ChainLink value evaluation for March 27, 2023, signifies a major decline out there, with damaging momentum. The worth of LINK has been persistently bearish previously few hours, dropping from $7.3 to $7 on March 26, 2023. Nonetheless, the market began to extend and the value of ChainLink gained most of its misplaced worth to achieve $7.1, simply barely reaching the $7 threshold.

Chainlink is at the moment buying and selling at $7.13 with a 24-hour buying and selling quantity of $450.73M, a market capitalization of $3.69B, and a market dominance of 0.32%. The LINK value has decreased by -1.72% within the final 24 hours. Chainlink’s highest value was reached on Could 10, 2021, at an all-time excessive of $52.89, whereas its lowest value was recorded on Sep 23, 2017, at an all-time low of $0.126297. The bottom value since its all-time excessive was $5.36, and the best LINK value for the reason that final cycle low was $9.45.

At present, the Chainlink value prediction sentiment is bearish, whereas the Concern & Greed Index is displaying 64 (Greed). Chainlink’s present circulating provide is 517.10M LINK out of a most provide of 1.00B LINK. The present yearly provide inflation fee is 10.73%, which implies that 50.09M LINK had been created within the final 12 months. By way of market capitalization, Chainlink is at the moment ranked #4 within the DeFi Cash sector and ranked #7 within the Ethereum (ERC20) Tokens sector.

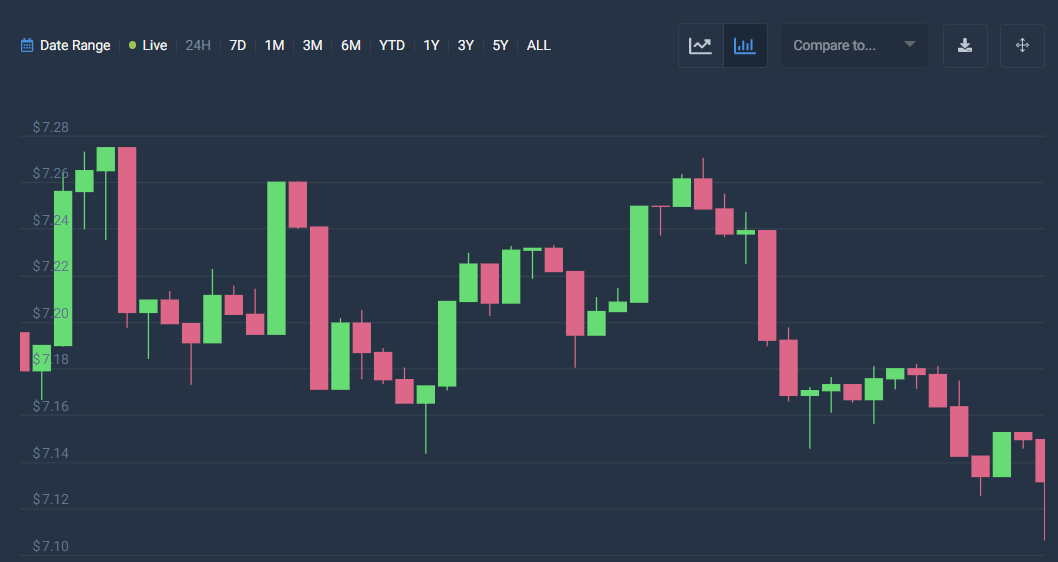

LINK/USD 1-day value evaluation: Newest developments

ChainLink value evaluation reveals a unstable market, with an upward pattern. This suggests that the value of ChainLink is displaying inclined dynamics towards change. The opening value of ChainLink is recorded at $7.15, with the best value additionally being $7.15. Nonetheless, the bottom value recorded is $7.11, and the shut value stays at $7.14. At present, the ChainLink market is experiencing a decline of 0.18%.

The worth of LINK/USD is at the moment beneath the Transferring Common, indicating a bearish pattern out there. The market appears to be dominated by bears; furthermore, the value of LINK/USD is declining, indicating a downward pattern. The market is displaying a bearish outlook with important potential for additional decline.

ChainLink value evaluation reveals that the Relative Power Index (RSI) is 51 displaying a steady cryptocurrency market. ChainLink is at the moment experiencing a section of devaluation the place its worth is lowering. The RSI rating is lowering because of the dominance of promoting actions, which is additional contributing to the downward motion out there.

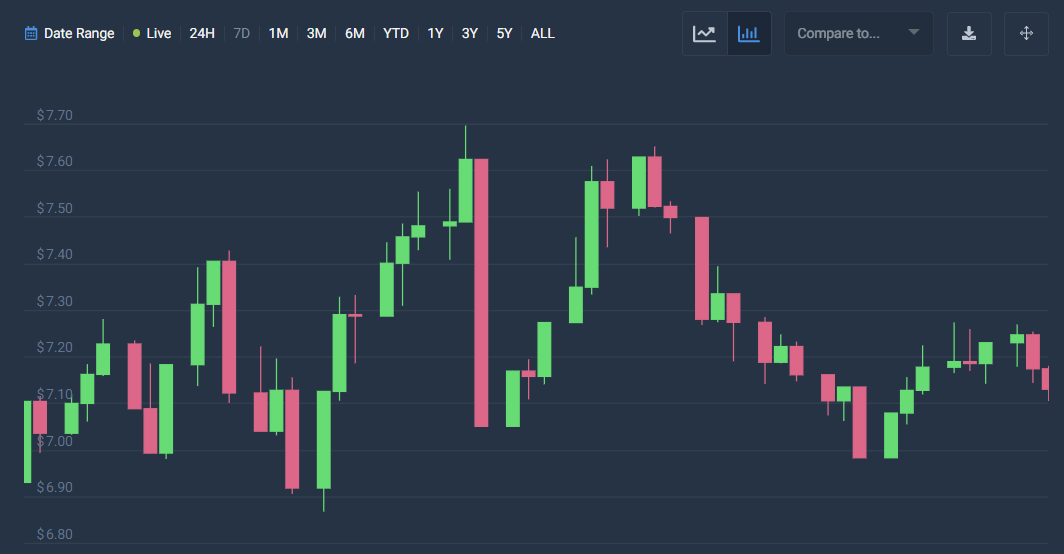

ChainLink value evaluation for 7-days

Upon conducting a ChainLink value evaluation, it may be noticed that the market is at the moment experiencing volatility after a interval of decline. This means that the value of ChainLink is changing into much less inclined to excessive modifications in both path. The opening value is recorded at $7.18, with the best value being $7.18. Alternatively, the bottom value is current at $7.11, depicting a change of -0.57%, whereas the shut value is recorded at $7.14.

Primarily based on the present market evaluation, the LINK/USD value is shifting below the Transferring Common value, indicating a bearish pattern out there. The pattern out there has proven bearish tendencies over the previous few hours, additional supporting this statement. Moreover, there was a damaging motion out there, leading to a lower within the worth of ChainLink and strengthening the bearish management out there.

Chainlink value evaluation reveals the Relative Power Index (RSI) to be 48, signifying a steady cryptocurrency. The present evaluation means that the LINK cryptocurrency is at the moment positioned within the central impartial area of the market. Moreover, the Relative Power Index (RSI) pattern signifies a shift towards a downward motion, which is commonly indicative of a bearish market. The lower within the RSI rating is additional proof of dominant promoting actions inside the market.

ChainLink Worth Evaluation Conclusion

Primarily based on the evaluation of Chainlink’s value, it may be inferred that the cryptocurrency is at the moment following a bearish pattern, indicating a major potential for damaging market exercise. Moreover, the prevailing market situations exhibit a downward trajectory, suggesting the potential of additional value depreciation sooner or later.