Bitcoin’s worth has seen notable volatility forward of the Federal Reserve’s rate of interest determination later right this moment, retracing from a latest excessive of $108,000 to hover round $104,000. The transfer comes amid a backdrop of combined world financial indicators, as contemporary information highlights continued inflationary pressures in main markets.

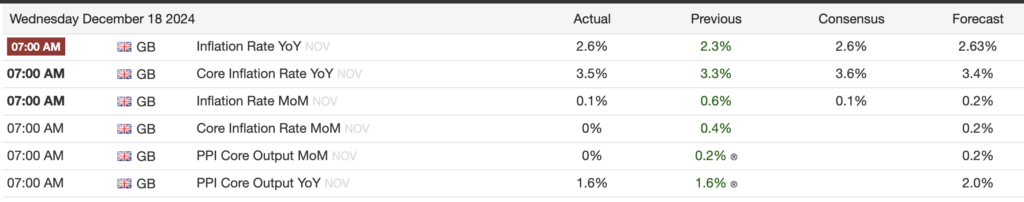

European and UK inflation prints arrived larger than prior readings, with UK inflation rising to 2.6% year-on-year in November, up from 2.3%, and Eurozone inflation settling at a ultimate 2.2% for a similar month, surpassing October’s 2% determine.

Within the UK, inflation rising aligns with forecasts however indicators a gentle uptick from October’s 2.3%. Core inflation, which excludes unstable gadgets, elevated to three.5%, reflecting persistent worth pressures. In Europe, inflation remained subdued, with the Euro Space’s core inflation regular at 2.7% year-over-year in November. In the meantime, building output grew marginally by 0.2%, recovering from a contraction the earlier month.

UK Producer Worth Index (PPI) information confirmed combined traits, with enter prices contracting by 1.9% yearly, whereas output costs fell 0.6% on the 12 months. US constructing permits elevated 6.1% in November to 1.505 million, whereas Housing begins fell 1.8% to 1.289 million, emphasizing a combined outlook forward of the Federal Reserve’s rate of interest determination later right this moment.

Buying and selling Economics Calendar additionally reported that US housing market exercise confirmed resilience, with constructing permits rising 6.1% in November, outpacing forecasts. Nonetheless, housing begins declined by 1.8% month-over-month, reflecting lingering challenges. The present account deficit widened to $310.9 billion in Q3, with persistent commerce imbalances as home demand remained strong.

The panorama aligns with investor uncertainty as markets await readability from the Federal Reserve. Bitcoin’s latest volatility reveals it stays delicate to macroeconomic developments, with its retracement reflecting warning as merchants assess the potential implications of the Fed’s determination on liquidity and danger belongings.

For updates on the Federal Reserve determination and its affect, observe CryptoSlate’s protection.