The idea of embedded finance isn’t new — consider a private-label bank card supplied by a division retailer — however the trendy distribution mannequin that marries monetary companies with a longtime enterprise’s gross sales setting is rising as a worldwide funds pressure.

That’s the first takeaway from a January report by DECTA, a worldwide fee processing agency utilized by greater than 2,000 firms in 32 international locations, which suggests customers in lots of demographics are embracing and demanding higher embedded monetary companies.

“I feel that’s what makes ideas akin to embedded finance attention-grabbing and thrilling for the time being: the know-how is lastly catching up with them,” mentioned Scott Dawson, head of gross sales and strategic partnerships for the London-headquartered DECTA, which supplies retailers, banks and fee service suppliers a whole vary of digital companies.

In inspecting embedded finance’s a number of sides, DECTA researchers gave a number of takeaways on what corporations can anticipate as functions of it proceed to evolve. They embrace excessive demand for the supply of a buyer’s most well-liked fee technique and the pace and ease of the expertise.

“Once you take a look at the info that we have now disclosed, customers care about this, and it’s a change within the fee ecosystem,” Dawson mentioned. “It’s truly affecting conversion charges, shopper confidence, and such. I feel that’s fairly attention-grabbing and fairly vital.”

Room to develop for embedded finance

The report concludes the marketplace for embedded finance, whereas considerably established already, nonetheless has room to develop. Embedded finance reached revenues of $20 billion within the US in 2021. Estimates say that determine will double within the subsequent three to 5 years.

DECTA carried out separate surveys within the U.S. and the UK with 1,504 respondents, consulting with British internet buyers aged 19-68 and their U.S. counterparts aged 23-68.

Among the many responses, 85% of Britons thought of the supply of a most well-liked fee technique ‘essential.’

One other discovering was that 49% of respondents from each international locations indicated they might abandon a purchase order if their most well-liked fee technique had been unavailable.

The surveys discovered that a greater checkout design can result in a 35% improve in conversion charges for giant e-commerce websites. Additionally, most respondents — 54% within the U.S. and 52% within the UK — thought of having a same-page checkout expertise after they buy a vital or critically vital situation.’

Different key findings within the report:

- Fifty-four % of Individuals mentioned embedded add-ons akin to insurance coverage or financing are both essential or probably the most vital issue for a optimistic buying expertise.

- Customized presents are a optimistic, however not important, further monetary incentive that may be improved by focusing on different demographics.

- Streamlining the shopper expertise is a $213-billion alternative: Within the U.S., an internet site that requires a buyer to log in was the second highest-rated supply of a detrimental expertise. Nearly half of the respondents reported they might possible abandon procuring in the event that they had been required to do it.

General, Dawson says that buyer expectations for a quick, trouble-free, and ‘frictionless’ procuring expertise are excessive as know-how evolves.

In response to the report, real-time funds elevated globally by 41% in 2020 alone. The know-how is changing into extra vital in key rising markets akin to India, which registered 25.6-billion transactions that yr.

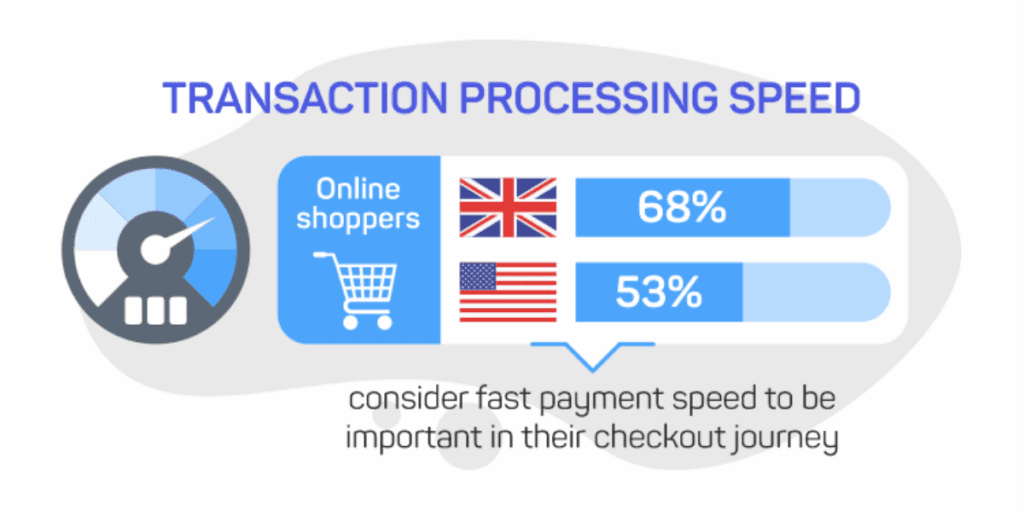

Amongst British respondents to the survey, 68% mentioned the pace of fee is ‘a very powerful’ or ‘a vital’ characteristic for a optimistic buyer expertise. Within the U.S., 53% felt quick fee clearing speeds are vital.

“I suppose it comes all the way down to is: the hallmark of true progress is individuals cease noticing and appreciating it. Take that (into thoughts), take a step again, and debundle it,” Dawson mentioned.

Within the 21 years he’s been working within the funds business, Dawson has seen the know-how and fee expertise clients right this moment take as a right evolve from its rudimentary digital daybreak.

“Twenty-one years in the past, you’d be fortunate if a web-based service might take on-line funds instantly,” Dawson mentioned. “Then, when these on-line companies started taking funds instantly, you’d be fortunate if it had the fee methodology you needed to make use of. After they did have the fee methodologies you need to use, you’d be fortunate in the event that they had been storing and utilizing your information securely that didn’t contain unethical use of your particulars.

“All these small steps have occurred over the past 20 years or so the place instantly — if a transaction takes greater than 12 seconds — individuals can get fairly upset.”

Right this moment, a buyer’s on-line procuring expertise has advanced to the purpose the place “this stuff which have taken years to be developed — and which have had a lot thought, a lot regulation and a lot growth put into them — are actually commonplace,” Dawson mentioned.

“We don’t even discover it.”

Learn extra