Bitcoin (BTC) has dropped 7.6% because it nearly — however not fairly — touched the psychological wall of $100,000 on Nov. 22.

That is the most important drop since Donald Trump received the U.S. presidential election, sparking a rally that despatched the biggest cryptocurrency by market capitalization hovering from a stage of round $66,000 by way of its report excessive.

Even so, the slide is not out of the abnormal. In bull markets bitcoin usually tumbles as a lot as 20% and even 30%, so-called corrections that are inclined to flush out leverage in an overheated market.

A big a part of the rationale the bitcoin worth did not get to $100,000 was the quantity of profit-taking that passed off. A report greenback worth of $10.5 billion of profit-taking passed off on Nov. 21, in accordance with Glassnode information, the most important day of profit-taking ever witnessed in bitcoin.

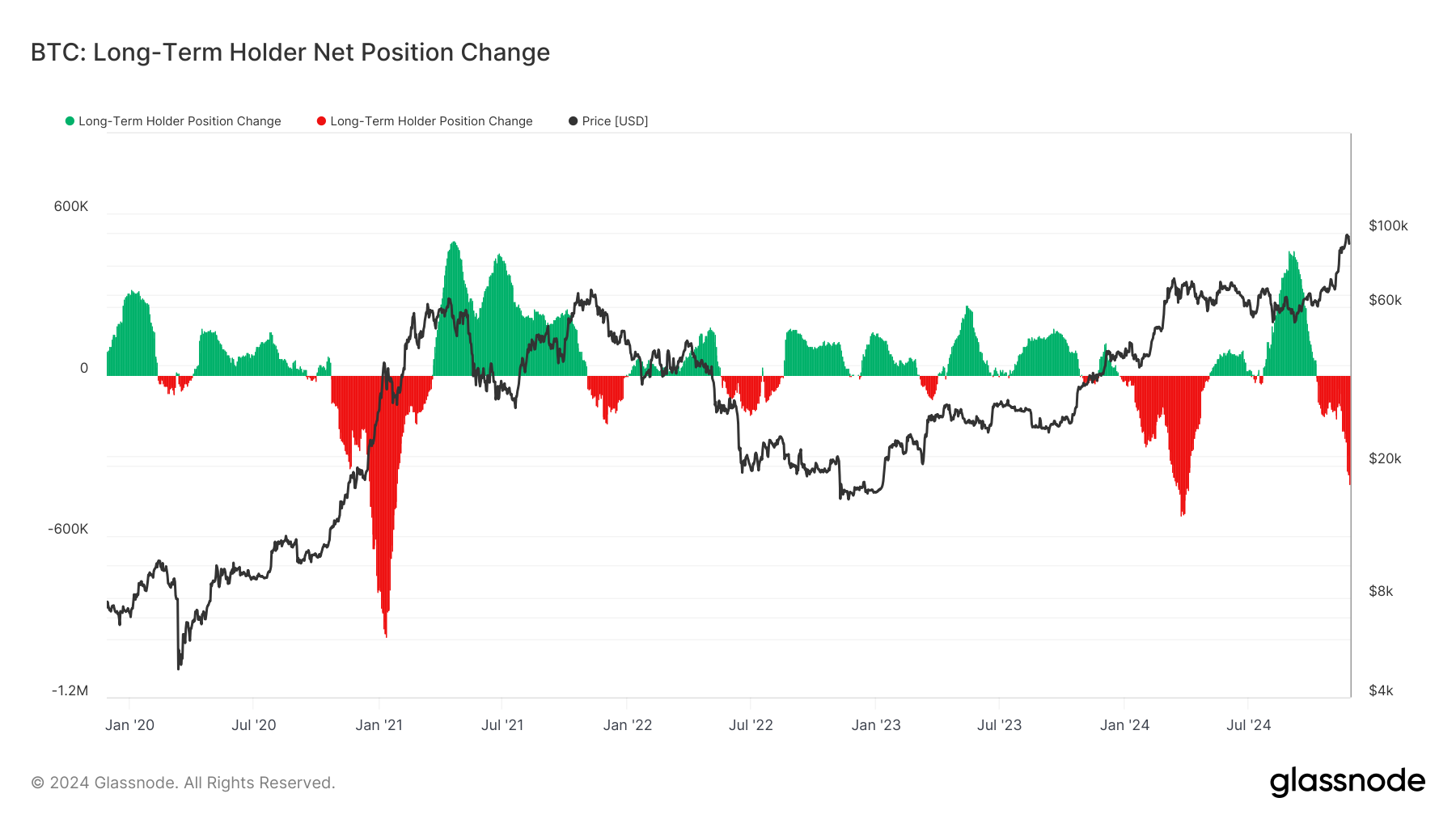

On the root of the motion are the long-term holders (LTH), a bunch Glassnode defines as having held their bitcoin for greater than 155 days. These traders are thought of “good cash” as a result of they have a tendency to purchase when the BTC worth is depressed and promote in occasions of greed or euphoria.

From September to November 2024, these traders have bought 549,119 BTC, or about 3.85% of their holdings. Their gross sales, which began in October and have accelerated since, even outweighed shopping for from the likes of MicroStrategy (MSTR) and the U.S. spot-listed exchange-traded funds (ETFs).

How lengthy is that this promoting stress going to final?

What’s noticeable from patterns in earlier bull markets in 2017, 2021 and early 2024, is that the proportion drop will get smaller every cycle.

In 2017, the proportion drop was 25.3%, in 2021 it reached 13.4% and earlier this 12 months it was 6.51%. It is at the moment 3.85%. If this charge of decline had been to proceed, that will see one other 1.19% drop or 163,031 BTC, which might take the cohort’s provide to 13.54 million BTC.

Every time, the long-term traders’ provide makes larger lows and better highs, so this might even be consistent with the pattern.