Bitcoin has reached new all-time highs for 4 consecutive days, hitting $99,500 simply hours in the past. The relentless surge has fueled excessive bullish sentiment available in the market, with buyers eagerly anticipating Bitcoin’s historic breakthrough of the $100,000 mark. Nonetheless, on-chain information means that the rally could face challenges as indicators of profit-taking emerge.

Associated Studying

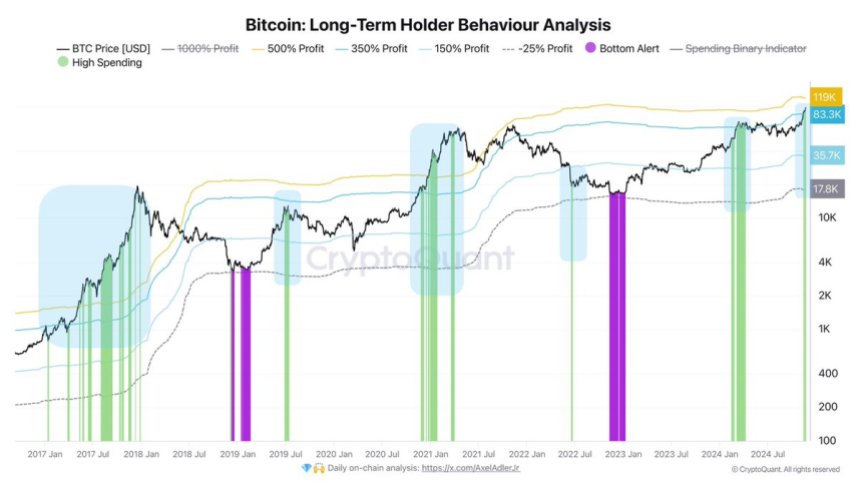

Key insights from CryptoQuant reveal that Lengthy-Time period Holders (LTHs) are actively spending their Bitcoin, capitalizing on earnings exceeding 350%. This habits signifies that some seasoned buyers are starting to lock in good points after the aggressive uptrend. Whale exercise and profit-taking by LTHs may briefly gradual the rally, doubtlessly triggering a consolidation part earlier than the subsequent leg up.

Whereas Bitcoin stays shy of the six-figure milestone, the market carefully examines whether or not it could actually maintain its momentum or if a pullback is imminent. Consolidation at these ranges may present the muse for BTC to reclaim its bullish development and break by the psychological $100,000 barrier.

Bitcoin Rally Appears Unstoppable

Bitcoin has surged a powerful 45% since November 5, displaying relentless upward momentum that seems unstoppable. Regardless of rising promoting exercise, demand continues to help the worth, driving Bitcoin to new highs and sustaining its bullish trajectory. Market contributors are actually carefully looking forward to potential alerts of a slowdown or correction as BTC pushes deeper into uncharted territory.

CryptoQuant analyst Axel Adler lately shared X information highlighting a major development amongst Lengthy-Time period Holders (LTHs). In line with Adler, LTHs are actively spending their Bitcoin, capitalizing on earnings exceeding 350%. This marks a essential juncture, as these holders are sometimes considered market stabilizers, and their promoting exercise may point out potential shifts in sentiment.

Adler additional notes that if Bitcoin’s worth surpasses $119,000, LTH earnings would soar to over 500%. Such extraordinary revenue ranges may set off a wave of promoting strain, doubtlessly resulting in the primary main correction after this unprecedented rally. Nonetheless, he emphasizes that predicting an actual worth level for a correction stays speculative, as no definitive threshold exists to find out when LTHs would possibly overwhelmingly exit their positions.

Associated Studying

Whereas the rally reveals no indicators of slowing down, this dynamic between demand and LTH profit-taking underscores the significance of monitoring market habits. Merchants ought to stay cautious as Bitcoin’s fast ascent unfolds.

BTC About To Attain $100K

Bitcoin trades at $98,600, lower than 2% from the extremely anticipated $100,000 mark. This psychological degree is predicted to be a major provide zone, with many buyers carefully watching worth actions round this milestone. Current “solely up” worth motion has left little room for merchants to purchase at decrease ranges, irritating those that hoped to build up throughout dips.

If Bitcoin holds above the essential $93,500 help degree within the coming days, market sentiment suggests a strong surge above $100,000 may comply with. Breaking this barrier would doubtless usher in additional bullish momentum, pushing Bitcoin into uncharted territory and fueling optimism for added good points.

Nonetheless, failure to keep up help at $93,500 may set off promoting strain, resulting in a worth pullback. In such a situation, Bitcoin would possibly take a look at decrease demand zones, with $85,000 and $80,000 recognized as key ranges to look at. These zones may present new accumulation alternatives for buyers seeking to capitalize on worth corrections.

Associated Studying

As Bitcoin approaches this historic degree, the subsequent few days will decide whether or not the market sustains its bullish development or enters a consolidation part. Merchants and buyers ought to stay vigilant as BTC navigates this essential juncture.

Featured picture from Dall-E, chart from TradingView