By James Van Straten (All occasions ET until indicated in any other case)

Every new day below the Trump administration is as intriguing as the subsequent, and Wednesday is shaping as much as be no completely different.

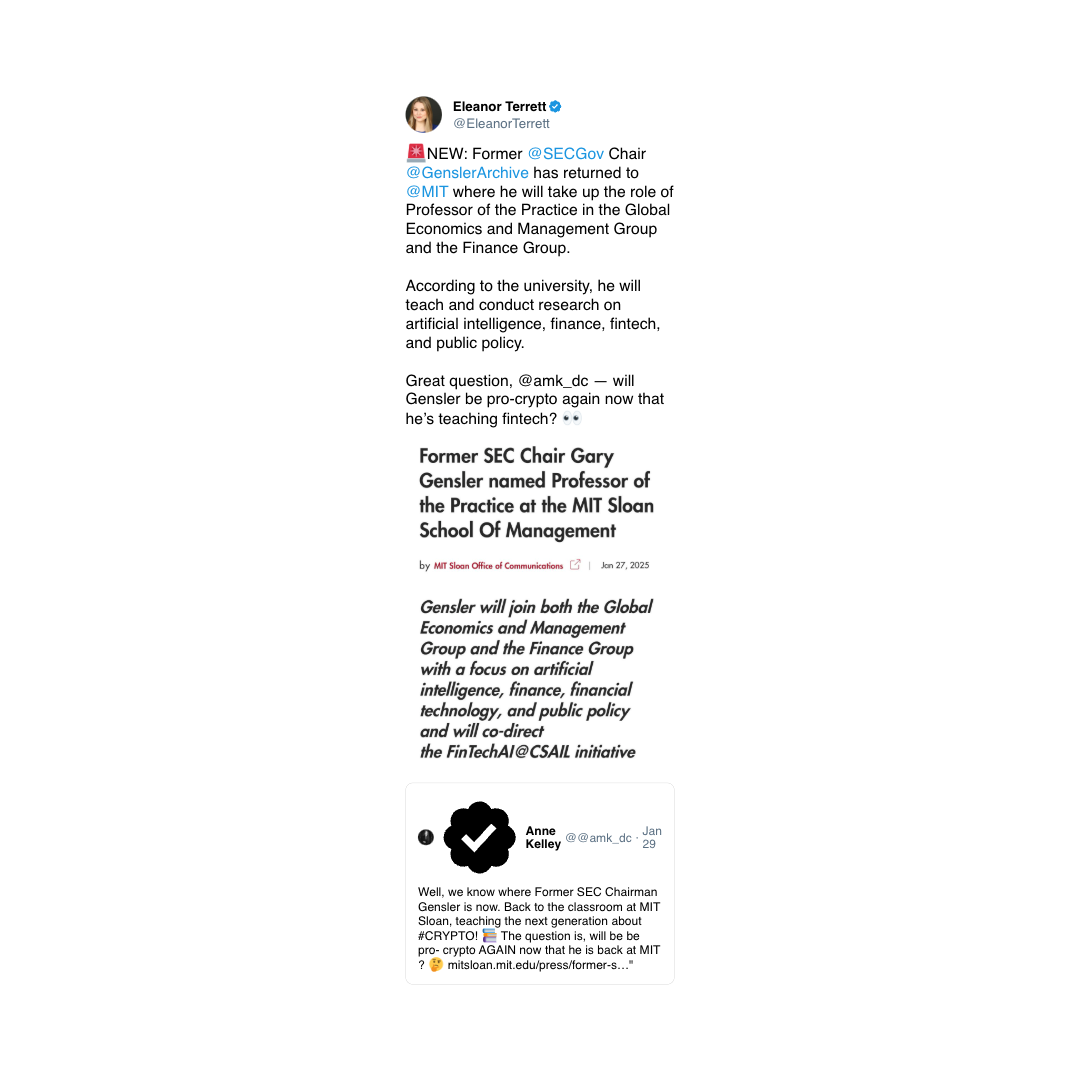

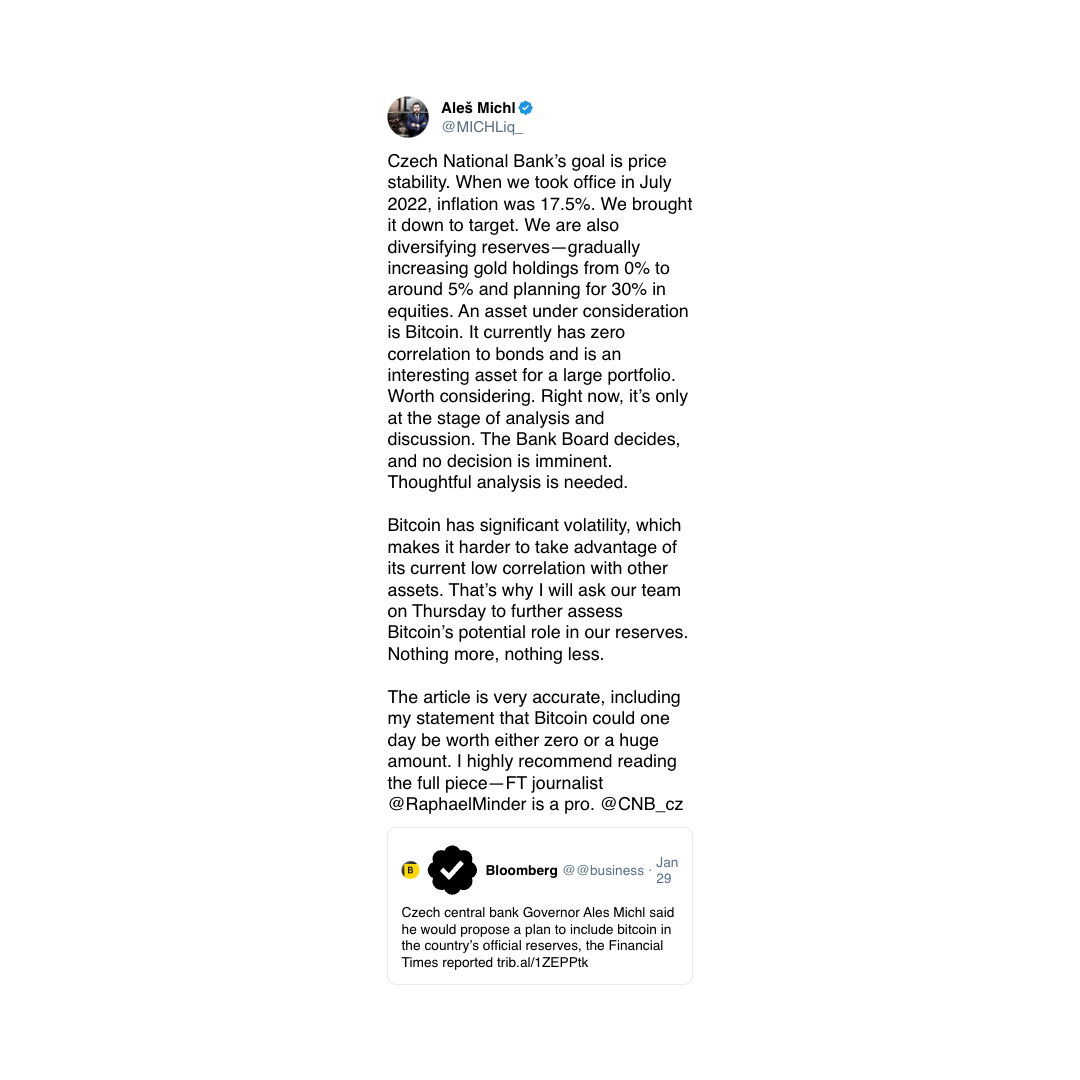

For one, the president’s enthusiasm for bitcoin is spurring different nations to check out the asset. Most lately, Czech Nationwide Financial institution Governor Aleš Michl stated he’ll current a plan so as to add billions of euros value of bitcoin to the financial institution’s reserves. If accepted, the establishment would grow to be the primary Western central financial institution to carry BTC as a reserve asset. Michl intends to current the plan to the financial institution’s board on Thursday.

There’s additionally the Federal Open Market Committee assembly later at the moment, the place the benchmark fed funds price is anticipated to be held at 4.25%-4.50%. The query is whether or not Fed Chair Jerome Powell will give a hawkish or dovish outlook, with a knock-on impact on asset costs.

Markets appear to have shaken off issues over the Chinese language DeepSeek AI program, with bitcoin again over $102,000. U.S. equities are shy of a brand new all-time excessive as Nvidia (NVDA) stormed again with an virtually double-digit enhance.

After the market closes, we might see some additional volatility, with main tech firms together with Tesla (TSLA) reporting earnings.

What to Watch

Crypto:

Jan. 29: Cardano’s Plomin onerous fork community improve.

Jan. 29: Ice Open Community (ION) mainnet launch.

Jan. 31: Crypto.com is suspending purchases of cryptocurrencies USDT, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO, and XSGD within the EU to adjust to MiCA rules. Withdrawals can be supported via Q1.

Feb. 2, 8:00 p.m.: Core blockchain Athena onerous fork community improve (v1.0.14)

Feb. 4: MicroStrategy (MSTR) This autumn, FY 2024 earnings.

Feb. 4: Pepecoin (PEPE) halving. At block 400,000, the reward will drop to 31,250 PEPE.

Feb. 5, 3:00 p.m.: Boba Community’s Holocene onerous fork community improve for its Ethereum-based L2 mainnet.

Feb. 6, 8:00 a.m.: Shentu Chain community improve (v2.14.0).

Feb. 12: Hut 8 Corp. (HUT) This autumn 2024 earnings.

Feb. 13 (after market shut): Coinbase World (COIN) This autumn 2024 earnings

Feb. 15: Qtum (QTUM) onerous fork community improve at block 4,590,000.

Feb. 18 (after market shut): Semler Scientific (SMLR) This autumn 2024 earnings.

Macro

Jan. 29, 8:45 a.m.: The Financial institution of Canada (BoC) releases the (quarterly) Financial Coverage Report.

Jan. 29, 9:45 a.m.: The BoC declares its interest-rate determination. That is adopted by a press convention at 10:30 a.m.

Est. 3% vs. Prev. 3.25%.

Jan. 29, 2:00 p.m.: The Federal Open Market Committee (FOMC) declares the U.S. central financial institution’s interest-rate determination. That is adopted by a press convention at 2:30 p.m. Livestream hyperlink.

Goal Vary for the Federal Funds Fee Est. 4.25% to 4.5% vs. Prev. 4.25% to 4.5%.

Jan. 30, 5:00 a.m.: The European Central Financial institution (ECB) releases This autumn GDP (Flash).

Progress Fee QoQ Est. 0.1% vs. Prev. 0.4%.

Progress Fee YoY Est. 1% vs. Prev. 0.9%.

December Unemployment Fee Est. 6.3% vs. Prev. 6.3%.

Jan. 30, 8:15 a.m.: The ECB declares its interest-rate determination. That is adopted by a press convention at 8:45 a.m. Livestream hyperlink.

Deposit Facility Fee Est. 2.75% vs. Prev. 3%.

Important Refinancing Fee Est. 2.9% vs. Prev. 3.15%.

Marginal Lending Fee Prev. 3.4%.

Jan. 30, 8:30 a.m.: The U.S. Bureau of Financial Evaluation (BEA) releases This autumn Advance GDP report.

GDP Progress Fee QoQ Est. 2.8% vs. Prev. 3.1%.

GDP Value Index QoQ Est. 2.5% vs. Prev. 1.9%.

Preliminary Jobless Claims for Week Ended Jan. 25 Est. 220K vs. Prev. 223K.

Persevering with Jobless Claims Est. 18900K vs. Prev. 1899K.

Core PCE Costs QoQ Est. 2.5% vs. Prev. 2.2%.

PCE Costs QoQ Prev. 1.5%.

Actual Client Spending QoQ Prev. 3.7%.

Jan. 30, 4:30 p.m.: The Federal Reserve releases H.4.1 report on Elements Affecting Reserve Balances for the week ended Jan. 29.

Steadiness Sheet Prev. $6.83T.

Jan. 30, 6:30 p.m.: Japan’s Ministry of Inner Affairs and Communications releases December unemployment report.

Unemployment Fee Est. 2.5% vs. Prev. 2.5%.

Jan. 30, 6:50 p.m.: Japan’s Ministry of Financial system, Commerce and Business releases December industrial manufacturing (preliminary) report.

Industrial Manufacturing MoM Est. 0.3% vs. Prev. -2.2%.

Industrial Manufacturing YoY Prev. -2.8%.

Retail Gross sales MoM Prev. 1.8%.

Retail Gross sales YoY Est. 3.2% vs. Prev. 2.8%.

Token Occasions

Governance votes & calls

ENS DAO is voting whether or not to transform 6,000 ETH into USDC to replenish its depleted reserves, which it could use to safe a 12-month operational runway to help ongoing commitments.

Stargate Finance DAO to provoke the Hydra Enlargement Program, which might allocate as much as $10 million in STG tokens to help key initiatives on Hydra chains which ought to final 12 months.

Pocket DAO is voting whether or not to exchange its compensation scheme with a DAO Compensation Committee of three members who can be chargeable for approving Pocket Community Basis-recommended awards.

Unlocks

Jan. 28: Tribal Token (TRIBL) to unlock 14% of its circulating provide value $60 million.

Jan. 31: Optimism (OP) to unlock 2.32% of circulating provide value $52.9 million.

Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating provide value $626 million.

Feb. 1: Sui (SUI) to unlock about 2.13% of its circulating provide value $226 million.

Token Listings

Jan. 28: Pudgy Penguins (PENGU) and Magic Eden (ME) to be listed on Kraken.

Jan. 29: Cronos (CRO), Motion (MOVE) and Regular (USUAL) to be listed on Kraken.

Conferences:

Day 1 of three: Crypto Peaks 2025 (Palisades, California)

Jan. 30, 12:30 p.m. to five:00 p.m.: Worldwide DeFi Day 2025 (on-line)

Jan. 30-31: Ethereum Zurich 2025

Jan. 30-31: Plan B Discussion board (San Salvador, El Salvador)

Jan. 30 to Feb. 1: Crypto Gathering 2025 (Miami Seashore, Florida)

Jan. 30-Feb. 1: CryptoXR 2025 (Auxerre, France)

Jan. 30-Feb. 2: Oasis Onchain 2025 (Nassau, Bahamas)

Jan. 30-Feb. 4: The Satoshi Roundtable (Dubai)

Feb. 1-28: Mammathon world hackathon for Celestia (on-line).

Feb. 3: Digital Property Discussion board (London)

Feb. 5-6: The 14th World Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico Metropolis)

Feb. 13-14: The 4th Version of NFT Paris.

Feb. 18-20: CoinDesk’s Consensus Hong Kong

Feb. 19: Sui Join: Hong Kong

Feb. 23-March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Speak

By Shaurya Malwa

Ai16z, an open-source AI agent platform, has rebranded to ElizaOS to ascertain knowledgeable id and keep away from trademark points with Andreessen Horowitz (a16z).

Shaw Walters, the founder, stated on X that the rebranding will increase collaboration with established individuals following a 300x progress in property below administration over three months, with plans for Eliza v2 underway.

Uniswap teased its forthcoming v4 in an X publish, bumping the UNI token up 7%. The brand new model has important enhancements to the Ethereum-based decentralized change protocol.

Key options embody “hooks” for pool customization, permitting for dynamic charges and on-chain orders, a singleton contract to decrease gasoline prices, flash accounting for environment friendly token transfers, and native ETH help.

Derivatives Positioning

The open interest-adjusted cumulative quantity delta (CVD) indicator reveals main cryptocurrencies, besides Mantra’s OM token, have seen web promoting stress within the perpetual futures market prior to now 24 hours.

WIF’s value has surged 16% alongside an uptick in open curiosity, whereas the CVD has dropped. It is a signal of merchants shorting the value rally.

Futures foundation stays elevated above 10% in BTC and ETH, an indication merchants are chasing the upside. Annualized one-month foundation in ETH’s CME futures is barely pricier than BTC, indicating relative attractiveness of ether for carry trades.

BTC and ETH choices expiring this week and on Feb. 7 present a bias for places. That is in all probability on account of pre-Fed defensive positioning and BTC struggling to do a lot above $100,000.

Block flows featured a brief place in BTC $130,000 name expiring on March 28.

Market Actions:

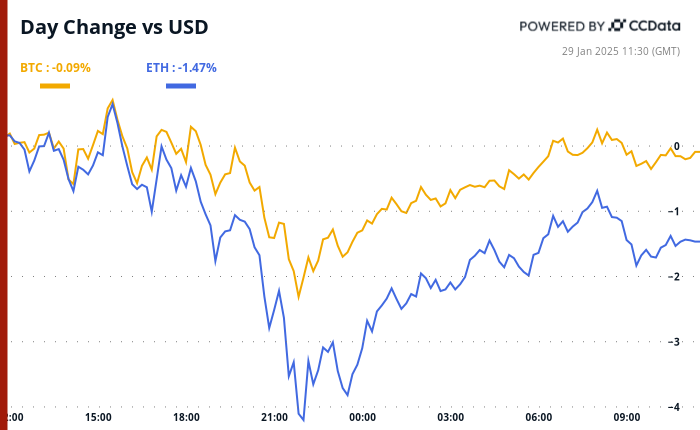

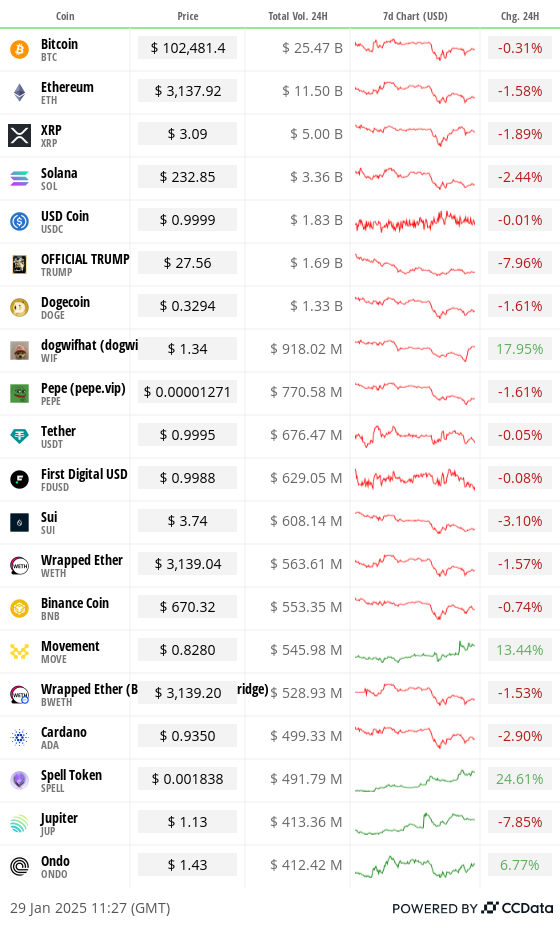

BTC is up 2.21% from 4 p.m. ET Tuesday to $102,509.74 (24hrs: -0.27%%)

ETH is up 2.7% at $3,134.98 (24hrs: -1.91%)

CoinDesk 20 is up 0.47% to three,733.87 (24hrs: +6.73%)

CESR Composite Staking Fee is down 13 bps to three.96%

BTC funding price is at 0.0101% (11.0454% annualized) on OKX

DXY is up 0.22% at 108.11

Gold is unchanged at $2,757.89/oz

Silver is unchanged at $30.16/oz

Nikkei 225 closed +1.02% at 39,414.78

Hold Seng closed +0.14% to twenty,225.11

FTSE is up 0.32% at 8,561.24

Euro Stoxx 50 is up 0.83% at 5,238.76

DJIA closed on Tuesday +0.31% to 44,850.35

S&P 500 closed +0.92% at 6,067.70

Nasdaq closed +2.03% at 19,733.59

S&P/TSX Composite Index closed +0.52% at 25,419.45

S&P 40 Latin America closed +0.34% at 2,338.52

U.S. 10-year Treasury is down 1 bp at 4.53%

E-mini S&P 500 futures are up 0.1% at 6,103.25

E-mini Nasdaq-100 futures are up 0.39% at 21,665.50

E-mini Dow Jones Industrial Common Index futures are unchanged at 45,029.00

Bitcoin Stats:

BTC Dominance: 59.37 (-0.34%)

Ethereum to bitcoin ratio: 0.03063 (-0.86%)

Hashrate (seven-day transferring common): 780 EH/s

Hashprice (spot): $58.2

Complete Charges: 4.72 BTC/ $483,629

CME Futures Open Curiosity: 171,750 BTC

BTC priced in gold: 37.2 oz

BTC vs gold market cap: 10.58%

Technical Evaluation

Bitcoin’s rally towards the yen has stalled, with the MACD histogram pointing to a weakening of the upward momentum.

The BOJ raised rates of interest final week to the best in 17 years.

Crypto Equities

MicroStrategy (MSTR): closed on Tuesday at $335.93 (-3.45%), up 1.21% at $340 in pre-market.

Coinbase World (COIN): closed at $281.82 (+1.38%), up 1.2% at $285.20 in pre-market.

Galaxy Digital Holdings (GLXY): closed at C$27.87 (+1.86%).

MARA Holdings (MARA): closed at $18.26 (-0.14%), up 0.77% at $18.40 in pre-market.

Riot Platforms (RIOT): closed at $10.95 (-4.37%), up 1.83% at $11.15 in pre-market.

Core Scientific (CORZ): closed at $11.31 (+0.27%), up 1.59% at $11.49 in pre-market.

CleanSpark (CLSK): closed at $10.05 (-2.47%), up 1.19% at $10.17 in pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $20.83 (+0.24%), up 1.39% at $21.12 in pre-market.

Semler Scientific (SMLR): closed at $52.30 (+3.71%), down 0.19% at $52.20 in pre-market.

Exodus Motion (EXOD): closed at $80.16 (+8.32%), down 0.2% at $80 in pre-market.

ETF Flows

ETF Flows

Spot BTC ETFs:

Each day web circulation: $18 million

Cumulative web flows: $39.5 billion

Complete BTC holdings ~ 1.171 million.

Spot ETH ETFs

Each day web circulation: $0

Cumulative web flows: $2.67 billion

Complete ETH holdings ~ 3.59 million.

Supply: Farside Buyers

In a single day Flows

Chart of the Day

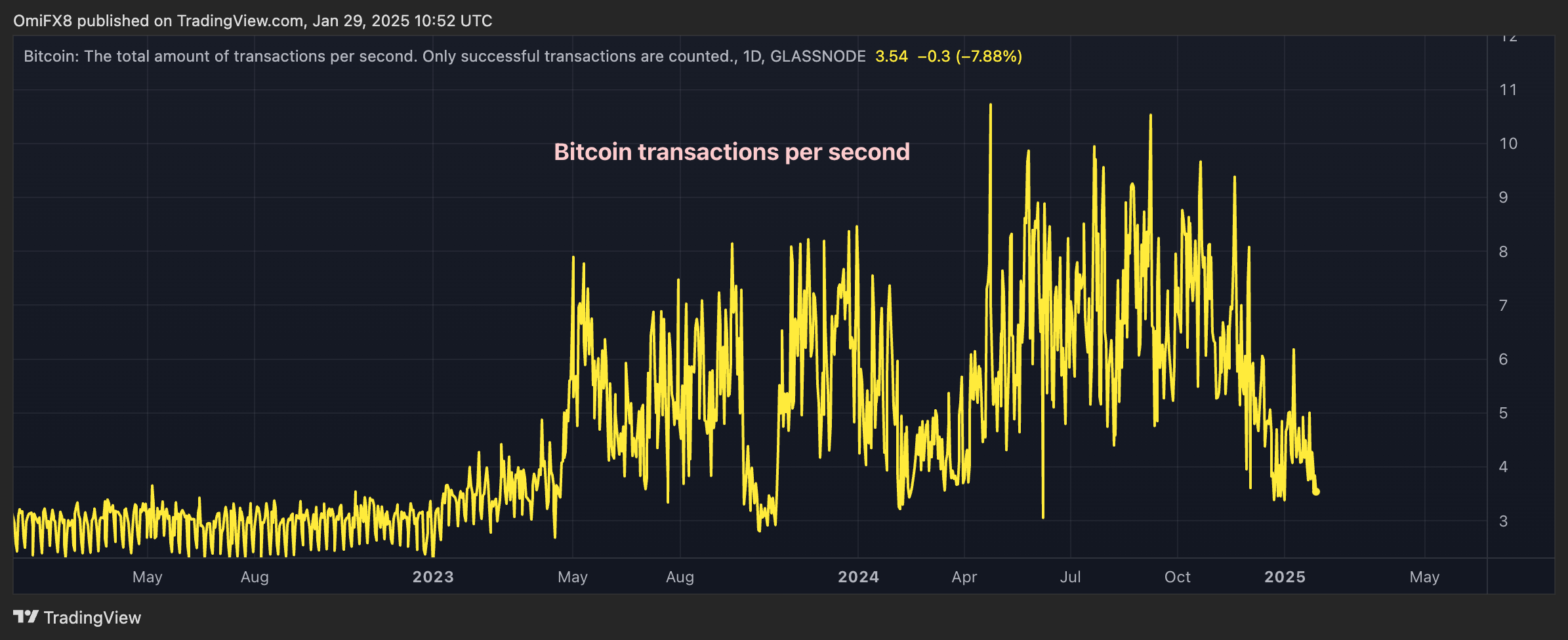

Bitcoin’s on-chain exercise has cooled considerably prior to now couple of months.

The overall variety of transactions per second has dropped to three.54 from highs above 10 in September-October.

Whereas You Had been Sleeping

Important Insights to Monitor Throughout Wednesday’s ‘No Change’ Fed Assembly (CoinDesk): The Federal Reserve is ready to carry the federal funds price regular, with Chair Jerome Powell anticipated to handle inflation, labor market shifts and debt issues.

Japan’s Metaplanet Plans to Purchase 21,000 Bitcoin by 2026 (CoinDesk): The corporate goals to carry 21,000 BTC by 2026, funding purchases via a $740 million inventory acquisition rights issuance. It at the moment owns 1,761 BTC.

Head of Czech Central Financial institution Needs It to Purchase Billions of Euros in Bitcoin (Monetary Occasions): Aleš Michl, governor of the Czech Nationwide Financial institution, will suggest investing as much as 7 billion euros ($7.3 billion) in bitcoin to diversify reserves. If accepted, the financial institution can be the primary Western central financial institution to carry BTC.

Merchants Guess ECB Will Must Deepen and Speed up Fee Cuts (Bloomberg): Merchants count on the ECB to chop charges aggressively, starting with a quarter-point drop Thursday, adopted by three extra cuts to carry the deposit price to 2% as U.S. tariff threats weaken the euro and increase bonds.

Overseas Buyers Are Fleeing India’s Inventory Market — however Analysts See Lengthy-Time period Potential (CNBC): Overseas buyers are pulling out of Indian markets as financial progress slows, driving the Nifty 50 and Sensex into correction territory. Some analysts name the downturn a pure recalibration.

Progress Engine or On line casino? World Buyers Rethink China Playbook (Reuters): Hedge funds and world portfolio managers are exiting China’s fairness and bond markets as obscure stimulus plans and weak progress stall the CSI 300 index, reflecting declining confidence in long-term investments.

Within the Ether