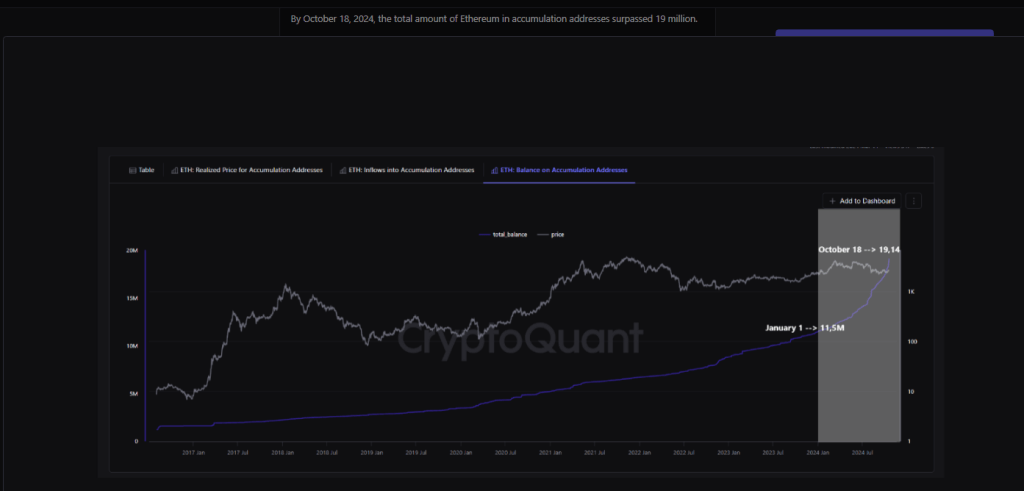

With a powerful enhance in coin acquisition, Ethereum aficionados are inflicting waves within the crypto house. From January’s 11.5 million, the latest statistics reveal a strong 19 million ETH now stashed in long-term holding addresses, virtually doubled, knowledge from CryptoQuant exhibits.

With buyers apparently rising their bets, this large surge factors to a rising religion in Ethereum’s future. The crypto world is rife with conjecture since many estimate this depend will attain 20 million by 12 months’s finish.

Associated Studying

Clearly, there’s a vital optimism in Ethereum’s long-term potential regardless of market swings, which leaves many questioning what’s behind this enhance in confidence and what this might imply for the scene of cryptocurrencies going ahead.

Numerous components are encouraging institutional and particular person buyers to extend their holdings. Notably, the US Securities and Change Fee’s (SEC) approval of spot Ethereum exchange-traded funds (ETFs) has allowed new gamers to enter the market.

Spot ETFs Push Demand

Extra curiosity from mainstream buyers has come from Ethereum spot ETF approval in nice half. This means that each particular person buyers and establishments are preparing for Ethereum’s long-term future. One researcher of cryptocurrencies even thinks that by the top of 2024, the ETH in accumulating addresses will equal the market worth of the most important corporations worldwide.

Moreover, assuming Ethereum costs stay round $4,000, the analyst tasks that if these patterns proceed, the overall worth of ETH held in these addresses could attain $80 billion. At $2,737 proper now, ETH has elevated in worth by over 3% over the past 24 hours and over 10% over the past week.

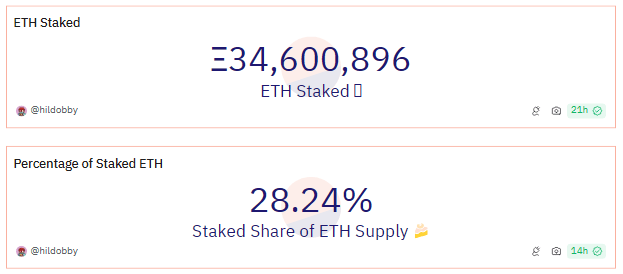

Staking Secures Extra Ethereum

The opposite predominant purpose why much less ETH is discovered available in the market to commerce is thru the enhance in Ethereum staking. In keeping with Dune Analytics, staking contracts have locked up over 34.6 million ETH that equates to just about 30% of the whole Ethereum provide, therefore exhibiting the statistics. This led to an absence of tokens on the market and subsequently performed an element in taming costs.

Extra worth progress for ETH could also be doable if the quantity staked retains rising. The Ethereum market could expertise much less volatility and extra long-term progress potential if there are much less sell-side pressures.

Associated Studying

The Value Outlook Is Good

The present worth swings of Ethereum are primarily upward. ETH is presently buying and selling above $2,700—an important assist degree—because of the assist of its 50-day transferring common. The 200-day transferring common, which is $3,022, stays a barrier, although. If Ethereum is to expertise constant worth progress, it is going to be crucial to interrupt over that impediment.

Ethereum’s long-term supporters are undoubtedly upbeat in regards to the platform’s future, and the accumulating tendency together with staking and spot ETFs counsel that this confidence may not be unfounded. Will probably be attention-grabbing to see if Ethereum can overcome vital pricing obstacles, however one factor is for certain: in the intervening time, the long-term image seems promising.

Featured picture from Pexels, chart from TradingView