Bitcoin (BTC) has surged previous the $65,000 mark, renewing merchants’ optimism for an “Uptober” rally that might lengthen the digital asset’s bullish momentum.

Is The Bitcoin “Uptober” Rally Lastly Right here?

Within the early hours of October 15, Bitcoin briefly crossed $66,000 earlier than retracing to $65,964 on the time of writing. Over the previous 24 hours, BTC has gained 1.4%.

In line with a report by crypto alternate Bitfinex, Bitcoin’s decisive transfer previous the essential $63,000 resistance stage, mixed with encouraging on-chain metrics, factors towards additional potential upside transfer.

Associated Studying

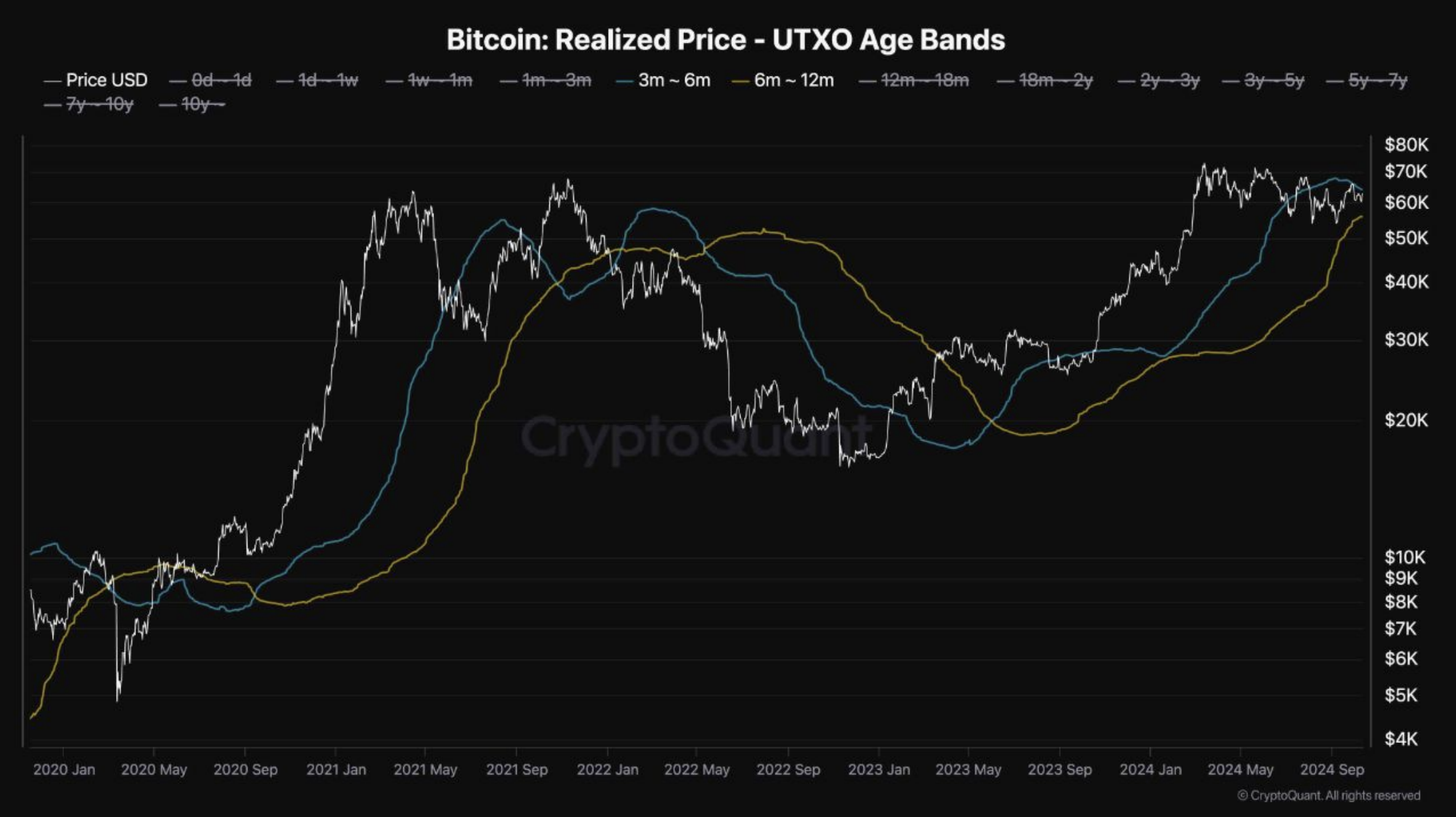

The report mentions that Bitcoin’s realized value of unspent transactions output (UTXO) age bands are a “pivotal on-chain metric for gauging Bitcoin’s market dynamics.”

For the uninitiated, Bitcoin’s UTXO age bands check with the worth at which totally different teams of BTC – based mostly on their holding length – had been final moved. Primarily, it helps observe the common buy value throughout varied age teams of BTC holders, indicating market sentiment and the profitability of particular cohorts.

Notably, the common realized costs for short-term (3-6 months) and mid-term (6-12 months) holders have traditionally been key assist or resistance ranges. The short-term holder value is round $63,000, whereas the mid-term holder value is $55,000.

When Bitcoin trades under the common buy value of those teams, it usually alerts a bearish development. Conversely, a transfer above these ranges can point out bullish momentum.

Since BTC has surpassed the $63,000 resistance, additional beneficial properties may very well be in sight. Nevertheless, a failure to shut above this stage might have triggered a possible decline towards $55,000.

Market Shows Sturdy Urge for food For Digital Belongings

The report highlights BTC’s weak value motion on October 10, when it fell to $58,943 on account of lack of aggressive shopping for within the spot market. Per the report, the vast majority of the promoting originated on Coinbase.

Associated Studying

The report mentions the Coinbase Premium Hole Indicator (CPGI) – a metric that exhibits the distinction between the BTC-dollar pair on Coinbase versus different main centralized exchanges.

The CPGI decreased by 100 factors as BTC’s value declined under $59,000. The report notes that throughout the previous 12 months, anytime the CPGI fell under 50 factors, BTC value has witnessed a subsequent restoration. The report provides:

Bitcoin has been buying and selling inside a broad vary for the previous eight months. Within the occasion of the onset of a bear market, promoting usually ensues when the Coinbase Premium turns destructive. Nevertheless, such promoting has not been noticed, suggesting that regardless of the fluctuations, the market stays comparatively secure with out widespread fear-driven divestment. This resilience might point out underlying energy or a balanced market sentiment that will steer future value actions.

This evaluation aligns with a separate report by crypto agency QCP Capital, which famous that the shallow sell-off within the crypto market following geopolitical tensions between Iran and Israel signifies sustained demand for risk-on property.

In associated information, BTC bulls will likely be relieved to be taught that the defunct crypto alternate Mt. Gox has delayed its compensation till October 2025, probably easing strain on spot promoting.

Nevertheless, some analysts warn that BTC might face value capitulation on account of tightening on-chain liquidity. On the time of writing, Bitcoin trades at $65,964, up 1.4% up to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and Tradingview.com