In accordance with the most recent on-chain knowledge, the Bitcoin Community Worth to Transactions (NVT) Golden Cross has fallen into an important area. What might this imply for the worth of the premier cryptocurrency?

What Does The Falling NVT Golden Cross Imply For Value?

In a latest Quicktake submit on the CryptoQuant platform, an analyst with the pseudonym Burakkesmeci revealed that the worth of Bitcoin may need reached a “native backside.” This thrilling prognosis relies on the most recent motion by the “NVT Golden Cross” metric.

For context, the “Community Worth to Transactions” ratio is an on-chain indicator that estimates the distinction between the Bitcoin market capitalization and transaction quantity. Sometimes, a excessive NVT worth indicators that an asset’s worth is excessive in comparison with the community’s transaction quantity, suggesting that the coin is overvalued.

Conversely, when the worth of the NVT metric is low, it implies that the coin’s market worth is small relative to the transaction quantity. Normally, this means that the asset is undervalued and its worth might nonetheless have room for upside motion.

Now, the Golden Cross indicator is a modified iteration of the NVT ratio, and it helps to mark gradual purchase and promote zones in short-term developments. In accordance with Burakkesmeci defined that when the NVT GC exceeds 2.2 (the pink zone), it implies that the worth in a short-term development is overheating (and the formation of a possible native prime).

However, the NVT Golden Cross dipping beneath -1.6 means that the worth decline is sporting out, signaling a possible backside. Burakkesmeci famous that these native tops and bottoms are areas relatively than simply exact ranges.

As proven within the chart above, the NVT Golden Cross has crossed beneath -1.6 and is at the moment round -3.3, suggesting that the Bitcoin worth is at an area backside. In accordance with the CryptoQuant analyst, this might symbolize a “gradual shopping for alternative” for traders seeking to get into the market.

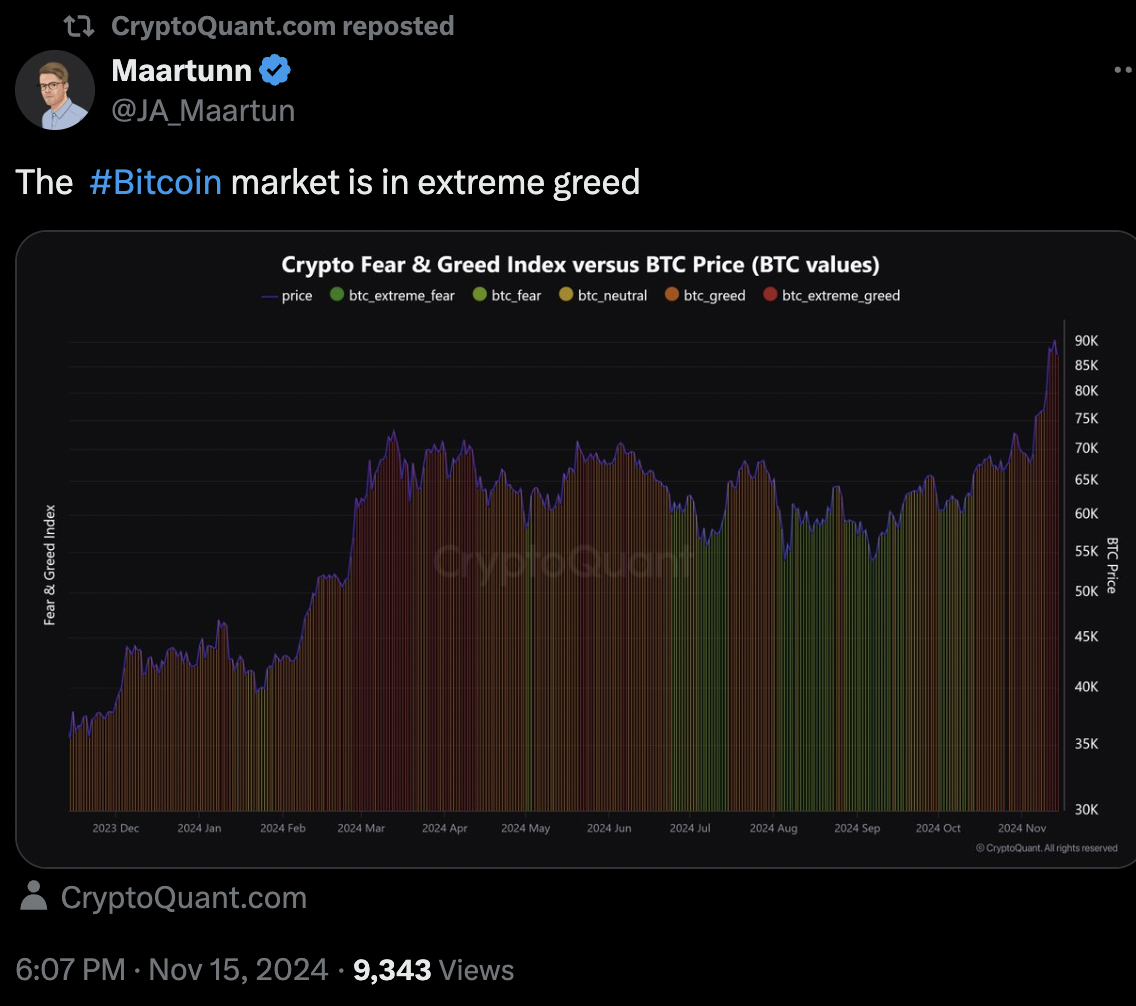

Bitcoin Market In Excessive Greed

Traders will need to proceed with warning particularly because the Bitcoin market appears to be overheating in the long run. In accordance with one other CryptoQuant analyst, the Worry & Greed Index has flagged excessive greed for the premier cryptocurrency.

Sometimes, when the Worry & Greed Index strikes towards one finish, there’s a potential for market reversal relying on the sentiment. On this case, the place the market is in excessive greed, the Bitcoin worth could also be about to witness a correction.

As of this writing, the worth of BTC sits simply beneath $91,000, reflecting a 3% enhance previously day. In accordance with CoinGecko knowledge, the market chief is up by a formidable 19% within the final seven days.