Bitcoin fluctuated between $92,000 and $100,000 by means of late December earlier than reclaiming $102,000 by Jan. 6. CryptoQuant information means that lowered sell-side liquidity, adjustments in over-the-counter (OTC) desk balances, and a renewed whale accumulation sample is likely to be elements shaping these fluctuations.

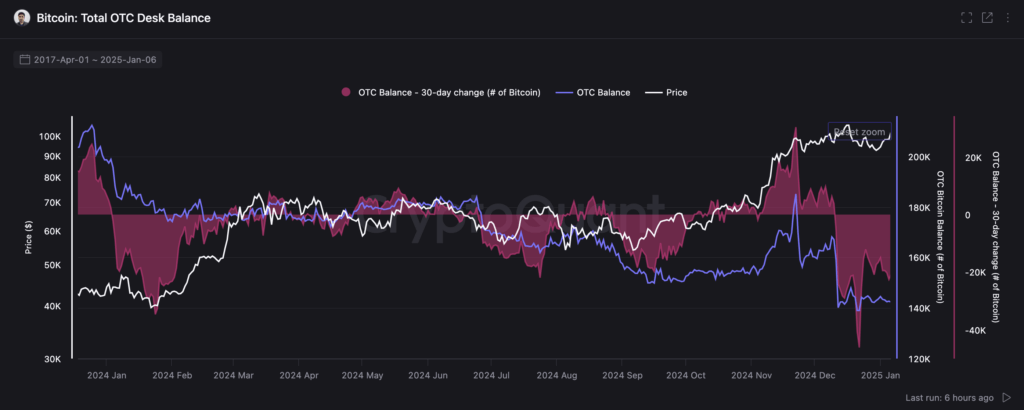

OTC Desk balances decline

Exercise on OTC desks, tracked by means of complete holdings and 30-day stability adjustments, reveals declining balances on the finish of 2024 after rising from October to December. Web outflows from these desks have appeared alongside a rising value setting, prompting discussions that giant entities might be withdrawing cash from OTC channels and holding them off-exchange.

Per CryptoQuant, the pink overlay within the OTC chart under displays a unfavourable 30-day change, indicating extra BTC outflow than influx, whereas the blue line measuring the general OTC desk stability exhibits a gradual lower. Analysts watch this dynamic as a result of it steadily coincides with institutional or high-volume consumers eradicating cash from instant circulation, typically transferring into spot Bitcoin ETFs.

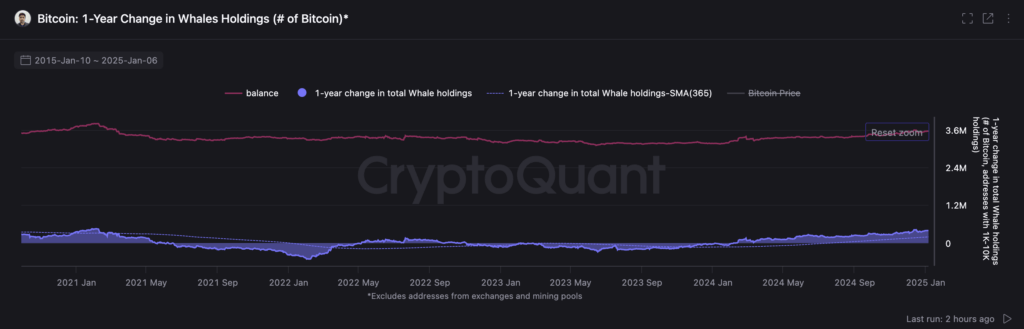

Whales accumulate Bitcoin

Additional insights emerge from whale conduct. Addresses with 1,000 to 10,000 BTC displayed extended web promoting from 2021 to 2023, but 2024 information confirmed a shift towards impartial to barely constructive accumulation, highlighted in one-year change metrics.

These addresses had been distributing over a multi-year interval, however more moderen information factors to a reversal. Till 2024, the pink line representing complete whale holdings had plateaued at decrease ranges after which moved barely increased, whereas the blue line measuring 1-year change started inching nearer to zero. Since January 2024, each the whale stability and 1-year change have moved constructive. This means that, at the least within the mixture, whales have lowered distribution and are probably reacquiring cash after the halving and subsequent volatility.

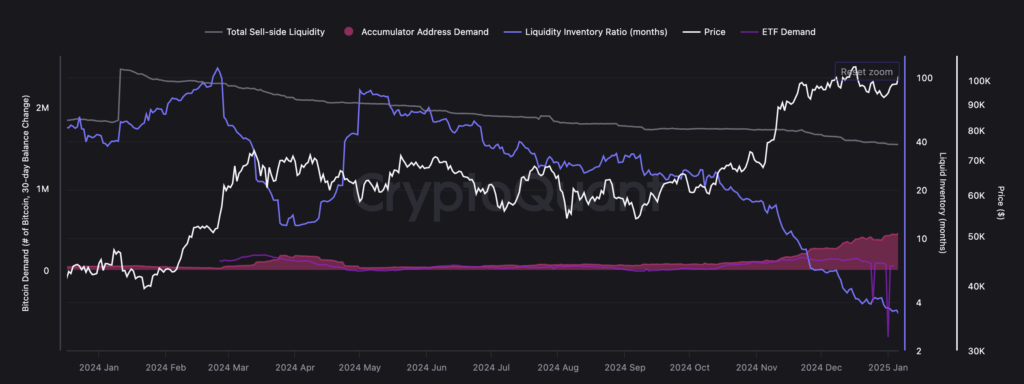

Promote-side liquidity declines

The liquidity stock ratio and complete sell-side liquidity measures add additional context. The CryptoQuant visualization under exhibits a downward pattern within the general liquid provide, suggesting fewer BTC reside in wallets recognized to have interaction in common promoting.

The liquidity ratio, typically expressed in months, compares accessible BTC in liquid addresses to ongoing demand, and a falling ratio signifies that new demand may extra shortly outstrip accessible provide. In the meantime, the accumulator tackle demand metric exhibits incremental inflows to addresses recognized for long-term holding. These inflows have steadily elevated since November 2024 slightly than spiking dramatically. That sample might signify a gradual however not explosive wave of “buy-and-hold” conduct, which may tighten market circumstances mixed with falling liquid provide.

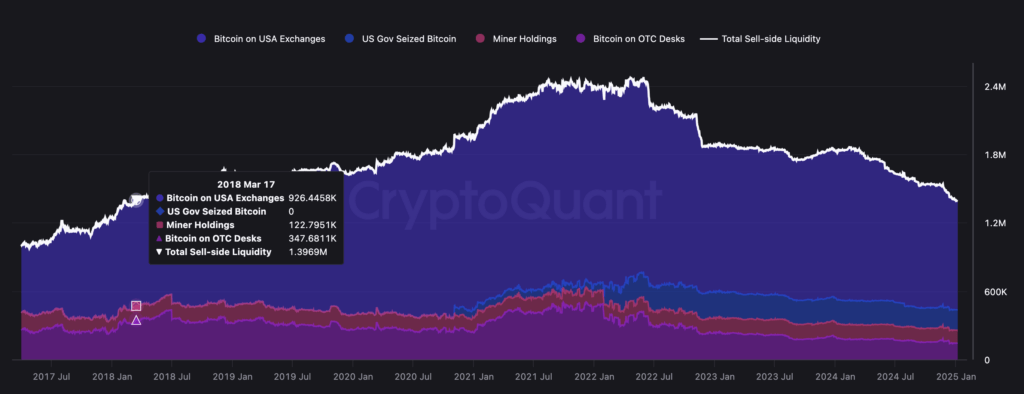

Promote-side liquidity intimately

The aggregated information under tracks this altering distribution of BTC throughout main classes: U.S. exchanges, OTC desks, miner holdings, and cash seized by authorities entities. Per CryptoQuant, the full variety of BTC on U.S. exchanges dropped from peaks above two million in 2021 to round 1.39 million at present. The final time this determine was this low was in March 2018.

This decline usually aligns with broader trade tendencies displaying lowered trade balances, probably influenced by rising consciousness of self-custody and institutional methods that favor off-exchange storage. The OTC portion, whereas smaller, echoes the downward sample seen in standalone OTC charts, stressing the chance that giant consumers have migrated cash away from simply accessible swimming pools of liquidity.

Miner holdings have proven restricted volatility, although occasional shifts of their stability can sign the affect of operational prices or broader market pressures. These fluctuations didn’t overshadow the drop in complete sell-side liquidity, which had stood within the multi-million coin vary earlier than declining as contributors moved property to personal wallets. Authorities-held BTC, which sometimes emerges from auctions of seized cash, stays a small element of the full provide however is tracked by on-chain analysts who word periodic spikes in that metric tied to large-scale authorized actions.

Bitcoin value historical past in 2024

Bitcoin’s value historical past by means of late 2024 into early 2025 offers a backdrop for deciphering these on-chain observations. It rallied from round $93,400 on Nov. 13 to repeated all-time highs in December, breaking $100,000 on Dec. 5 and reaching $108,300 on Dec. 17. The following pullback to about $93,000 on Dec. 20 didn’t erase the broader uptrend, and every rally introduced provide circumstances again into focus.

As CryptoQuant information exhibits, the interaction of trade stability declines, OTC desk outflows, and whale accumulation suggests that provide strain stays a key affect on market construction. Merchants have pointed to the regular demand from accumulators, average miner promoting, and lowered trade reserves as proof that the float of obtainable cash continues to shrink.

Observers word that these developments adopted the April 2024 halving, which lowered block rewards to three.125 BTC each ten minutes, including one other dimension to produce constraints. By November 2024, the U.S. presidential election end result coincided with a swift value surge that noticed Bitcoin method $100,000, a psychologically vital threshold.

Bitcoin stays close to six figures, with on-chain information suggesting that the circulating provide pool stays tight. The reaccumulation by bigger holders, web outflows from OTC desks, and incremental additions to accumulator addresses converge to bolster the notion that circulating BTC could also be much less plentiful than in earlier cycles.

The put up Bitcoin sell-side liquidity hits lowest stage since 2018 fueling BTC rally appeared first on CryptoSlate.