Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

An analytics agency has defined how the info associated to the stablecoins might trace at whether or not the Bitcoin market prime is in or not.

Stablecoins Have Seen Their Market Cap Contact New Highs Just lately

In a brand new put up on X, the market intelligence platform IntoTheBlock has mentioned in regards to the pattern within the mixed stablecoin market cap. “Stablecoins” consult with cryptocurrencies which might be pegged to a fiat forex (with USD being the preferred alternative).

Typically, buyers make use of those belongings after they need to keep away from the volatility related to different cash like Bitcoin. Merchants who make investments into stablecoins, nonetheless, normally accomplish that as a result of they plan to enterprise (again) into the unstable aspect of the sector.

Associated Studying

As such, the availability of those fiat-tied tokens is commonly thought-about because the accessible ‘dry powder’ for Bitcoin and different cryptocurrencies. Given this placement of the stables within the sector, their market cap might be value keeping track of.

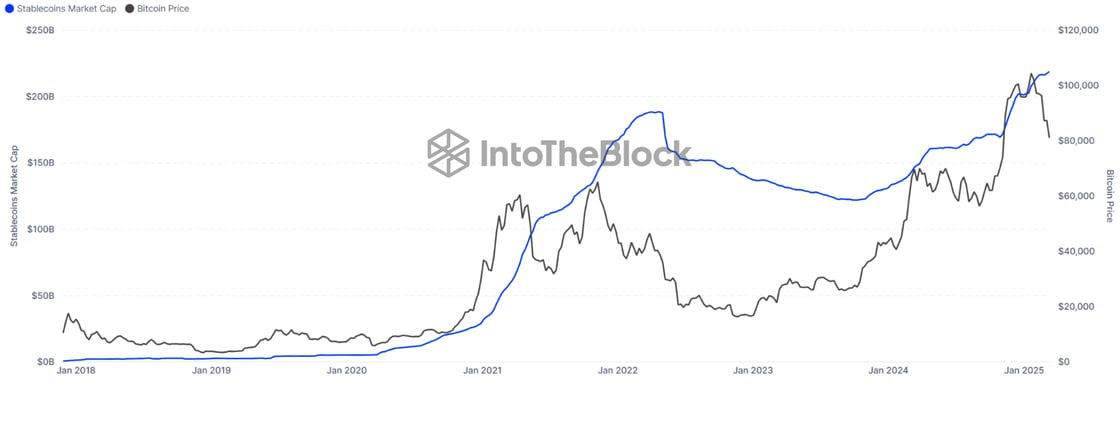

Right here is the chart shared by the analytics agency that exhibits the pattern within the stablecoin market cap over the previous few years:

As displayed within the above graph, the market cap of the stablecoins has been driving an uptrend not too long ago and exploring new all-time highs (ATHs). Following the newest continuation to the rise, the metric has hit a whopping $219 billion.

To place issues into perspective, the market cap of Ethereum (ETH), the second largest asset within the sector, is just below $233 billion. Thus, the stables are lower than $14 billion away.

IntoTheBlock has identified an fascinating sample associated to this indicator. Within the chart, it’s seen that the metric’s prime final cycle was when it hit $187 billion in April 2022. Evidently, this peak out there cap of the stables coincided with the beginning of the bear market.

“Traditionally, stablecoin provide peaks align with cycle highs,” notes the analytics agency. Thus far within the present cycle, the indicator has continued to rise, regardless of the decline within the asset’s value. If the earlier pattern is something to go by, this could possibly be a sign that Bitcoin and different cash are but to enter a bear market.

That mentioned, the newest market situations haven’t precisely been completely bullish. Essentially the most constructive state of affairs happens at any time when each BTC and the stablecoins get pleasure from a rise of their market caps. In such a interval, a internet quantity of recent capital inflows are getting into into the sector.

Associated Studying

At current, although, the stablecoins have been rising whereas Bitcoin and others have been falling. This might doubtlessly suggest a rotation of capital has been occurring, relatively than recent inflows.

In the course of the mid-2021 correction, an analogous sample emerged, however the market was capable of finding its footing and the second half of the rally happened. It now stays to be seen whether or not one thing related would occur for Bitcoin this time as nicely, or if the market will go the best way it did in 2022.

Bitcoin Worth

On the time of writing, Bitcoin is buying and selling round $84,700, down over 4% within the final seven days.

Featured picture from Dall-E, IntoTheBlock.com, chart from TradingView.com