A sooner onboarding course of for business-focused digital financial institution Grasshopper is on the core of its new partnership with MANTL.

Grasshopper, which relaunched a yr in the past and reported a vital progress in 2022, will use MANTL’s digital industrial deposit origination course of to create a extra favorable buyer expertise.

MANTL is a fintech agency providing omnichannel account origination software program for banks and credit score unions.

“The preliminary platform launch will likely be over the subsequent two months or much less. We’ll be stay digitally opening accounts for and onboarding small companies searching for checking/financial savings accounts, so deposit merchandise,” Chris Tremont, the chief digital officer of Grasshopper Financial institution, stated in a current interview.

Earlier this month, Grasshopper reported a 124 % rise in deposits to greater than $549 million and a 262 % enhance in loans to greater than $450 million. Compared, whole income surpassed $17 million, a 239 % enhance yr over yr.

Grasshopper focuses on SMBs

Grasshopper focuses on attracting and serving small- to medium-sized companies throughout the US which are snug doing enterprise digitally.

“Our purpose is to collect deposits, and we really feel like that’s the place you construct the connection,” Tremont stated. “You could have a few of that knowledge. If it turns into your most important enterprise working account, and also you’re transacting, loads of knowledge flows by them, the place you’re feeling snug making a choice. The first step is that deposit relationship.

“Providing the credit score, a minimum of you may make a pre-approval choice. Then behind the scenes, our firm and MANTL work with some subtle know-your-business sort corporations that may do that, which have this knowledge, whether or not it could transcend only a FICO rating, the place you’re doing a little money stream and underwriting. It’s like this versus having to be on the opposite finish of that on the financial institution, spending days spreading statements and underwriting a deal.

“In order that’s the purpose: to resolve shortly on a few of these smaller-dollar loans to our present purchasers.”

MANTL expertise ‘greatest in school’

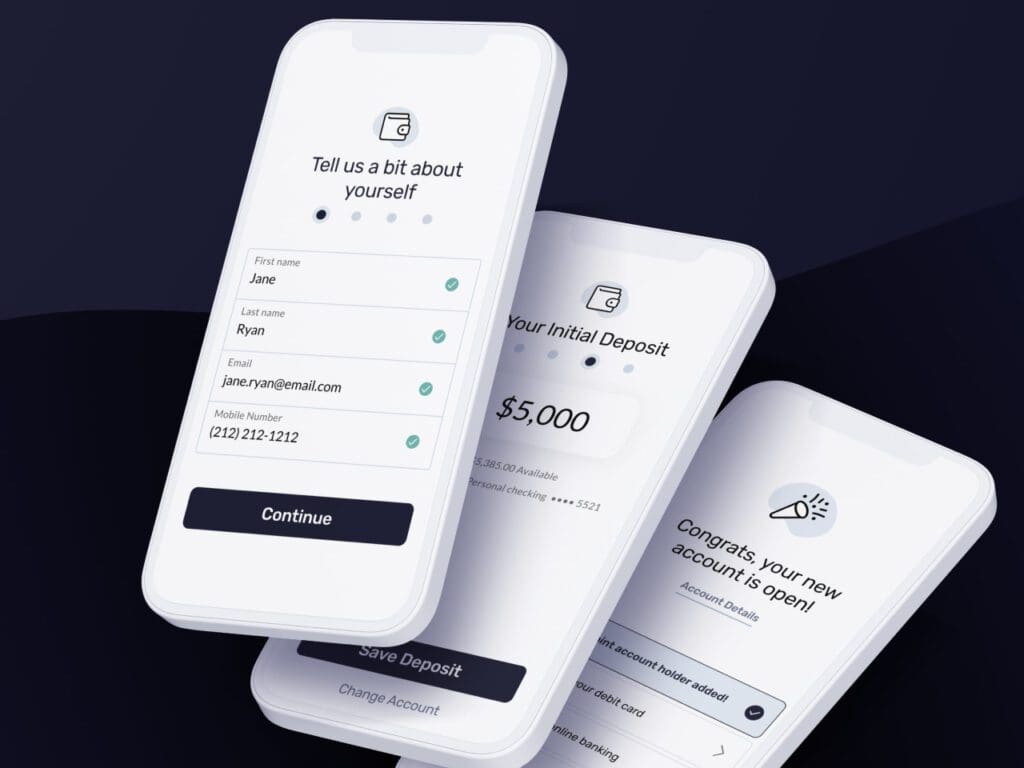

The New York-based Grasshopper partnered with MANTL “to boost and streamline its present on-line enterprise account opening course of, empowering the financial institution to unlock new income streams and scale effectively whereas delivering best-in-class digital banking experiences to the SMB market,” in line with a media launch.

Grasshopper is utilizing the Business Deposit Origination platform, which MANTL purports to be among the many quickest and best-performing options available on the market. This partnership will simplify doc assortment for Grasshopper, eliminating guide processes.

MANTL’s digital platform automates as much as 97 % of software choices for a easy, fast, intuitive onboarding expertise.

“Permitting a small- or medium-sized enterprise to open an account in in all probability below 10 minutes with none paper or have to depart the consolation of their house or workplace to take action, we’re going to get that stay,” Tremont stated.

“The following focus will then be on providing these purchasers a mortgage digitally as nicely and with the ability to originate and onboard that mortgage seamlessly the way in which we did for deposits.”