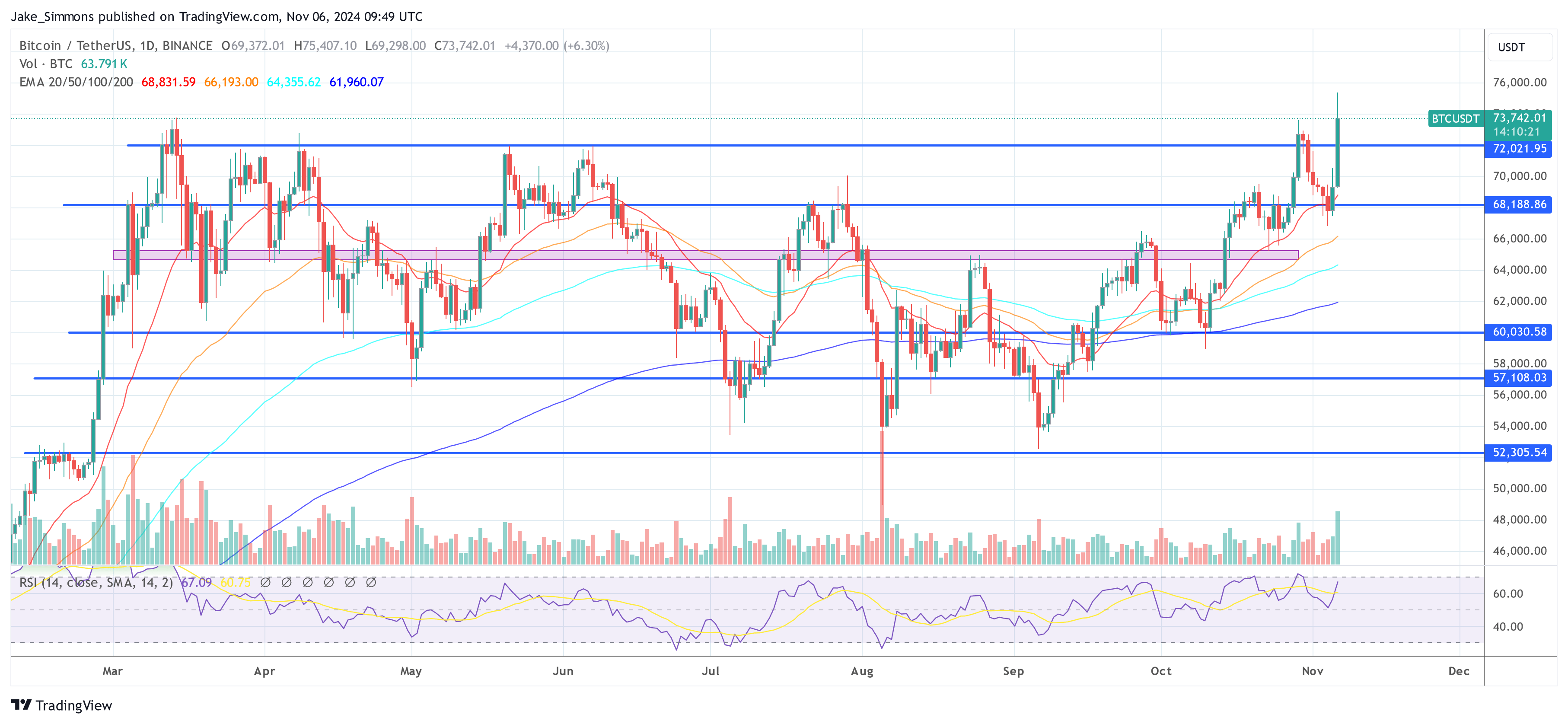

The 2024 US presidential election is determined. Donald Trump will get a second time period, defeating Kamala Harris. Within the midst of election night time, the Bitcoin value rose to a brand new all-time excessive of $75,407 on Binance.

The euphoria is pushed by Trump’s huge election guarantees. He needs to determine Bitcoin as a nationwide strategic stockpile, fireplace Securities and Alternate Fee (SEC) Chairman Gary Gensler and customarily implement a crypto-friendly coverage. Whereas a Harris victory would have meant a short-term setback for Bitcoin in keeping with most consultants, the predictions by nearly all of consultants are extraordinarily bullish due to the Trump victory.

Nevertheless, famend economist Henrik Zeberg gives a cautionary perspective. Zeberg warns that Trump’s proposed financial insurance policies might precipitate a US recession, resulting in a “blow-off prime” situation for Bitcoin and the broader crypto market. Central to his argument is Trump’s plan to interchange sure taxes with tariffs to stimulate home financial progress.

Is A Bitcoin Blow-Off High State of affairs Looming?

Drawing parallels with historic occasions, Zeberg means that Trump’s tariff technique might echo the financial missteps of the Twenties and Nineteen Thirties. In a submit on X, he shared a hyperlink to the Wikipedia web page for the Smoot-Hawley Tariff Act of 1930. He acknowledged: “Now all the pieces is lined up for historical past to repeat itself. US Tariffs carried out right into a Recession—reinforcing the downturn and popping the Best Bubble ever.”

Associated Studying

The Smoot-Hawley Tariff Act is broadly thought to be a catalyst that deepened the Nice Melancholy. By considerably rising US tariffs on imported items, the act prompted retaliatory tariffs from different nations, resulting in a extreme contraction in worldwide commerce. This protectionist spiral exacerbated world financial decline, leading to heightened unemployment and extended hardship worldwide.

Amid these financial considerations, Zeberg has projected a big, but probably short-lived, surge in Bitcoin’s value. “Making it Easy! BTC goal 115-123K,” he asserted through X a couple of days in the past. His evaluation is grounded in Fibonacci extension ranges—a technical evaluation software used to foretell future value actions based mostly on historic value patterns.

Associated Studying

In accordance with Zeberg’s evaluation, the essential stage to watch is the 1.618 Fibonacci extension, calculated at $114,916.16. He means that this stage is “very possible the highest,” indicating that Bitcoin might attain this value level earlier than experiencing a big reversal.

The evaluation additionally notes different key Fibonacci ranges that will function resistance factors throughout Bitcoin’s ascent. The 0.382 stage at $77,437.88 marks a big preliminary resistance following the breakout from the earlier all-time excessive.

The 0.618 stage at $85,205.47 might act as minor resistance as the worth climbs. Moreover, the 1.0 stage at $107,435.71 represents an important psychological and technical threshold, whereas the 1.27 stage at $123,148.19 signifies a potential overshoot past the first goal zone.

An annotation on Zeberg’s chart poses the query, “58% in lower than 3 months into the highest?” This implies he anticipates a fast value enhance inside a comparatively brief time-frame, in step with historic patterns.

At press time, BTC traded at $73,742.

Featured picture created with DALL.E, chart from TradingView.com