Fast Take

In keeping with a latest SEC submitting, the Morgan Stanley Institutional Fund, Inc. – Counterpoint International Portfolio reported complete internet property of $10,042,729 as of June 30, 2024. The portfolio holds 216 completely different investments and has a portfolio turnover price of 51% for the primary half of the 12 months.

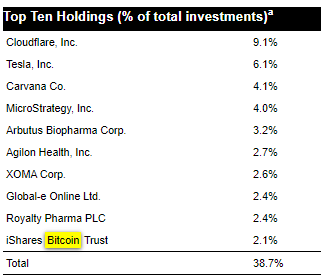

Among the many portfolio’s high ten holdings, notable investments embody the iShares Bitcoin Belief (BlackRock IBIT ETF), which represents 2.1% of complete property—roughly a $211,000 stake. MicroStrategy, recognized for its vital Bitcoin holdings, ranks fourth with a 4.0% portfolio weighting, or roughly a $402,000 funding. Whereas not a devoted digital property firm, Tesla is the second-largest holding, accounting for six.1% of the portfolio, reflecting its notable Bitcoin publicity as a part of its company technique.

These positions spotlight the portfolio’s vital publicity to digital property and associated corporations, reflecting a broader curiosity in Bitcoin and its affect on the company sector.