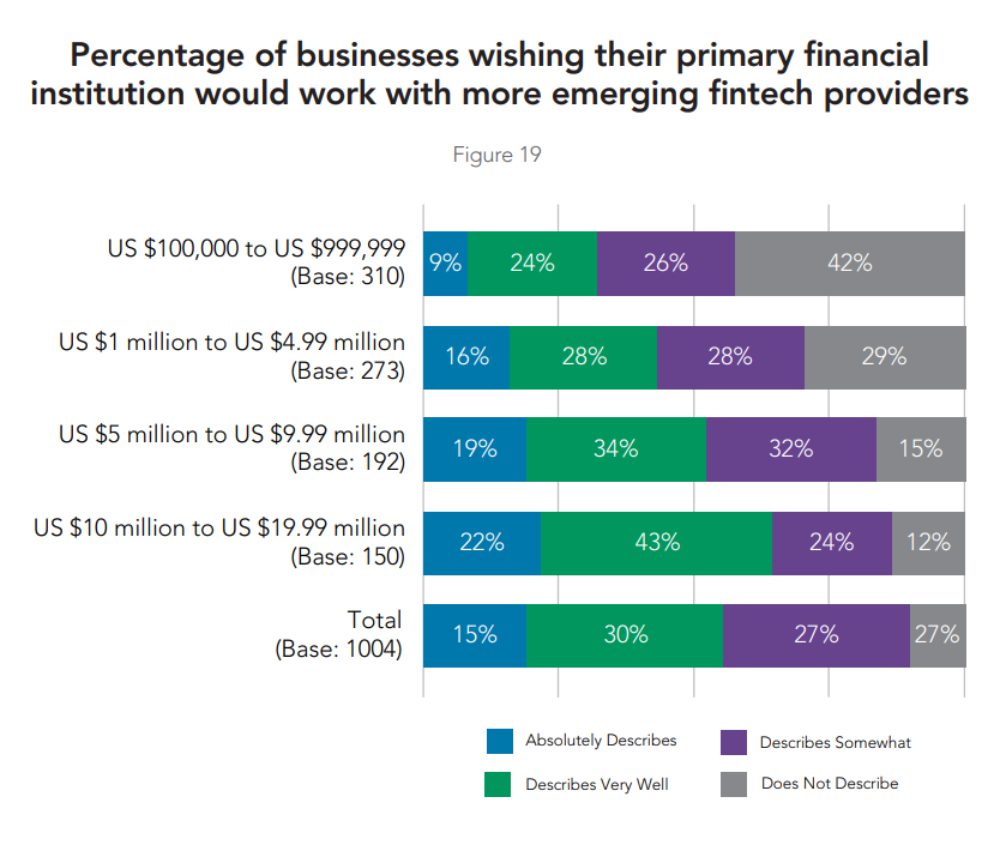

Two key takeaways in digital back-end transformation and funds innovation from the 2023 State of Business Banking Market Evaluation Report from Q2 and subsidiary PrecisionLender, launched Jan. 31, ought to additional encourage fintechs and small companies about future alternatives for development in terms of service from monetary establishments.

It highlights the significance for monetary establishments to additional accomplice with fintechs to raised service small companies.

Q2 supplies digital banking and lending options for banks, credit score unions, alt-fi, and fintech firms, enabling them to supply complete data-driven digital experiences to their finish customers.

Additional fine-tuning the digital expertise for patrons, who’ve come to anticipate processes to work very similar to different processes of their lives, is crucial for business bankers who search to extend income alternatives, says Sensible.

Like many sectors seeking to bolster enterprise within the wake of the financial shutdowns as a result of COVID-19 pandemic, banks and credit score unions are more and more partnering with fintechs to enhance the digital expertise, significantly in terms of back-end processes.

“What occurred is the pandemic took a evident mild and shined it actual shiny, as if to say, ‘In the event you’re not within the workplace, when you’re not within the constructing, these things is far more durable to do when it’s handbook,’ after which the identical factor for patrons,” mentioned Sensible, who’s closely centered at Q2 on the monetary establishment’s area.

A ‘mindset shift’ as a result of new homeowners’ experiences

It’s a “generational transformation” we’re seeing concerning this course of. For small companies, it’s not essentially being spurred by the repercussions of the COVID pandemic, however by the technological adjustments that form individuals’s day-to-day life, Sensible says.

“The boomers that personal the companies are beginning to retire, and the millennials are shifting in, and so they have totally different experiences as a client,” mentioned Sensible. “They’re used to the best way Amazon works and Netflix works. They’re used to having predictive issues assist inform them what they should do, so there’s a mindset shift due to their experiences as shoppers that they’re now bringing to their companies.”

As Sensible co-wrote within the report, “what as soon as was a dialog about self-service and the web banking platform has morphed into a much bigger dialog concerning the digital ecosystem and the way it can profit the monetary establishment and its enterprise purchasers.”

By inspecting processes and figuring out inefficiencies that digitization and automation can handle, banks can higher present a sturdy digital expertise for patrons “whereas reducing the time to income for the monetary establishment,” she writes.

Streamlined processes have created a requirement

“Say a small enterprise wants a $25,000 mortgage or a $50,000 mortgage; they’ll attain out to SoFi for Amex and have a mortgage accepted in as fast as 48 hours,” Sensible mentioned in an interview.

“It relies on the credit standing and the quantity they’re asking for and all that, however there’s a complete streamlined course of to make that actually quick, the place those self same small companies going right into a financial institution department immediately and filling out an software for a small enterprise mortgage, it may well take weeks typically.

“The banks are getting higher, and so they’re doing higher at closing these inside per week or two, relying on the financial institution, however there’s nonetheless a big lag in comparison with what they’re in a position to get from the choice sources for financing.

“In order that’s created plenty of the demand: individuals’s experiences with these different entities. They need to have these experiences with their monetary establishments as effectively.”

The belief issue is ‘large.’

A pivotal level within the relationship between banks and their clients is the belief issue: each shoppers and companies have religion — there’s ‘nonetheless an enormous belief with clients,’ says Sensible — of their monetary establishments.

“One of many areas we went into within the report was this concept of fintech integration into the financial institution’s experiences,” she mentioned. “After we exit and ballot small enterprise clients, they actually need their financial institution to be or their monetary establishment to be the place to convey that each one collectively. They belief the banks. They know that we have now entry to their knowledge anyway. They know that we can assist vet the fintechs and assist vet who is sweet companions.

“The small enterprise clients need these varieties of companies from their banks, after which the banks depend on individuals like us to assist convey that collectively extra cohesively.”

Price effectivity central to funds shift to digital

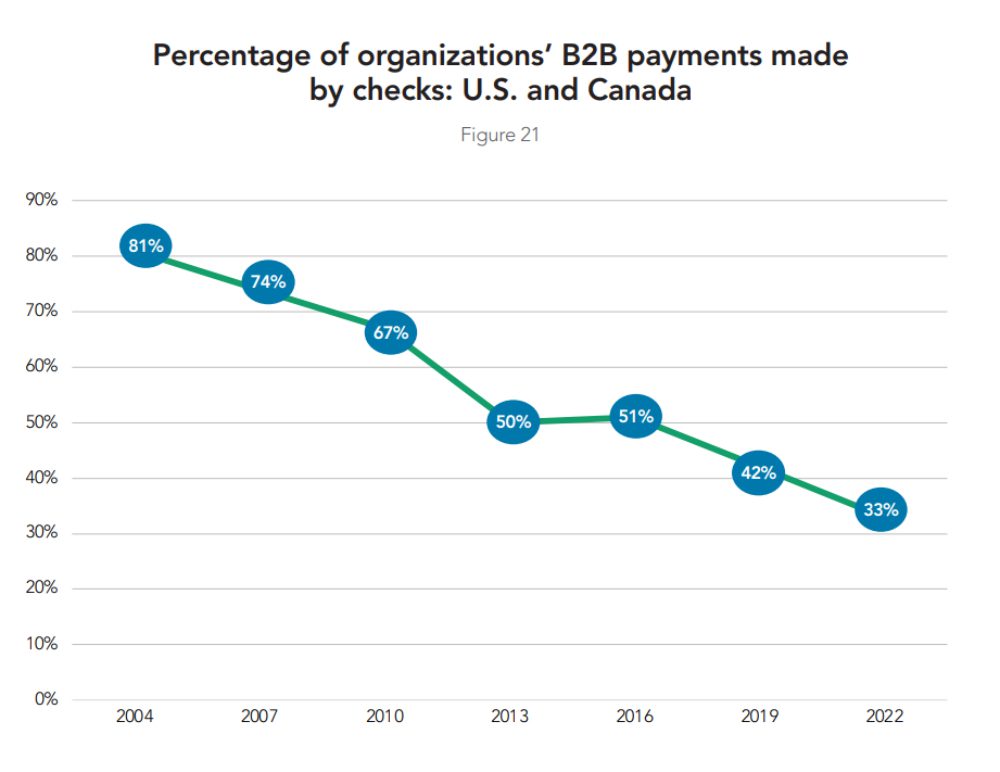

Fee improvements are additionally serving to degree the enjoying area, one other key takeaway from the Q2 report. The pandemic work-from-home setting and additional development of examine fraud have seen extra digital adoption by small companies when issuing funds.

Nonetheless, a 3rd of B2B funds within the U.S. and Canada are made by paper examine, down from 42 % in 2019, and a pattern has been pointing down steadily, if not sharply, since 2004, when that determine was 81 %.

“Although we’ve seen that determine come down, it’s large,” Sensible mentioned.

Past making funds sooner, the good thing about shifting them to a digital system is price effectivity. Bill/remittance knowledge can journey with the fee from begin to end. New instantaneous fee rails set to be launched within the US, such because the Federal Reserve financial institution’s FedNow service, are anticipated to assist remodel fee duties.

“The bigger firms which might be suppliers to small companies are searching for methods to streamline how they’re paying. They might slightly not get checks, but when they get an ACH, they don’t need the knowledge in an e mail,” Sensible mentioned. “That’s why I believe the wealthy messaging capabilities that the brand new instantaneous fee rails provide are a chance for us to unravel that ache level lastly.

“I’ve been seeing this ache level with companies for many years, for simply 20-30 years. I keep in mind within the Nineties having conditions with companies making an attempt to incentivize their smaller companies or buying and selling companions to pay electronically and determine methods to get the remittance data there.”