Bitcoin at the moment ranges between $65,000 and $69,500 following two weeks of bullish value motion, sparking renewed optimism amongst analysts and buyers. The prevailing sentiment is that BTC is on the verge of reaching new all-time highs within the coming weeks, with confidence constructing that March’s cycle high predictions might have been untimely.

Associated Studying

Key metrics from CryptoQuant reveal that Bitcoin remains to be removed from typical cycle-top situations, as an alternative signaling a bullish outlook as we transfer into November. Because the U.S. election approaches November 5 and macroeconomic components proceed to shift, value motion is anticipated to stay unpredictable and risky.

Market contributors are watching intently, anticipating that geopolitical and financial occasions might affect BTC’s trajectory. Given this context, many consider the subsequent main transfer for Bitcoin might catalyze a contemporary leg up, probably breaking by earlier highs.

Bitcoin Calm Earlier than The Storm?

Bitcoin is holding agency above $67,000, displaying resilience because it edges to a possible breakout above $70,000. Nonetheless, the present value motion signifies that Bitcoin might consolidate under this key degree earlier than transferring as much as new highs within the subsequent leg. Market contributors intently watch BTC’s conduct round these value ranges, as a sustained push above $70,000 might set the stage for vital good points.

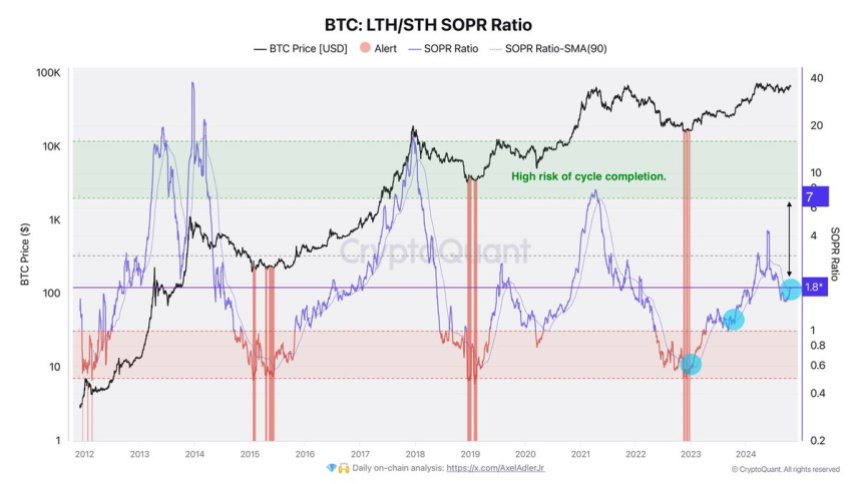

CryptoQuant analyst Axel Adler just lately shared vital insights on X, highlighting the present Lengthy-Time period Holder (LTH) to Quick-Time period Holder (STH) SOPR Ratio, which sits at 1.8. This metric is commonly used to gauge promoting strain and market sentiment, with increased ranges indicating elevated profit-taking that might sign a market peak.

In response to Adler, when this ratio climbs to round 7, Bitcoin will likely be nearing a cycle end result. The ratio’s bullish cross with its 90-day transferring common displays a optimistic outlook, supporting the narrative that BTC stays nicely under its cycle high.

Associated Studying

This metric’s motion and broader market power paint a good image for Bitcoin’s value motion within the coming weeks. The info means that Bitcoin nonetheless has room to develop inside this cycle, offering confidence to long-term holders and buyers searching for continued upside.

BTC Technical Ranges

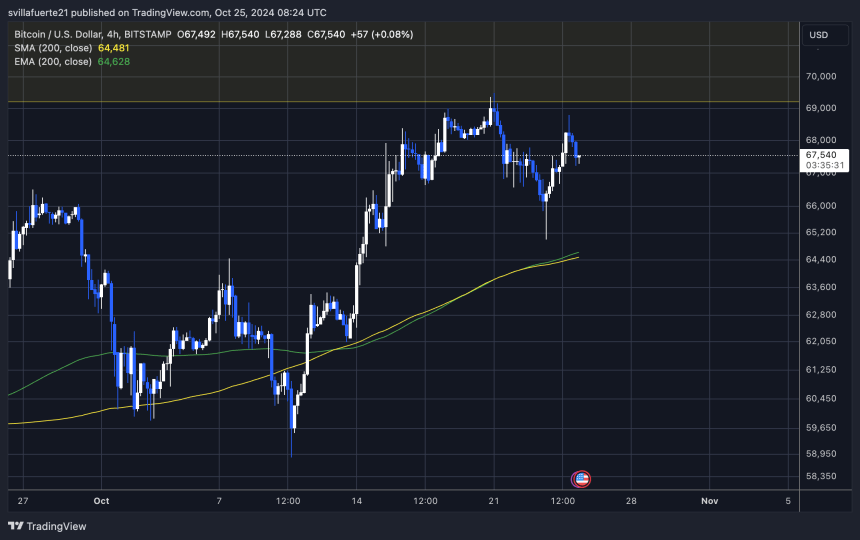

Bitcoin is buying and selling at $67,500, dealing with challenges after failing to take care of its bullish construction on the 4-hour chart. The worth couldn’t set a brand new excessive above $69,500, marking a possible shift in momentum. An important help degree now sits at $65,000, the native low that beforehand held the bullish development intact. Holding above this degree is important to stop a broader retrace and keep confidence amongst bulls.

At the moment, value motion stays indecisive, leaving the route for the approaching days unclear. A breakout above $69,500 would restore the bullish construction, possible drawing extra consumers into the market and signaling one other rally try. Conversely, a break under the $65,000 help would sign a retrace, probably main BTC to decrease demand zones as bulls look to regroup.

Associated Studying

The present consolidation part highlights the significance of those ranges in figuring out Bitcoin’s short-term trajectory. With each bulls and bears vying for management, BTC’s potential to carry above $65,000 will likely be essential to retaining bullish sentiment.

Featured picture from Dall-E, chart from TradingView