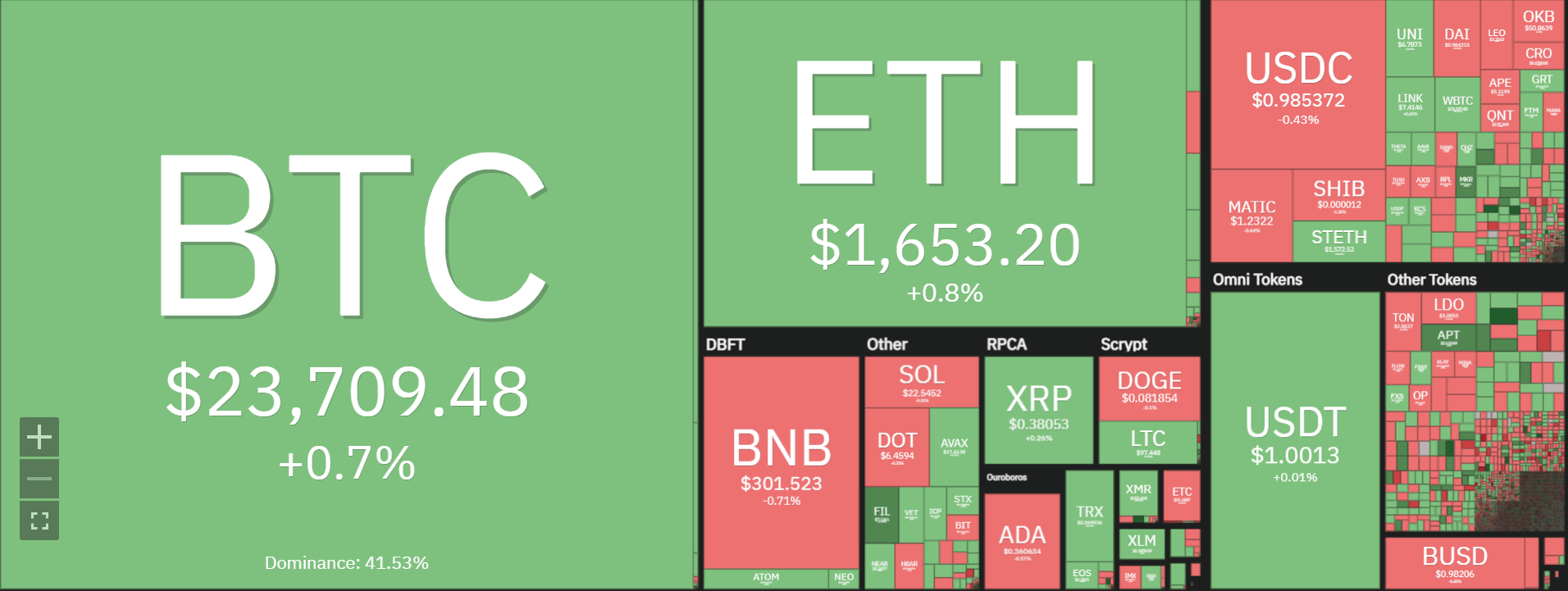

Bitcoin worth evaluation for the brand new month is bullish as Bitcoin has managed to surge previous yesterday’s excessive of $23,880.63. Bitcoin opened at this time’s buying and selling session buying and selling alongside the help line of $23,000 whereby the bears got here and dipped the costs to lows of $22,800. Nevertheless, the bulls managed to defend this stage and push increased previous yesterday’s excessive. The worth is presently buying and selling at $23,734.05 and is displaying additional upside potential. If BTC continues to maintain the bullish momentum it may attain costs of $24,000 and even increased within the days forward.

Bitcoin closed February with a inexperienced month-to-month candle and appears to be coming into a brand new bullish section in March. It is usually necessary to notice that the bulls have been defending the help line of $23,000 for 3 days now thus confirming its energy as a key help stage. Bitcoin appears to have bottomed on the $23,000 stage because the bulls have held the road for over per week. The consumers appear to be again in full power and the market may begin surging north of $24,000 as soon as extra if there’s sufficient bullish momentum.

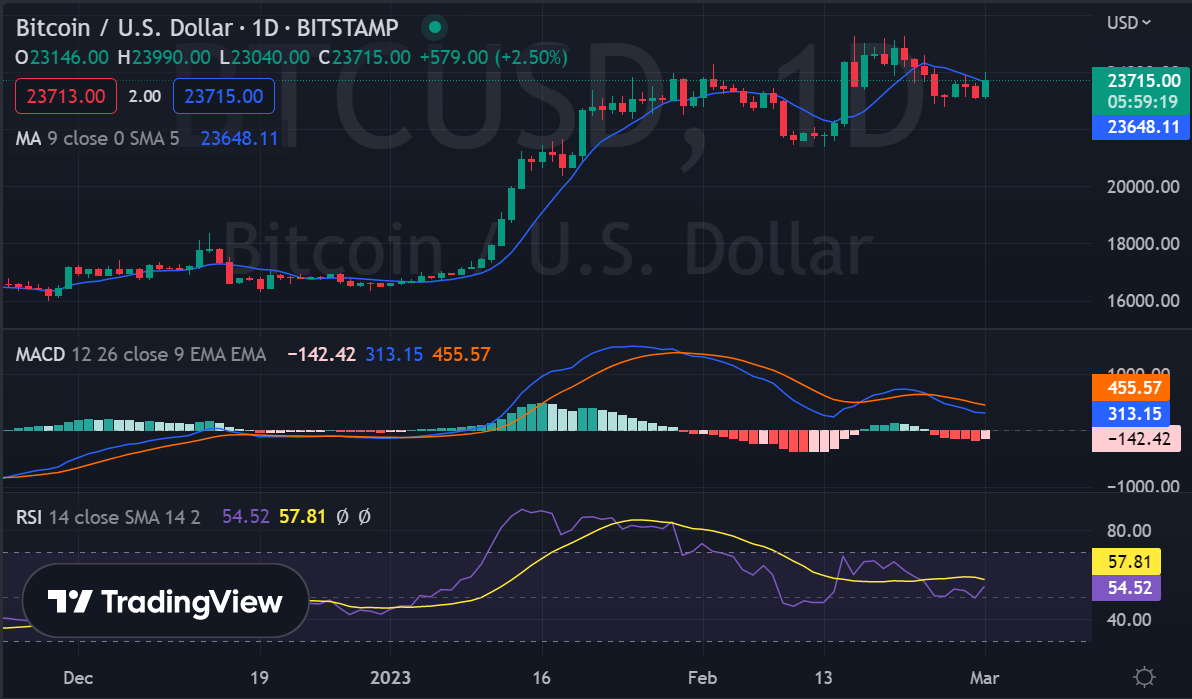

Bitcoin worth evaluation on a each day chart: Bulls collect steam above the $23,500 stage

On the each day chart, Bitcoin has been buying and selling in a range-bound method with help at $23,400 and resistance at $24,000-$24,100. Yesterday’s excessive of $23,880.63 is presently appearing as sturdy help for the bulls and could possibly be examined as soon as once more. If the bulls handle to push the value previous this stage and maintain it, we may see Bitcoin surge above $24,000 within the days forward. Nevertheless, if the bears make a comeback and break beneath the SMA 50 and the $23,400 help stage, we may count on Bitcoin to dip towards the SMA 200 at $22,600.

Bitcoin technical indicators reveal the bulls haven’t but established agency management of the market. The RSI continues to be hovering in impartial territory and the 8-day EMA is buying and selling beneath the 21-day EMA indicating that additional sideways motion could possibly be anticipated in days forward. The MACD line continues to be trending beneath the pink sign line, thus confirming that the bears nonetheless have a stronghold available in the market.

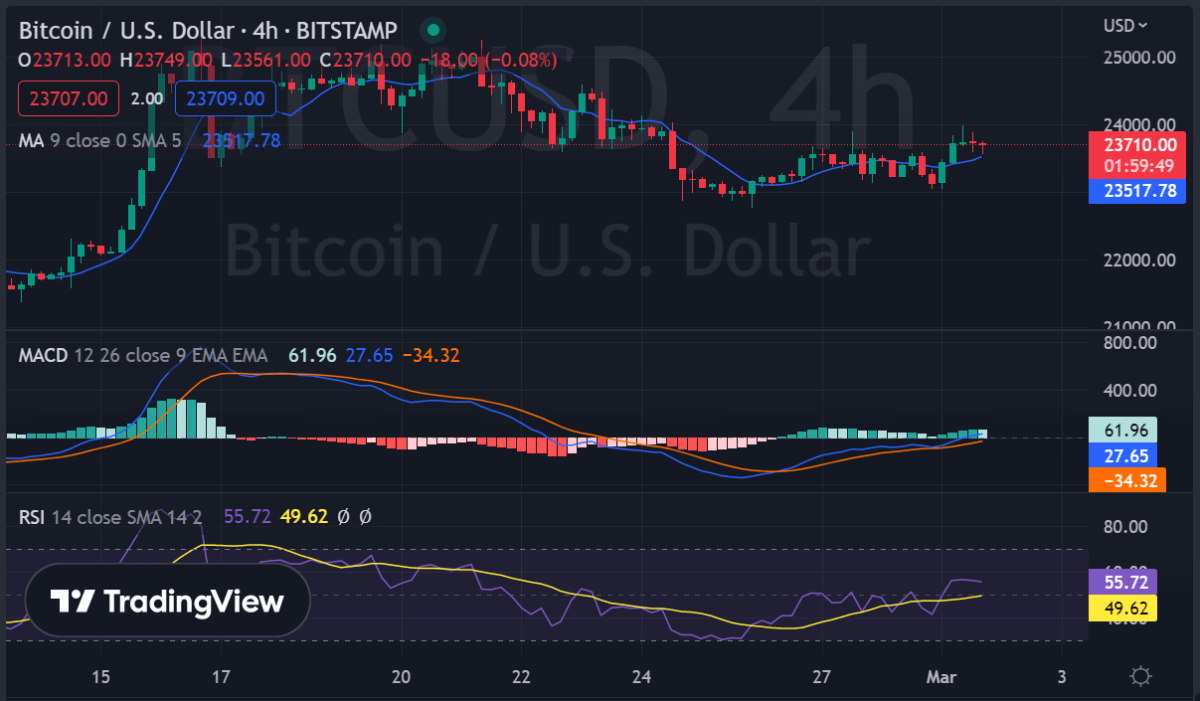

Bitcoin worth evaluation in a 4-hour timeframe: Bullish divergence

Bitcoin worth evaluation on a 4-hour chart reveals BTC may probably escape from the $23,500-$24,000 vary. The MACD line is trending above the pink sign line indicating that the bulls are slowly however certainly gaining management of the market. Moreover, a bullish divergence has shaped on the 4-hour chart which could possibly be signaling a potential reversal in pattern someday quickly if Bitcoin manages to shut above $24,000.

The worth of BTC is nonetheless beneath the each day transferring common and the 8-day EMA, indicating that additional sideways motion is probably going earlier than we see any main strikes. The Relative Energy Index indicator is presently at 55.75, signaling that there’s room for additional upside if the consumers can proceed to realize momentum within the upcoming days.

Bitcoin worth evaluation conclusion

Bitcoin worth evaluation for at this time reveals Bitcoin stays bullish and will probably surge previous $25,000 this month if sufficient bullish momentum is maintained. The important thing help stage to be careful for is at $23,500 whereas resistance lies at $24,000-$24,100. Additional sideways motion is probably going earlier than we see any main strikes and the RSI indicator wants to maneuver into overbought territory for a extra definitive uptrend to be confirmed.

Whereas ready for Bitcoin to maneuver additional, see our Value Predictions on XDC, Polkadot, and Curve