Dogecoin’s derivatives market have turn into busier than ever as costs rose sharply following Twitter’s choice to exchange its in style blue chook brand with an image of a Shiba Inu canine earlier this week.

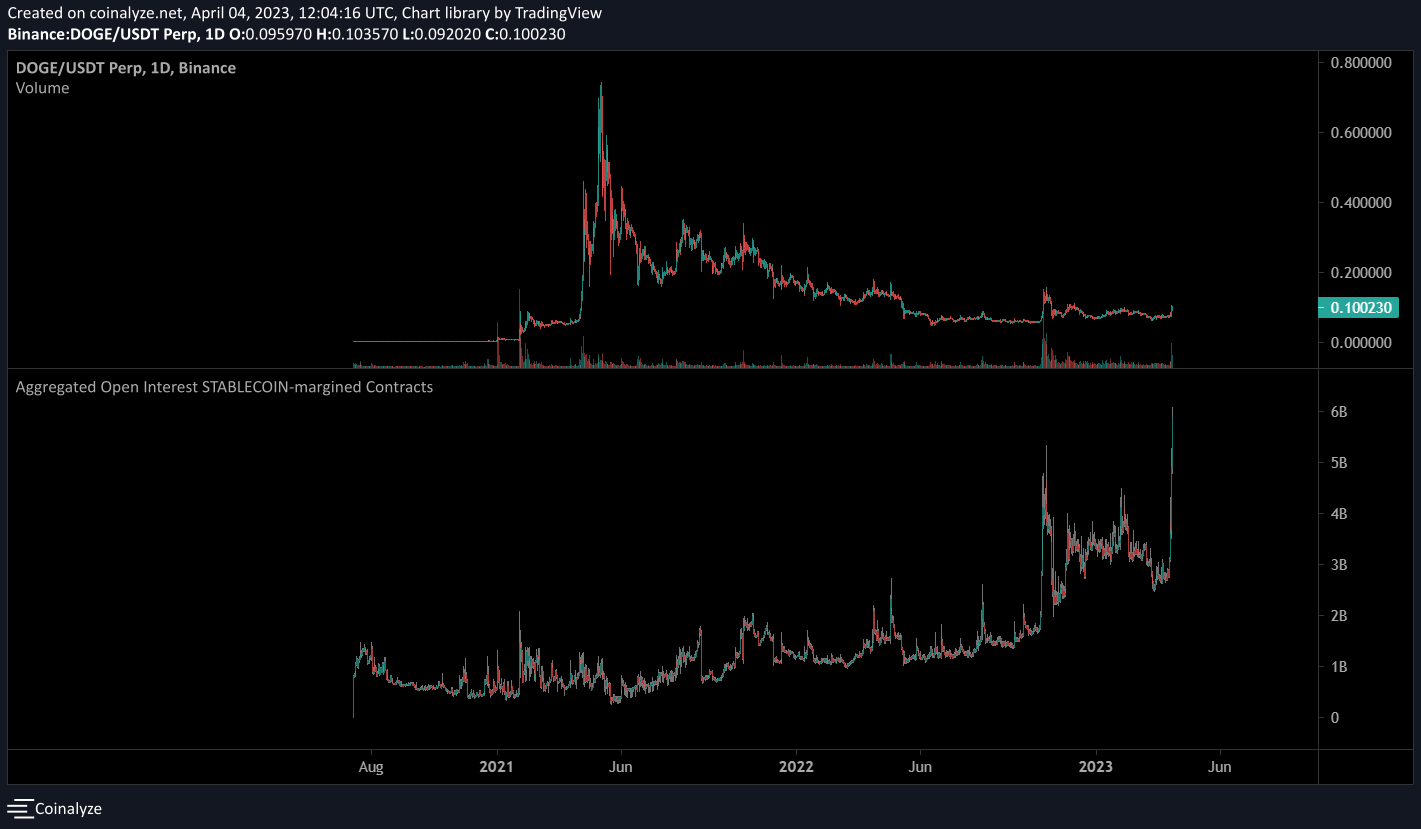

Open curiosity (OI) in stablecoin-margined dogecoin (DOGE) futures contracts surged to almost 6 billion DOGE tokens as of Tuesday night time, information from Coinanlyze reveals, setting a document lifetime peak. This represents $600 million price of dogecoin in unsettled futures positions as of Wednesday.

The earlier peak for stablecoin-margined contracts was 5 billion DOGE tokens in November 2021, valued at over $1 billion on the time. Stablecoin-margined contracts are settled in tokens corresponding to tether (USDT).

In the meantime, coin-margined contracts on dogecoin – which settled in different belongings, corresponding to bitcoin, as a substitute of stablecoins – noticed over $55 million in complete open curiosity as of Wednesday.

Stablecoin or fiat-margined futures provide linear payoff as the worth of the collateral stays regular regardless of the broader market pattern. In the meantime, coin-margined contracts provide a non-linear payoff and are extra liable to liquidations, because the dealer takes a loss on each the collateral and futures contract when the market goes in opposition to his/her wager.

Thus, stablecoin-margined contracts are higher suited to threat averse merchants and for hedging whereas coin-margined contracts are most popular by aggressive merchants, notably throughout bull runs.

Stablecoin-margined contracts on dogecoin have set document highs. (Coinalyze)

What does OI actually imply?

OI refers back to the variety of unsettled contracts, or the online quantity of positions opened by merchants, on monetary derivatives that monitor an underlying asset. This can be utilized to find out market power behind a latest worth pattern – suggesting market volatility forward as a substitute of costs remaining flat.

Information reveals funding charges, or a charge paid by leverage merchants to stay in a futures place, is a mean of +0.01% on cryptocurrency alternate Binance, which has the best open curiosity amongst counterparts, and an identical charge on Bybit. Charges on OKX are fluctuating between -0.04% and +0.02%. Constructive charges indicate leverage is skewed on the bullish aspect.

Funding charges are periodic funds made by merchants based mostly on the distinction between costs within the futures and spot markets. Relying on their open positions, merchants will both pay or obtain funding. The funds guarantee there are at all times contributors on each side of the commerce.

Contributors make the most of refined methods to gather funding charges whereas hedging losses resulting from token actions.

In the meantime, Coinalyze analysts instructed CoinDesk that present open curiosity ranges recommended excessive quantities of leveraged bets on dogecoin.

“Very doubtless we are going to see much more liquidators,” the agency mentioned, suggesting the dogecoin market may see steep volatility within the brief time period.

As such, some say the present transfer is unlikely to be sustained.

“Memecoin pumps might typically recommend bullishness amongst retailers. Nevertheless, this isn’t indicative of a long-term pattern as we are able to see by the large DOGE spike of 2021 and the huge stoop quickly afterward,” François Cluzeau, Head of Buying and selling at Flowdesk, instructed CoinDesk in a Telegram message.

“Bitcoin’s secure upwards momentum additionally correlates with this. There’s a sure trickle-down impact that follows the no. 1 cryptocurrency. That is additionally partially as a result of many leverage their memecoin bets with bitcoin,” Cluzeau added.

Edited by Oliver Knight and Omkar Godbole.