Bitcoin has been on a exceptional upward trajectory, pushing above the $96,000 mark for a number of days after consolidating beneath the psychological $100,000 stage. Because the main cryptocurrency, Bitcoin has constantly damaged all-time highs over the previous three weeks, with yesterday marking a milestone weekly shut at $98,000—the very best in its historical past.

Associated Studying

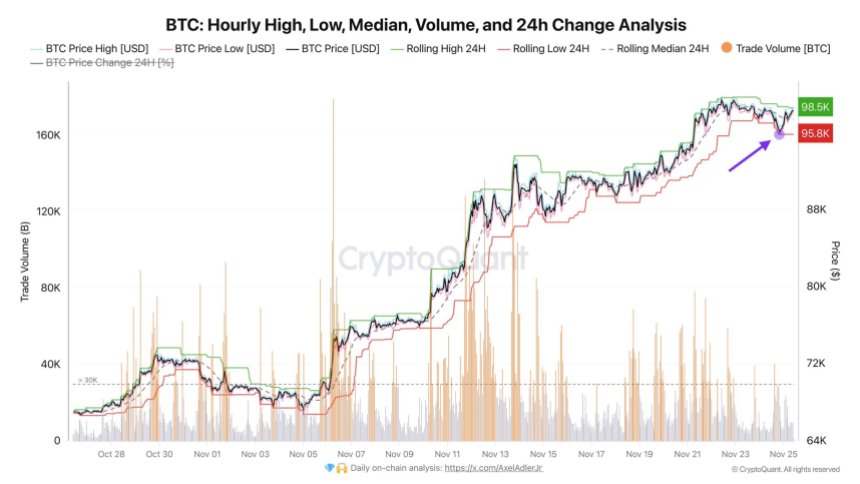

CryptoQuant analyst Axel Adler shared an insightful evaluation on X, emphasizing that Bitcoin’s current try and dip beneath $95,000 met with vital resistance, reinforcing the energy of present assist ranges. In accordance with Adler, the market is now poised for a important take a look at of the $100,000 mark, a barrier that might catalyze additional bullish momentum or sign a short-term consolidation part.

With Bitcoin’s bullish trajectory displaying no indicators of slowing, merchants and traders are intently looking forward to a breakout above $100,000. Such a transfer might ignite broader market optimism and drive renewed curiosity in altcoins, doubtlessly shaping the following part of the crypto market’s progress. Nonetheless, failure to interrupt above this key stage may set off a wholesome correction, setting the stage for a extra sustainable rally.

Bitcoin Value Motion Stays Sturdy

Bitcoin’s worth motion has remained exceptionally bullish regardless of a current retrace from $99,800 to $95,800—a minor dip of lower than 4%. Traders broadly see this pullback as a short consolidation part earlier than a possible breakout above the pivotal $100,000 mark.

The resilience demonstrated throughout this retrace has bolstered confidence amongst market contributors, with many viewing it as a wholesome pause in an ongoing uptrend.

Famend CryptoQuant analyst Axel Adler weighed in on the current market actions by way of X, sharing a technical evaluation that reinforces Bitcoin’s strong bullish construction. Adler highlighted that pushing BTC to decrease demand ranges was unsuccessful, additional solidifying present assist zones.

In accordance with his insights, the stage is now set for Bitcoin to lastly take a look at the important $100,000 space and gauge the market’s response at this psychological threshold. As BTC approaches this milestone, investor sentiment seems divided. Many merchants view the $100,000 stage as a really perfect worth to start taking earnings, citing historic patterns of pullbacks after vital round-number milestones.

Associated Studying

Nonetheless, others stay optimistic about Bitcoin’s continued energy, forecasting a possible surge past $100,000. Predictions for the rally’s peak vary between $105,000 and $120,000, reflecting a broader perception within the cryptocurrency’s long-term potential. Whether or not Bitcoin consolidates or continues climbing, all eyes stay on its subsequent strikes.

Bullish Weekly Shut Might Ship BTC Increased

Bitcoin has achieved its highest weekly shut in historical past, recording a formidable $98,000. This milestone is a technical achievement and a important psychological increase for market contributors. It alerts a robust bullish surroundings that might quickly propel Bitcoin above the coveted $100,000 mark.

The $98,000 stage now serves as a sturdy assist zone, and sustaining this worth—or a minimum of staying above $95,000—within the coming days can be pivotal. A breakout above these ranges might propel Bitcoin in direction of $100,000 with vital momentum. Such a transfer would solidify Bitcoin’s uptrend and appeal to additional curiosity from retail and institutional traders.

Associated Studying

Nonetheless, continued consolidation beneath $100,000 stays a risk. Bitcoin could take a number of weeks of sideways motion to assemble the energy wanted for the following leg up. Whereas doubtlessly irritating for short-term merchants, this consolidation part would supply a wholesome basis for sustainable progress.

Featured picture from Dall-E, chart from TradingView