It’s been a busy week for Tether, as the corporate introduced that it had licensed the minting of one other 1 billion USDT tokens, pushing the whole variety of minted tokens to $33 billion within the final 12 months. Based on blockchain knowledge, the extra tokens have been minted on the Tron community and instantly despatched to the corporate’s treasury pockets.

Whale Alert additionally confirmed the newest transaction final Tuesday at round 20:43 (UTC). The corporate’s newest replenishment order has sparked hypothesis of accelerating demand and a possible worth surge.

1,000,000,000 #USDT (999,750,000 USD) minted at Tether Treasuryhttps://t.co/Vxw2yhfwTY

— Whale Alert (@whale_alert) October 29, 2024

Tether CEO Confirms New Mint, Saying It’s ‘Approved However Not Issued’

Paolo Ardoino, Tether’s CEO, has confirmed this newest mint order, saying that the transaction was “licensed however not issued.” In blockchain parlance, the newly minted USDT tokens on the Tron community should not but circulating however are nonetheless a part of the corporate’s stock. In brief, these are simply in storage, prepared for the subsequent batch of chain swaps and issuance requests.

The corporate formally disclosed the minting order on its transparency web page. The newly minted tokens totaling $1.05 billion are listed beneath the “licensed however not issued” column of USDT.

USDT: Issuance At Tron Reaches $20 Billion

Tether is experiencing a surge in demand, mirrored within the variety of tokens minted on the Tron community final 12 months. To this point, as of October twenty ninth, the Tron community had minted $20 billion in tokens. The Tron community occupies a particular place in USDT’s ecosystem, accounting for greater than half of the whole USDT tokens in circulation.

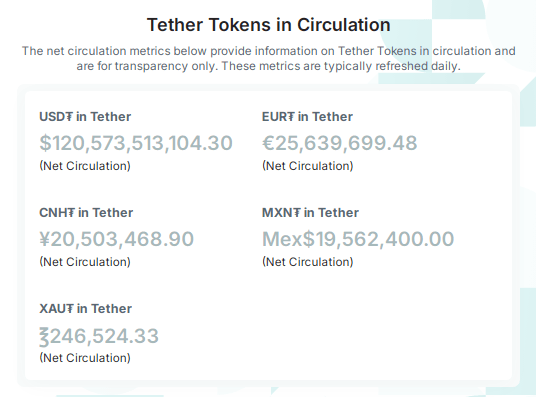

Based on the newest knowledge obtainable, as many as $120 billion Tether tokens are in circulation; greater than 51% and about 61.7 billion are saved on the Tron community. Ethereum represents the second largest USDT reserve, which is about 45% of $55 billion. All in all, Tether nonetheless leads as a stablecoin issuer with a share of greater than 67% of the general stablecoins in circulation.

What’s Subsequent For Tether?

The newest mint order has raised questions on what the longer term holds for Tether’s USDT tokens. One of many assumptions is that the latest spike in bitcoin worth had brought on a rise within the stablecoins. “after they print, we go increased,” one person posted on social media, relating it to the minting of contemporary tokens to fulfill future requests for the issuances.

Historically, the minting and deployment of stablecoins sign an rising demand for crypto in a bullish market. A rise in stablecoin’s provide typically pushes cryptos’ market costs. For instance, when Tether launched $3 billion value of USDT tokens final August, Bitcoin’s worth stabilized after dipping beneath the $50,000 degree.

Featured picture from Tether.io, chart from TradingView