By Omkar Godbole (All instances ET until indicated in any other case)

“I do not perceive how can anybody suppose BTC is just not a discount at these costs…,” Andre Dragosch, head of analysis – Europe at Bitwise, mentioned on X Monday as BTC’s worth dipped under $90,000.

Whereas the remark could seem overly optimistic to macro bears, it isn’t with out justification. Even because the DXY, Treasury yields, and Fed fee expectations look to destabilize danger belongings, company and institutional demand for BTC continues to strengthen.

Intesa Sanpaolo, Italy’s largest financial institution by market capitalization, has reportedly bought BTC, snapping up 11 BTC for $1 million. That might speed up crypto adoption within the European Union’s third-largest financial system, which already has 1.4 million residents holding cryptocurrencies.

If that is not sufficient, company Treasury purchases of BTC have already reached 5,774 BTC within the first two weeks of January, outpacing the availability of latest BTC.

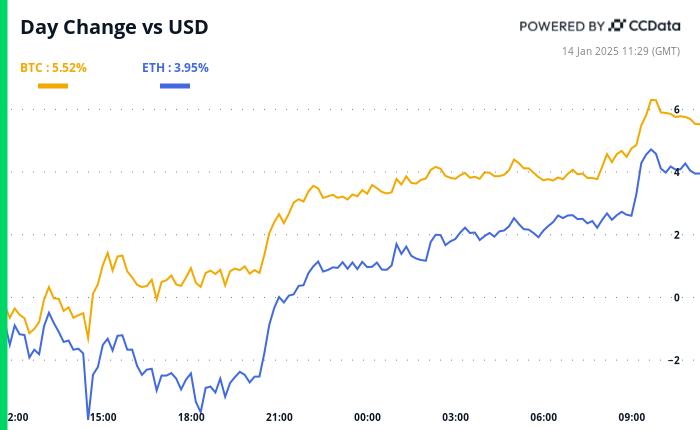

To Dragosch’s credit score, BTC has bounced to over $96K, hinting at an finish of the value weak spot that started a month in the past at report highs above $108K. As traditional, that has introduced cheer to all corners of the crypto market, with AI, gaming and meme sub-sectors main the cost.

The restoration, supported by ongoing institutional adoption and rumors of President-elect Donald Trump planning to subject an government order addressing crypto-accounting SEC guidelines on day one, means that bears could discover it tough to say their affect.

Costs could transfer into six figures if Tuesday’s U.S. producer worth index factors to softer inflation within the pipeline, weakening the hawkish Fed narrative. Notice that the greenback index’s rally has already stalled amid experiences that Trump’s tariffs can be gradual and smaller than initially feared.

What to Watch

- Crypto

- Macro

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI information.

- PPI MoM Est. 0.3% vs. Prev. 0.4%.

- Core PPI MoM Est. 0.3% vs. Prev. 0.2%.

- Core PPI YoY Est. 3.7% vs. Prev. 3.4%.

- PPI YoY Est. 3.4% vs. Prev. 3%.

- Jan. 14, 8:55 a.m.: U.S. Redbook YoY for the week ended on Jan. 11. Prev. 6.8%.

- Jan. 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s Shopper Worth Index Abstract.

- Core Inflation Price MoM Est. 0.2% vs. Prev. 0.3%.

- Core Inflation Price YoY Est. 3.3% vs. Prev. 3.3%.

- Inflation Price MoM Est. 0.3% vs. Prev. 0.3%.

- Inflation Price YoY Est. 2.8% vs. Prev. 2.7%.

- Jan. 16, 2:00 a.m.: The U.Okay.’s Workplace for Nationwide Statistics November 2024’s GDP estimate.

- GDP MoM Est. 0.2% vs. Prev. -0.1%.

- GDP YoY Prev. 1.3%.

- Jan. 16, 8:30 a.m.: The U.S. Division of Labor releases the Unemployment Insurance coverage Weekly Claims Report for the week ending on Jan. 11. Preliminary Jobless Claims Est. 214K vs. Prev. 201K.

- Jan. 17, 5:00 a.m.: Eurostat releases December 2024’s Eurozone inflation information.

- Inflation Price MoM Ultimate Est. 0.4% vs Prev. -0.3%.

- Core Inflation Price YoY Ultimate Est. 2.7% vs. Prev. 2.7%.

- Inflation Price YoY Ultimate Est. 2.4% vs. Prev. 2.2%.

- Jan. 14, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases December 2024’s PPI information.

Token Occasions

- Governance votes & calls

- Compound DAO is discussing the creation a brand new unit chargeable for managing APR incentive campaigns to draw massive conservative buyers.

- Maple Finance DAO is discussing utilizing 20% of the payment income the protocol will generate in Q1 to purchase again SYRUP tokens and distributed them to SYRUP stakers.

- Unlocks

- Jan. 14: Arbitrum (ARB) to unlock 0.93% of its circulating provide, price $70.65 million.

- Jan. 15: Connex (CONX) to unlock 376% of its circulating provide, price $84.5 million.

- Jan. 18: Ondo (ONDO) to unlock 134% of its circulating provide, price $2.19 billion.

- Token Launches

- No main token launches scheduled right now.

- Jan. 15: Derive (DRV) will launch, with 5% of provide going to sENA stakers.

Jan. 16: Solayer (LAYER) to host token sale adopted by 5 months of factors farming. - Jan. 17: Solv Protocol (SOLV) to be listed on Binance.

Conferences:

Token Discuss

By Francisco Rodrigues

- Holoworld AI has introduced the beginning of Agent Market, a Solana-based token launchpad permitting customers to create, commerce, and work together with on-chain AI brokers and their tokens with out coding abilities. {The marketplace} has integration with a number of social channels together with X, permitting for brokers to be deployed on these channels after launch.

- Regardless of enduring a steep correction, AI tokens have outperformed each different basket class throughout the cryptocurrency house up to now this 12 months, owing their returns to a big surge seen within the first week of the 12 months. CCData’s basket efficiency exhibits that year-to-date, AI tokens are up 2.5%, whereas the second-best performing class, trade tokens, is up lower than 0.5%.

- On the opposite finish of the spectrum, actual world asset (RWA) tokens are down greater than 14% , considerably underperforming memecoins, which dropped roughly 10% on this month’s correction.

- Standard Protocol, the favored decentralized finance protocol that got here underneath hearth final week over an surprising change in its redemption mechanism, has activated its Income Change for USUALx holders.

- Solana-based token launchpad Pump.enjoyable has moved 122,620 SOL price over $21 million to Kraken, bringing their whole deposited funds to 1.785 million SOL price $362 million, Onchain Lens revealed.

- The FTX property has executed its month-to-month SOL redemption switch, unstaking 182,421 SOL and transferring the funds to twenty completely different addresses. Since November, FTX has redeemed over $500 million in SOL, and it nonetheless holds $1.18 billion in its staking tackle.

Derivatives Positioning

- Massive cap tokens, excluding XLM, XRP and HYPE, have seen a decline in perpetual futures open curiosity prior to now 24 hours.

- Entrance-end BTC and ETH choices danger reversals present impartial sentiment regardless of the value restoration. Close to-dated and long-term choices present a bias for calls.

- Block flows featured massive buy of calls at $95K and $98K expiring within the subsequent two weeks and an ETH bull name unfold, involving March 28 expiry calls at $5.5K and $6.5K.

Market Actions:

- BTC is up 2.56%% from 4 p.m. ET Tuesday to $96,615.50 (24hrs: +6.44%)

- ETH is up 3.84% at $3,233.91 (24hrs: +5.76%)

- CoinDesk 20 is up 4.69% to three,463.07 (24hrs: +6.84%)

- Ether staking yield is up 15 bps to three.12%

- BTC funding fee is at 0.01% (10.95% annualized) on Binance

- DXY is down 0.35% at 109.57

- Gold is up 0.22% at $2,679.50/oz

- Silver is up 0.76% to $30.32/oz

- Nikkei 225 closed -1.83% at 38,474.30

- Cling Seng closed +1.83% at 19,219.78

- FTSE is up 0.17% to eight,237.93

- Euro Stoxx 50 is up 1.03% to five,005.29

- DJIA closed on Monday +0.86% at 42,297.12

- S&P 500 closed +0.16 at 5,836.22

- Nasdaq closed -0.38% at 19,088.10

- S&P/TSX Composite Index closed -0.93% at 24,536.30

- S&P 40 Latin America closed +0.49% at 2,192.57

- U.S. 10-year Treasury was unchanged at 4.79%

- E-mini S&P 500 futures are up 0.54% to five,906.00

- E-mini Nasdaq-100 futures are up 0.71% to 21,096.00

- E-mini Dow Jones Industrial Common Index futures are up 0.37% to 42,682.00

Bitcoin Stats:

- BTC Dominance: 58.52

- Ethereum to bitcoin ratio: 0.033

- Hashrate (seven-day transferring common): 773 EH/s

- Hashprice (spot): $54.3

- Whole Charges: 7.77 BTC/ $721,654

- CME Futures Open Curiosity: 174,105 BTC

- BTC priced in gold: 35.6/oz

- BTC vs gold market cap: 10.14%

Technical Evaluation

- Regardless of the in a single day bounce, BTC’s worth stays within the Ichimoku cloud, a momentum indicator created by Japanese journalist Goichi Hosada.

- A crossover above the cloud would sign a renewed bullish outlook.

Crypto Equities

- MicroStrategy (MSTR): closed on Monday at $328.40 (+0.15%), up 3.19% at $338.89 in pre-market.

- Coinbase World (COIN): closed at $251.20 (-2.93%), up 3.18% at $259.20 in pre-market.

- Galaxy Digital Holdings (GLXY): closed at C$26.04 (-3.8%)

- MARA Holdings (MARA): closed at $17.19 (-3.75%), up 3.61% at $17.81 in pre-market.

- Riot Platforms (RIOT): closed at $11.77 (-1.92%), up 3.65% at $12.20 in pre-market.

- Core Scientific (CORZ): closed at $13.6 (-3.13%), up 1.6222.22$13.82 in pre-market.

- CleanSpark (CLSK): closed at $10.19 (+0.99%), up 3.24% at $10.52 in pre-market.

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $22.22 (-3.85%), up 7.29% at $23.84 in pre-market.

- Semler Scientific (SMLR): closed at $52.70 (+2.61%), up 4.19% at $54.91 in pre-market.

- Exodus Motion (EXOD): closed at $33.58 (-11.09%).

ETF Flows

Spot BTC ETFs:

- Each day internet movement: -$284.1 million

- Cumulative internet flows: $35.94 billion

- Whole BTC holdings ~ 1.131 million.

Spot ETH ETFs

- Each day internet movement: -$39.4 million

- Cumulative internet flows: $2.41 million

- Whole ETH holdings ~ 3.535 million.

Supply: Farside Buyers, as of Jan. 13.

In a single day Flows

Chart of the Day

- The chart exhibits efficiency of assorted crypto market sub-sectors in 2024.

- Memecoins witnessed a staggering 254% acquire final 12 months, outperforming the broader market and bitcoin by a giant margin.

Whereas You Have been Sleeping

- Is Bitcoin Backside In? BTC’s Worth Motion is Inverse of December Peak Above $108K (CoinDesk): Bitcoin dipped under $90K on Monday as funding banks speculated about potential Fed fee hikes, nevertheless it rebounded to $94K, suggesting the value could have briefly bottomed after current volatility.

- Crypto Financial institution Sygnum Will get Unicorn Standing With $58M Spherical (CoinDesk): Sygnum, a Switzerland and Singapore-based digital asset financial institution, achieved unicorn standing after elevating $58M to help European and Hong Kong growth, enhanced Bitcoin choices, and acquisition plans.

- Sony’s Layer-2 Blockchain “Soneium” Goes Reside (CoinDesk): Sony has launched “Soneium,” a layer-2 blockchain on Ethereum, leveraging Optimism’s OP Stack to attach web2 and web3 audiences whereas supporting gaming, finance, and leisure functions.

- Because the U.S. Greenback Soars, Right here Are Europe’s Greatest Winners and Losers (CNBC): The robust U.S. greenback, fueled by greater yields and capital flows, weakens the euro and pound, growing prices for internet importers like Germany and the U.Okay., whereas benefiting Norway’s oil exports.

- China Will ‘Attempt Very Laborious’ to Gradual Yuan’s Fall, UBS’ Wang Says (Bloomberg): UBS says a weaker yuan will provide restricted export advantages, as Beijing seeks to gradual its decline amid US tariff threats, a powerful greenback, and dangers of capital outflows.

- BOJ Set to Talk about Whether or not to Increase Charges Subsequent Week (The Wall Avenue Journal): Deputy Gov. Himino says the Financial institution of Japan will talk about a possible fee hike on Jan. 23-24, noting inflation developments align with projections. His remarks lifted bond yields, whereas the yen briefly weakened earlier than recovering.

Within the Ether