The rise and rise of Jack Dorsey and his fintech powerhouse, Block, was threatened yesterday by a damning report from quick sellers, Hindenburg Analysis.

Claiming fraud and manipulation, with actions to help the operations of criminals, the analysis group set forth various factors that they allege show Dorsey’s wrong-doing.

After all, Dorsey has denied the allegations and has introduced he will probably be exploring authorized motion in opposition to the group for publishing the “factually inaccurate and deceptive report.”

“We’re a extremely regulated public firm with common disclosures, and are assured in our merchandise, reporting compliance packages, and controls,” he continued. “We is not going to be distracted by typical short-seller techniques.”

Shareholders weren’t satisfied, and shares took a dive as a response.

The fintech darling falls from grace.

Like most of the fintechs which have made headlines not too long ago for all of the mistaken causes, Block was a poster little one of the trade.

Previously generally known as Sq., the corporate burst into the funds sector in 2009 with a revolutionary concept that claimed to make card funds accessible for even the smallest service provider.

With its pocket-sized tap-to-pay gadget that plugged into retailers’ mobiles, the corporate rose to stardom, gaining a valuation of $3 billion on the time of its public itemizing in 2015.

By 2022, the agency had modified its title to Block and grown right into a $54 billion powerhouse. Touting FDIC-backed financial institution accounts with associate banks, a funds platform, inventory and crypto buying and selling services, and bodily debit playing cards (in addition to acquired BNPL supplier, Afterpay), the founders stood by their mantra of “offering financial empowerment” for the unbanked and underbanked.

Maybe too frictionless

The Hindenburg report focuses totally on CashApp, the corporate’s peer-to-peer fee app that facilitates the frictionless motion of cash between clients and investments.

They stated the “empowerment” of the unbanked and underbanked had prolonged to probably the most underbanked teams of all – criminals.

The quick sellers allege that the corporate inflated studies of consumer accounts, permitting clients to create a number of accounts and facilitating id fraud and felony scams. In response to the report, former staff estimated between 40%-75% of accounts have been false.

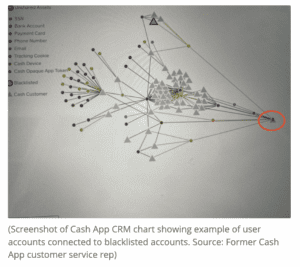

“Even when customers have been caught participating in fraud or different prohibited exercise, Block blacklisted the account with out banning the consumer,” learn the report, alleging that most of the flagged accounts have been usually related to many different lively accounts.

Intercourse trafficking, drug dealing, and COVID-relief fee fraud are simply among the actions Hindenburg defined have been facilitated by the app on account of “frictionless” insurance policies and lax compliance measures.

To show their level, Hindenburg executed a plan to arrange an account and obtain a fee card underneath the title Donald J Trump, claiming a whole lot of different clients have carried out the identical. The result’s a community of “Donald Trumps” and “Elon Musks”.

The group claimed these actions bloated numbers through the pandemic, inflicting the corporate to soar to success through the pandemic. All of the whereas, the founders are stated to have cashed out over $1 billion in inventory, guaranteeing “they are going to be positive, whatever the end result for everybody else.”

As well as, the group claimed that most of the statements Block and Dorsey himself had made about their companies have been deceptive. Bloating numbers within the face of competitors and failing acquisitions had apparently turn into commonplace.

Afterpay additionally comes underneath fireplace.

Except for the allegations of facilitating fraud by way of Money App, Hindenburg additionally introduced the Afterpay acquisition into their sights.

The deal closed in 2022, permitting Block to convey their clients a BNPL platform that they stated would add to the Money App providing, “supporting shoppers with versatile, accountable fee choices.”

Nonetheless, the quick sellers have stated the acquisition was extra an try and keep away from accountable lending and client safety legal guidelines in Australia. Consequently, the group has stated the platform facilitates a cycle of debt that makes the corporate cash whereas preying on weak clients.

That is an argument the BNPL sector has confronted quite a few occasions, however Hindenburg has made Block’s actions within the sector look significantly predatory, outlining an consciousness in stability sheets of heightened delinquency charges whereas the corporate claimed to be “a accountable client product sponsored by charges from retailers.”

“A banker” in a tie-die costume

Consequently, Hindenburg Analysis has deemed Block, with Jack Dorsey on the helm, akin to “a standard monetary companies firm.”

With this, as they put it, the corporate’s “key focus appears to be on dressing up predatory loans and charges as revolutionary merchandise, avoiding regulation and embracing worst-of-breed compliance insurance policies to be able to revenue from its facilitation of fraud in opposition to shoppers and the federal government.”

Whether or not Dorsey and Block, like many others who’ve been the topic of a Hindenburg report, will face an investigation stays to be seen. Dorsey has launched, all weapons blazing, right into a full denial protection.

Nonetheless, Block’s shares took successful, and whereas they’ve since crept up barely, doubt hangs within the air – Maybe Dorsey’s shining imaginative and prescient of a monetary firm “for the individuals” might by no means recuperate.

RELATED: Block reveals resilience and a refocused funding framework