By Omkar Godbole (All instances ET until indicated in any other case)

The previous 24 hours have been marked by bullish postings on social media, with notable figures voicing optimistic outlooks on the cryptocurrency market which have labored their approach into costs.

Bitcoin has bounced to over $98,000 from $96,900, with President Donald Trump’s son Eric encouraging family-linked World Liberty Monetary to put money into the most important cryptocurrency.

Cardano founder Charles Hoskinson was amongst these portray an optimistic image. “To present you a way of how large the upcoming bull market is for crypto, we simply absorbed a downturn that was bigger than the collapse of Luna or FTX and have already practically recovered: 710 billion in losses and 740,000 merchants liquidated in 24 hours. 2025 is Crypto’s 12 months,” Hoskinson posted.

Cardano’s ADA token rose 4% and different main altcoins together with XRP, SOL and ETH posted comparable good points, CoinDesk information present.

As for ether, whereas the analyst neighborhood stays bearish, establishments appear to be shopping for it up. Information tracked by on-chain sleuth Lookonchain exhibits previously two days a buying and selling agency withdrew 62,381 cash from centralized exchanges, shifting them to Coinbase Prime. Market maker Wintermute famous sturdy over-the-counter demand for ether early this week.

In different information, Conor Grogan, a director of Coinbase, speculated that crypto trade Kraken might know Bitcoin creator Satoshi Nakamoto’s actual id. Nakamoto might personal 1.096 million BTC, with a paper wealth exceeding Invoice Gates, Grogan stated. A invoice has been launched within the U.S. Senate to control stablecoins, which might enhance demand for U.S. Treasuries and “spur monetary innovation,” FxPro’s chief market analyst, Alex Kuptsikevich, stated.

On the macro entrance, China-sensitive currencies just like the Australian and New Zealand {dollars} are once more weak in opposition to the U.S. greenback, however stay in latest ranges, indicating that markets don’t count on an extended, drawn-out U.S.-China commerce conflict. Trump, nevertheless, is in no hurry to name President Xi Jinping and that might cap good points in danger property for now.

The U.S. Treasury Secretary Scott Bessent has stated that the Trump administration needs to decrease the U.S. Treasury yield, which might bode properly for danger property. Even so, the 10-year price might spike greater if Thursday’s weekly U.S. jobless claims and fourth-quarter Unit Labor Prices paint a optimistic image of the financial system. That would arrest BTC’s upswing. Keep alert!

What to Watch

- Crypto:

- Feb. 6: Berachain (BERA) mainnet launch, in addition to preliminary creation and distribution of its native token. 15.75% of BERA tokens can be airdropped to neighborhood members, purposes and liquidity suppliers.

- Feb. 6, 8:00 a.m.: Shentu Chain community improve (v2.14.0).

- Feb. 13: Begin of Kraken’s gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA shoppers. The method ends March. 31.

- Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will begin reimbursing collectors.

- Macro

- Feb. 6, 7:00 a.m.: Financial institution of England (BoE) releases Financial Coverage Abstract and Minutes of the Financial Coverage Committee Assembly in addition to the February Financial Coverage Report. The press convention is live-streamed half-hour later.

- Curiosity Charge Choice Est. 4.5% vs. Prev. 4.75%

- Feb. 6, 8:30 a.m.: U.S. Division of Labor releases Unemployment Insurance coverage Weekly Claims report for week ended Feb. 1.

- Preliminary Jobless Claims Est. 213K vs. Prev. 207K

- Nonfarm Productiveness QoQ (Preliminary) Est.1.4% vs. Prev. 2.2%

- Persevering with Jobless Claims (January) Est. 1870K vs. Prev. 1858K

- Jobless Claims 4-Week Common Prev. 212.5K.

- Feb. 6, 2:00 p.m.: U.S. Home Monetary Providers Committee listening to about “Operation Choke Level 2.0“: Two of the witnesses are Paul Grewal, Coinbase’s chief authorized officer, and MARA Holdings CEO Fred Thiel. Livestream Hyperlink.

- Feb. 6, 2:30 p.m.: Fed Governor Christopher J. Waller is giving a speech on Funds on the Atlantic Council in Washington. Livestream hyperlink.

- Feb. 7, 8:30 a.m.: U.S. Bureau of Labor Statistics (BLS) releases January’s Employment State of affairs report.

- Non Farm Payrolls Est. 170K vs. Prev. 256K

- Unemployment Charge Est. 4.1% vs. Prev. 4.1%

- Feb. 8, 8:30 p.m.: China’s Nationwide Bureau of Statistics (NBS) releases January’s Shopper Worth Index (CPI) report.

- Inflation Charge MoM Prev. 0%

- Inflation Charge YoY Prev. 0.1%

- PPI YoY Prev. -2.3%

- Feb. 6, 7:00 a.m.: Financial institution of England (BoE) releases Financial Coverage Abstract and Minutes of the Financial Coverage Committee Assembly in addition to the February Financial Coverage Report. The press convention is live-streamed half-hour later.

- Earnings

- Feb. 6: CleanSpark (CLSK), post-market, $-0.06

- Feb. 10: Canaan (CAN), pre-market, $-0.08

- Feb. 11: HIVE Digital Applied sciences (HIVE), post-market, $-0.11

- Feb. 11: Exodus Motion (EXOD), post-market, $0.14 (2 ests.)

- Feb. 12: Hut 8 (HUT), pre-market, $0.04

- Feb. 12: IREN (IREN), post-market, $-0.01

- Feb. 12 (TBA): Metaplanet (TYO:3350)

- Feb. 12: Reddit (RDDT), post-market, $0.25

- Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

- Feb. 13: Coinbase World (COIN), post-market, $1.61

Token Occasions

- Governance votes & calls

- OsmosisDAO is discussing a change to using taker charges collected in OSMO to burn 50% of collected charges.

- Threshold DAO is discussing the creation of a bond program to deal with its stablecoin’s liquidity challenges.

- Bonk DAO is voting on burning 2.025 trillion BONK “celebrating the top of the BONKDragon marketing campaign and the 2025 Lunar New Yr.”

- Feb. 6: 11 a.m.: Livepeer (LPT) to host a Core Dev Name on Discord.

- Feb. 6, 2 p.m.: Arbitrum to maintain an open name about utilizing AI to empower decentralized finance purposes.

- Feb. 6, 12 pm.: Moonwell to maintain a governance name.

- Feb. 6: Bittensor (TAO) to vote on launching a dynamic Tao, which introduces a extra decentralized method to governance.

- Feb. 7, 1 p.m.: Sweat Financial system (SWEAT) to maintain a token holders briefing discussing tokenomics, product roadmap and partnerships.

- Feb. 8, 1:08 p.m.: A dYdX Basis vote on granting the dYdX Operations subDAO signer market authority over the market map and eradicate income sharing for that operate is on monitor to cross.

- Unlocks

- Feb. 9: Motion (MOVE) to unlock 2.17% of circulating provide value $31.41 million.

- Feb. 10: Aptos (APT) to unlock 1.97% of circulating provide value $68.99 million.

- Token Launches

- Feb. 6: Berachain (BERA) to be listed on Bybit, Bithumb, Bitget, BingX, MEXC, SwissBorg, Kraken, OKX, LBank, Gate.io, BitMart, Binance and KuCoin.

Conferences:

Token Discuss

By Shaurya Malwa

- The Floki DAO neighborhood voted with a 99.71% approval price to speculate $125,000 from its treasury into upcoming BNB Chain-based AI Agent Unhealthy AI.

- The funding will diversify Floki’s treasury and deepen its involvement within the blockchain and AI sectors.

- Unhealthy AI plans to make use of synthetic intelligence and machine studying to develop a decentralized AI ecosystem for varied makes use of, similar to on-line bots and AI-based purposes. Over 45% of its token provide is devoted to Floki, together with airdrops to FLOKI and TokenFi customers.

- Comparable AI brokers on different chains have valuations between $720 million and $2.8 billion.

Derivatives Positioning

- BTC and ETH perpetual funding charges have flipped optimistic in an indication of renewed bias for bullish bets, in keeping with Velo Information.

- Funding charges for SUI, XLM, HBAR, TON, SHIB and ONDO stay destructive.

- XMR has recorded the very best optimistic open interest-adjusted cumulative quantity delta amongst majors previously 24 hours, indicating web shopping for exercise.

- Bullish sentiment has been in restored within the front-end BTC choices on Deribit, however that is not the case in ETH choices.

- Block flows featured BTC calendar spreads, outright longs in $130K December expiry name and a bull name unfold, betting on a rally to $5K in ETH.

Market Actions:

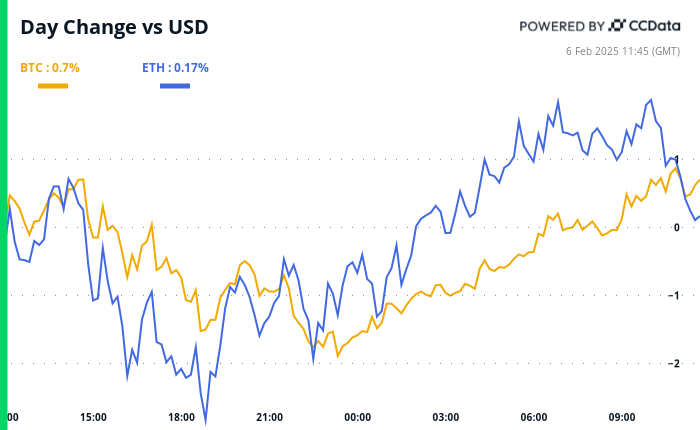

- BTC is up 1.7 % from 4 p.m. ET Wednesday to $98,0682.38 (24hrs: +0.76%)

- ETH is up 4.15% at $2,812.62 (24hrs: +0.37%)

- CoinDesk 20 is up 1.54% to three,281.41 (24hrs: -0.60%)

- CESR Composite Staking Charge is down 9 bps to three.09%

- BTC funding price is at 0.0041% (4.52% annualized) on Binance

- DXY is up 0.36% at 107.96

- Gold is unchanged at $2,865.30/oz

- Silver is down 0.97% to $31.99/oz

- Nikkei 225 closed +0.61% at 39,066.53

- Dangle Seng closed +1.43% at 20,891.62

- FTSE is up 1.18% at 8,724.97

- Euro Stoxx 50 is up 0.70% at 5,307.80

- DJIA closed +0.71% to 44,873.28

- S&P 500 closed +0.39% at 6,061.48

- Nasdaq closed +0.19% at 19,692.33

- S&P/TSX Composite Index closed +1.15% at 25,569.84

- S&P 40 Latin America closed -0.39% at 2,392.39

- U.S. 10-year Treasury is down 4 bps at 4.42%

- E-mini S&P 500 futures are unchanged at 6,090.25

- E-mini Nasdaq-100 futures are unchanged at 21,749.00

- E-mini Dow Jones Industrial Common Index futures are unchanged at 45,007.00

Bitcoin Stats:

- BTC Dominance: 61.45 (0.15%)

- Ethereum to bitcoin ratio: 0.02867 (-0.69%)

- Hashrate (seven-day shifting common): 808 EH/s

- Hashprice (spot): $59.7

- Complete Charges: 5.12 BTC / $515,226

- CME Futures Open Curiosity: 163,495 BTC

- BTC priced in gold: 34.0 oz

- BTC vs gold market cap: 9.65%

Technical Evaluation

- The BTC/JPY pair has penetrated the bullish trendline connecting greater lows registered in October and November.

- The breakdown might embolden bears, though the pair stay locked in a sideways vary.

Crypto Equities

- MicroStrategy (MSTR): closed on Wednesday at $336.70 (-3.33%), up 1.10% at $340.40 in pre-market.

- Coinbase World (COIN): closed at $275.14 (-1.87%), up 1.89% at $280.34 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$27.66 (-0.04%)

- MARA Holdings (MARA): closed at $17.03 (-3.51%), up 1.53% at $17.29 in pre-market.

- Riot Platforms (RIOT): closed at $11.74 (-4.48%), up 1.36% at $11.90 in pre-market.

- Core Scientific (CORZ): closed at $12.71 (+4.10%), up 1.18% at $12.86 in pre-market.

- CleanSpark (CLSK): closed at $10.31 (-4.89%), up 2.33% at 10.65% in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.46 (-0.49%), up 1.16% at $22.72 in pre-market.

- Semler Scientific (SMLR): closed at $51.79 (+1.07%), up 2.24% at $52.95 in pre-market.

- Exodus Motion (EXOD): closed at $51.36 (-9.53%), up 2.61% in pre-market.

ETF Flows

Spot BTC ETFs:

- Every day web movement: $66.4 million

- Cumulative web flows: $40.67 billion

- Complete BTC holdings ~ 1.176 million.

Spot ETH ETFs

- Every day web movement: $18.1 million

- Cumulative web flows: $3.17 billion

- Complete ETH holdings ~ 3.785 million.

Supply: Farside Traders

In a single day Flows

Chart of the Day

- The chart exhibits inflows into gold-backed tokens has surged alongside an increase within the spot value of gold.

- The yellow metallic rose to a file excessive of $2,882 Wednesday.

Whereas You Have been Sleeping

- Trump’s Goal to Decrease the 10-Yr Yield May Bode Nicely for Bitcoin (CoinDesk): U.S. Treasury Secretary Scott Bessent stated the Trump administration goals to decrease the 10-year Treasury yield by controlling inflation and lowering the funds deficit, which might assist danger property, together with bitcoin.

- Berachain’s BERA Trades at $8 Forward of 79M Token Airdrop and Mainnet Launch (CoinDesk): Layer-1 blockchain Berachain’s mainnet begins up later right now. Of the overall 500 million BERA tokens to be created, practically 80 million can be airdropped to eligible customers.

- Tiger21 Founder Michael Sonnenfeldt Says Extremely-Wealthy are Bullish on BTC (CoinDesk): Michael Sonnenfeld, founding father of TIGER 21, a peer advisory group for ultra-high-net-worth buyers, stated BTC now serves as each a retailer of worth and an alternative to gold.

- Bitcoin Musings Draw Scrutiny Over Czech Central Financial institution Governor (Bloomberg): Czech central financial institution governor Aleš Michl’s proposal to speculate as much as 5% of reserves in bitcoin might face a months-long overview and be decreased to beneath 1%, insiders report.

- Trump’s Commerce Struggle Provides to ‘Clear Decoupling’ on Central Financial institution Charge Cuts (Monetary Occasions): Because the Fed holds rates of interest regular amid inflation worries, Trump’s new tariffs intensify dangers, prompting central banks in economies reliant on U.S. exports to chop charges to defend in opposition to slower development.

- Surging Greenback Spurs Bounce in Company FX Hedging (Reuters): U.S. corporations incomes overseas are boosting hedging to safeguard repatriated income as confidence grows that Trump’s tariffs will maintain the greenback excessive, threatening to erode transformed earnings.

Within the Ether