DappRadar’s newest report on the state of DeFi confirmed that the trade noticed a profitable quarter, regardless of the difficulties it confronted on the finish of 2022.

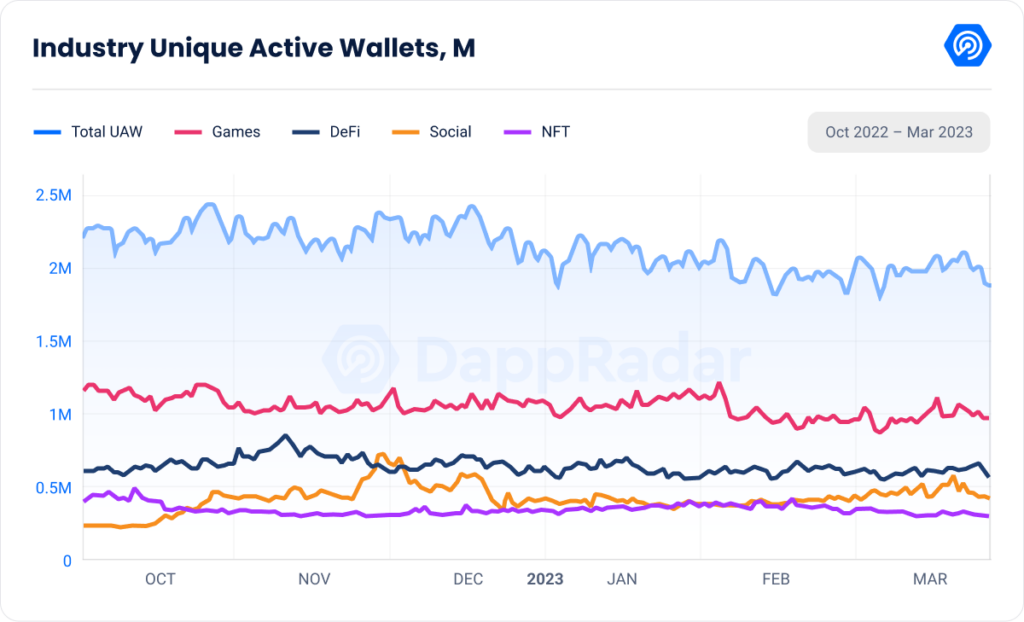

The continued bear market solely affected the variety of energetic customers interacting with DeFi apps. In accordance with the report, the variety of day by day distinctive energetic wallets (dUAWs) decreased by nearly 10% in comparison with the earlier quarter.

Nevertheless, that is according to the general drop in dUAWs throughout all crypto sectors since final quarter.

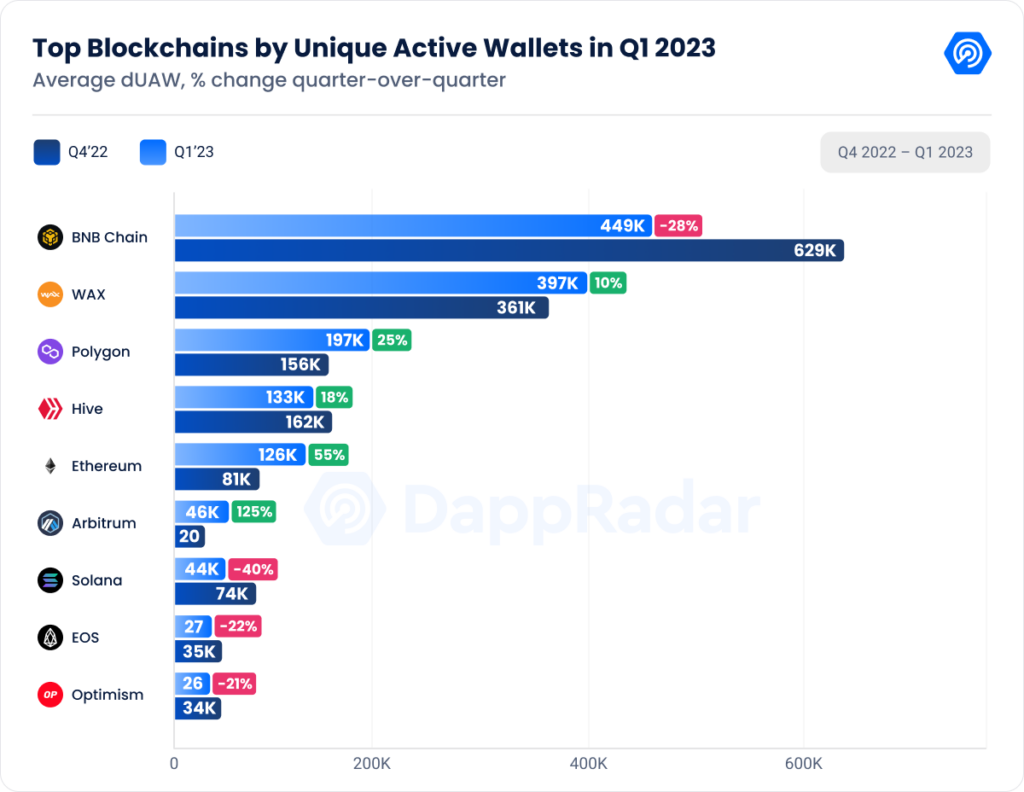

Nearly all of these customers are energetic on Binance, which noticed 449,000 dUAWs this quarter. Nevertheless, that is nonetheless a 28% lower from the 629,000 dUAWs it registered final quarter, displaying its dominance in DeFi might be reducing.

Wax took second place with slightly below 400,000 dUAWs, a 9% improve over the previous three months. Polygon noticed a 25% improve in dUAWs, surpassing 197,000 distinctive wallets per day.

Whereas most different blockchain platforms skilled some development by way of energetic customers, none rival Arbitrum which noticed its variety of dUAWs improve by 125% in comparison with final quarter.

Elevated curiosity in Arbitrum additionally elevated the whole worth locked (TVL) in DeFi. The DeFi sector closed the quarter with $83.3 billion in TVL — a 37% improve from the earlier quarter.

Abirtrum’s long-awaited airdrop attracted a big quantity of customers to the platform, pushing the entire sector ahead. Information from DappRadar confirmed that Arbitrum noticed a 118% improve In TVL, closing the quarter with $3.2 billion.

GMX, a decentralized change providing perpetual future buying and selling, accounted for over 80% of all TVL in Arbirum.

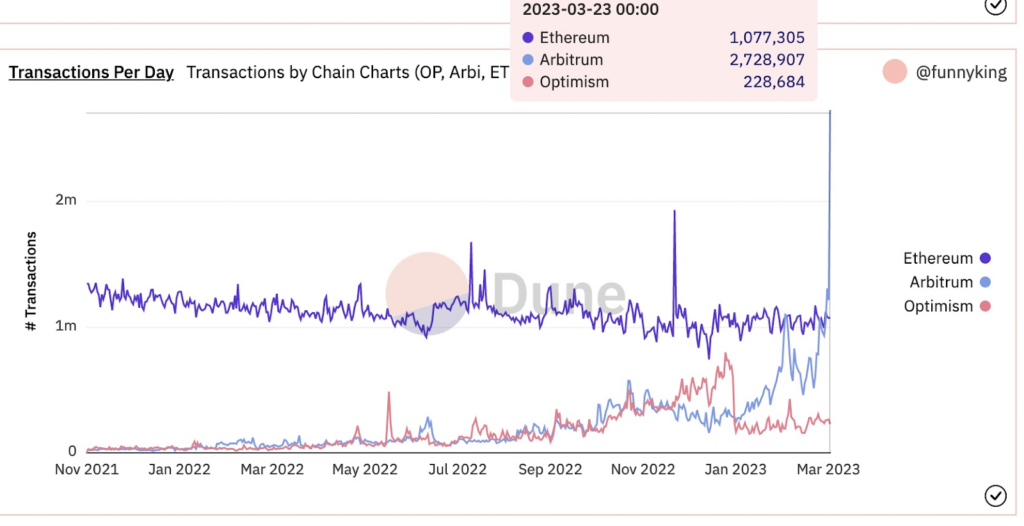

Arbitrum distributed over 1 billion ARB tokens to round 600,000 customers, pushing the variety of transactions on the blockchain to a document of two.7 million, surpassing each Ethereum and Optimism.