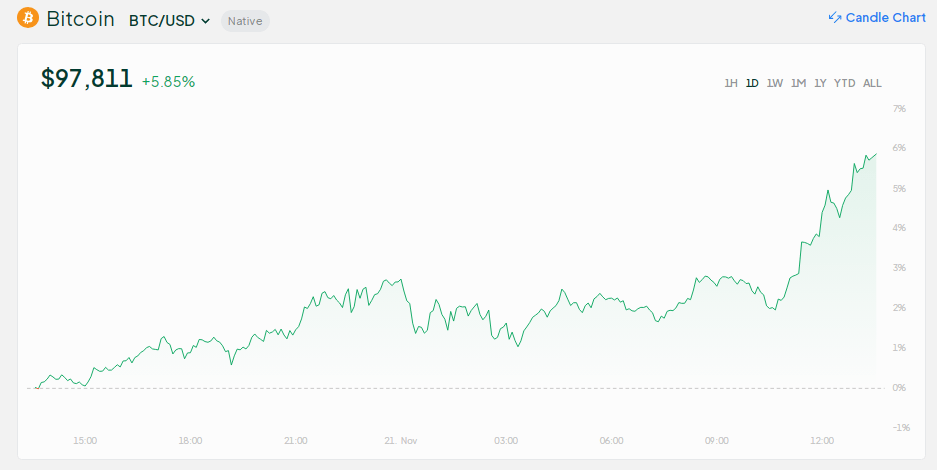

Bitcoin continues its worth explosion this Thursday, hitting a new all-time excessive and breaking the $97,000 barrier throughout intra-day buying and selling. The crypto asset’s worth then spiked 5.7%, reaching $97,811 on Bitstamp, boosting its market cap to $1.93 trillion.

Associated Studying

The current surge in Bitcoin’s worth isn’t just a market pattern, however a mirrored image of the rising optimism surrounding incoming US President Donald Trump’s potential crypto-friendly insurance policies and his decide for the Securities and Trade Fee (SEC) chief.

This optimism has led to a 3% enhance within the cumulative cryptocurrency market cap, now standing at $3.37 trillion. The 24-hour buying and selling quantity on Thursday noticed a 5% enhance, reaching $ 190 billion.

Bullish Pattern Thanks To Trump’s Win

The plain signal of the optimistic pattern within the bitcoin market: its worth has greater than doubled this 12 months. The entire business has joined the upward surge, contributing an incredible $900 billion to the overall crypto market capitalization. On condition that Bitcoin is barely $3,000 wanting the $100,000 milestone, the sector is bursting with hope about what the subsequent few weeks can carry for the digital asset.

Based on Edu Patel, CEO of Mudrex, Bitcoin’s worth final 12 months was $30,000. At the moment, the asset’s worth surged to greater than $97,000, reflecting a development of over 300%.

Patel mentioned a number of components are pushing Bitcoin’s worth, together with Trump’s election and optimism over his decide as chairman of the SEC, and his pleasant crypto insurance policies. As well as, he additionally acknowledged the rising institutional participation in Bitcoin choices and ETFs.

Is Trump Planning A Particular Place To Oversee Crypto?

The current worth surge of Bitcoin underscores the rising significance of the asset and cryptocurrency to the economic system. The Trump administration has additionally signaled the potential of creating a selected workplace to supervise the administration’s cryptocurrency insurance policies.

Based on some sources, the president’s group is at the moment contemplating this workplace, and plenty of crypto execs are jockeying for an viewers with the president.

1/

MicroStrategy simply satisfied buyers to pay $520,234 per BitcoinThat’s the largest Bitcoin play I’ve ever seen: pic.twitter.com/yeZfGlcm6j

— ELI5 of TLDR (@explain_briefly) November 20, 2024

Institutional Adoption, MicroStrategy’s Bitcoin-First Coverage Enhance Value

Some consultants additionally attribute Bitcoin’s current run to MicroStrategy’s daring “Bitcoin-first” coverage. Michael Saylor of MicroStrategy has doubled down on this strategy and bought extra BTC to spice up its portfolio. Different corporations have adopted go well with and are planning so as to add the asset to their inventories.

Associated Studying

The rising recognition of Bitcoin ETFs additionally helps, and the market at the moment advantages from the introduction of choices buying and selling. Based on a number of sources, greater than $4 billion has flowed into Bitcoin ETFs for the reason that November elections. Additionally, this week, Reuters reviews that BlackRock is off to an thrilling begin with its BTC ETFs with name choices.

Featured picture from Pixabay, chart from TradingView