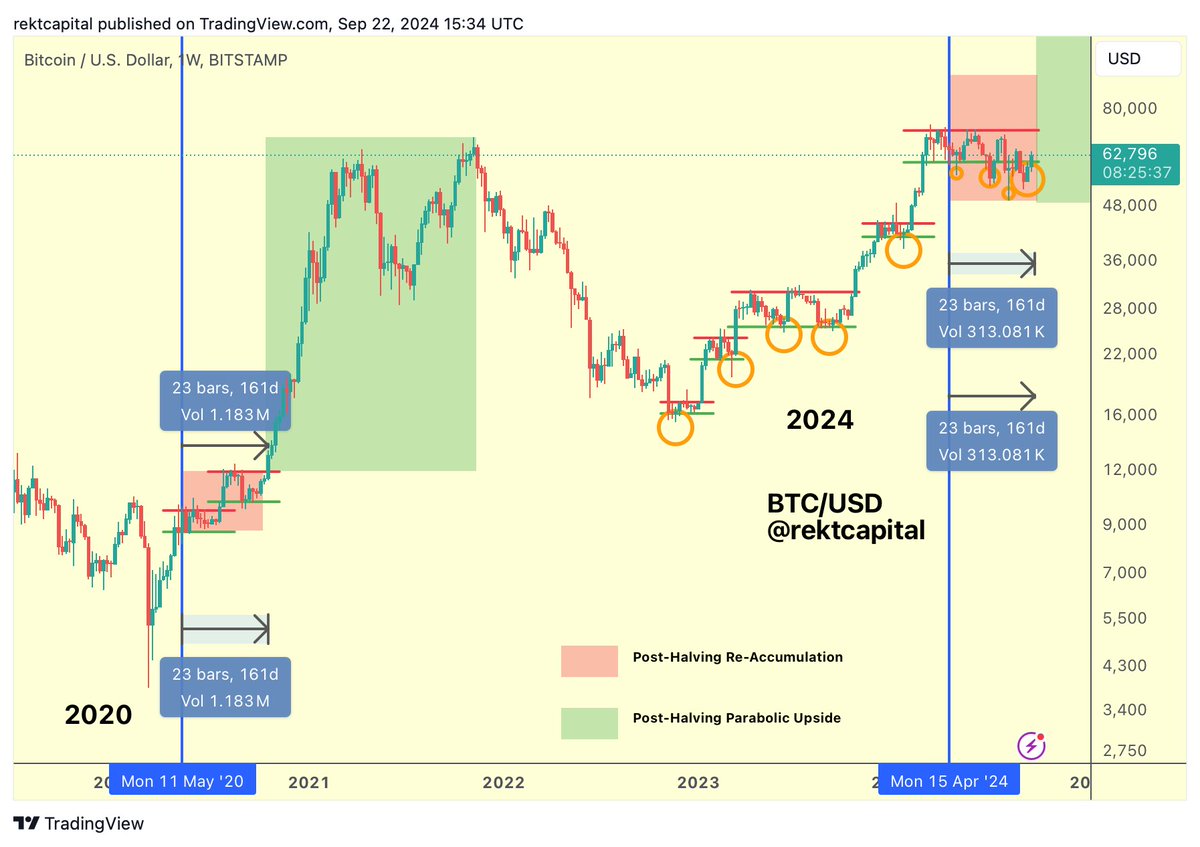

Bitcoin has reached a vital milestone 161 days after its April halving, mirroring a pivotal second from 2020 when the digital asset broke out from its reaccumulation vary. Rekt Capital highlighted this temporal alignment, noting that in 2020, Bitcoin started a major upward transfer precisely 161 days post-halving.

Rekt Capital’s chart under compares the post-halving durations of 2020 and 2024 and divulges hanging similarities. Each instances, Bitcoin entered a reaccumulation section lasting roughly 161 days after the halving occasions. In 2020, this era culminated in a parabolic rally as Bitcoin broke by means of resistance ranges it had repeatedly examined.

Help and resistance ranges in each durations present constant testing and retesting, forming a basis for potential upward momentum. Rounded backside patterns noticed within the charts sign accumulation and will additional help the breakout thesis.

Whereas historic patterns point out the potential for a major transfer, variations in market circumstances, reminiscent of quantity, spotlight that outcomes is probably not equivalent.

A notable distinction between the 2 durations is the buying and selling quantity on the chart, which makes use of Bitstamp. In 2020, Bitstamp’s quantity through the 161-day post-halving interval was 1.183 million, whereas in 2024, it stands at 313,081. This divergence suggests a change in market participation, which might affect the character of any potential breakout.

Throughout all exchanges, CryptoSlate’s chart under exhibits 2.5 million in buying and selling quantity since this 12 months’s halving, whereas there have been 4 million within the 161 days after the 2020 halving. This confirms the discount in quantity for the reason that comparative interval final cycle. Nonetheless, the drop in quantity just isn’t as drastic in relative phrases.

Bitstamp noticed a 73% decline, whereas TradingView’s mixed index depicts a 37% lower.