Who’re the neatest folks within the crypto room, and what are they doing with their capital?

“Sensible cash” is the moniker assigned to a loosely outlined group of traders and merchants who’ve an edge of their buying and selling actions, usually just because they’ve extra capital at their disposal.

The argument is that these with extra capital have extra assets and extra to lose. Due to this, different, smaller traders wish to understand how they’re spending their cash.

You’re studying Crypto Lengthy & Quick, our weekly e-newsletter that includes insights, information and evaluation for the skilled investor. Join right here to get it in your inbox each Wednesday.

To make sure, “good cash” has appeared something however.

In 1998, Lengthy Time period Capital and its staff of PhDs required a $3.6 billion bailout, spurred by extreme leverage and poor buying and selling outcomes.

Ten years later, the 2008 monetary disaster served as one other instance when the neatest folks within the room required federal help to offset buying and selling losses.

Most lately in crypto, the failures of FTX, Alameda Analysis, Three Arrows Capital and others confirmed the neatest folks within the room making catastrophic errors.

So does watching what others are doing make sense in any respect?

I say, undoubtedly sure. Whilst you ought to decide your total thesis, seeing how capital is flowing can present useful insights. Excluding outright fraud, checking the good cash – or so-called giant capital flows – at all times is smart.

Even when poor outcomes can occur with a sound thesis (perhaps an sudden occasion modifications situations), what issues is the extent to which these people or establishments can sway markets by their mere presence. Like a big ocean vessel, giant capital flows usually take different issues with it, even when they’re shifting towards an iceberg. Gauging the vessel’s path forward of time can supply clues into how intently you wish to courtroom catastrophe and what number of life jackets you carry alongside.

In crypto, a variety of on-line instruments can present real-time perception into how capital is shifting. These instruments are a uniquely admirable attribute of blockchain primarily based property.

A few of the instruments differ, relying on the asset. For bitcoin (BTC), one possibility is “whale exercise.” Whales are distinctive pockets addresses with 1,000 or extra cash.

The 1,000 quantity feels arbitrary, however the implied minimal BTC portfolio worth of $28 million at the moment, and almost $70 million at its peak, feels adequately giant to supply some bigger investing guideposts.

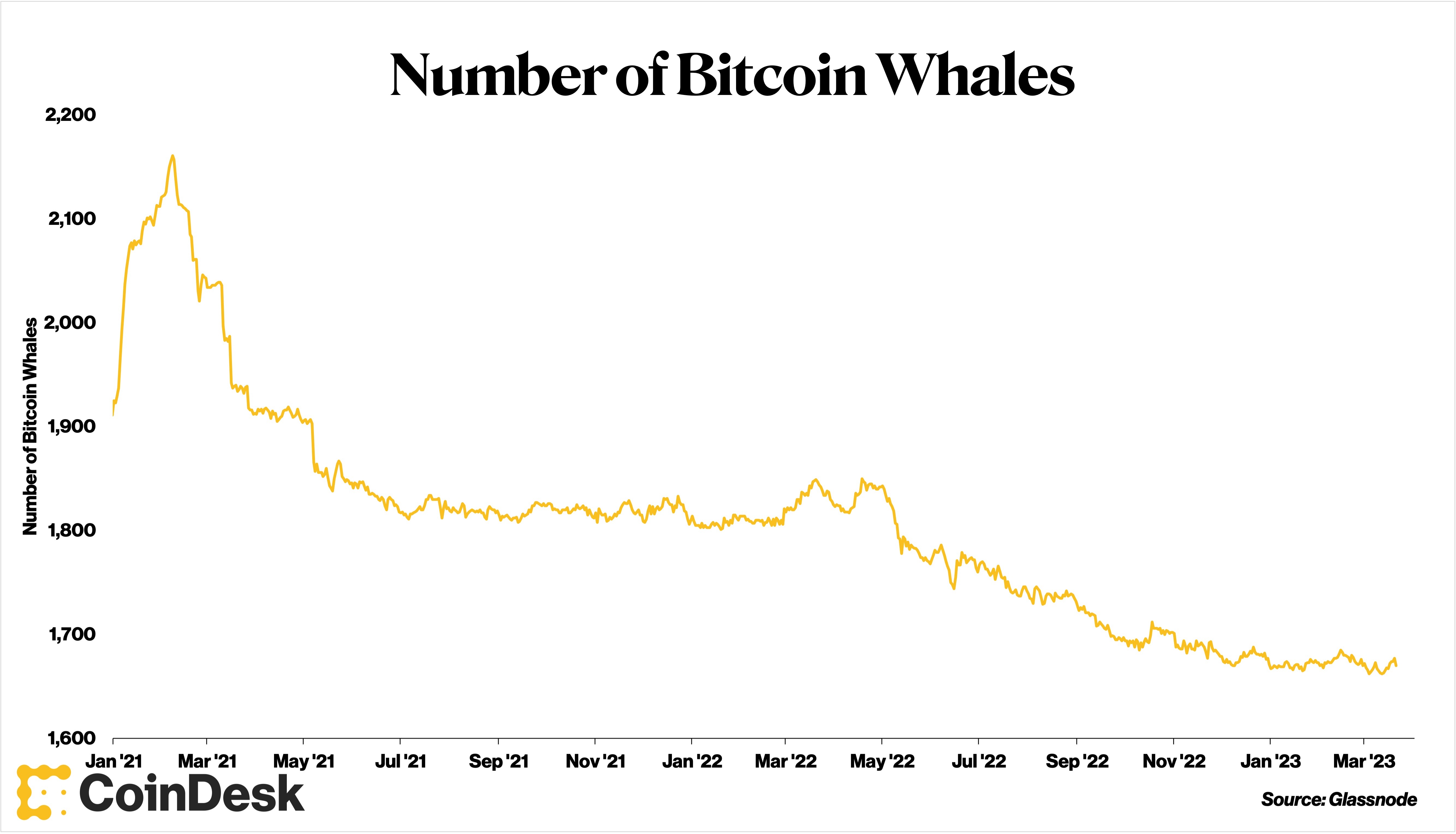

One metric of be aware is solely the decline within the variety of whales over the past two years.

(Sage Younger/CoinDesk)

Since peaking at 2,157 in February 2021, the variety of whales has fallen by 22%. BTC’s worth, by comparability, has fallen by 41% over the identical time interval.

Taking a look at the place whales are sending cash can also be value contemplating. Are whales sending cash to or from exchanges? The previous has traditionally implied bearishness, whereas the latter normally signifies bullish sentiment.

Just lately, cash have been flowing to exchanges. The online alternate quantity for whales has been optimistic since October 2022.

These two components recommend that bigger traders have been cautious. Fewer whales exist, and those nonetheless round have their cash poised to promote. They may very well be incorrect, however figuring out what they’re doing is value figuring out.

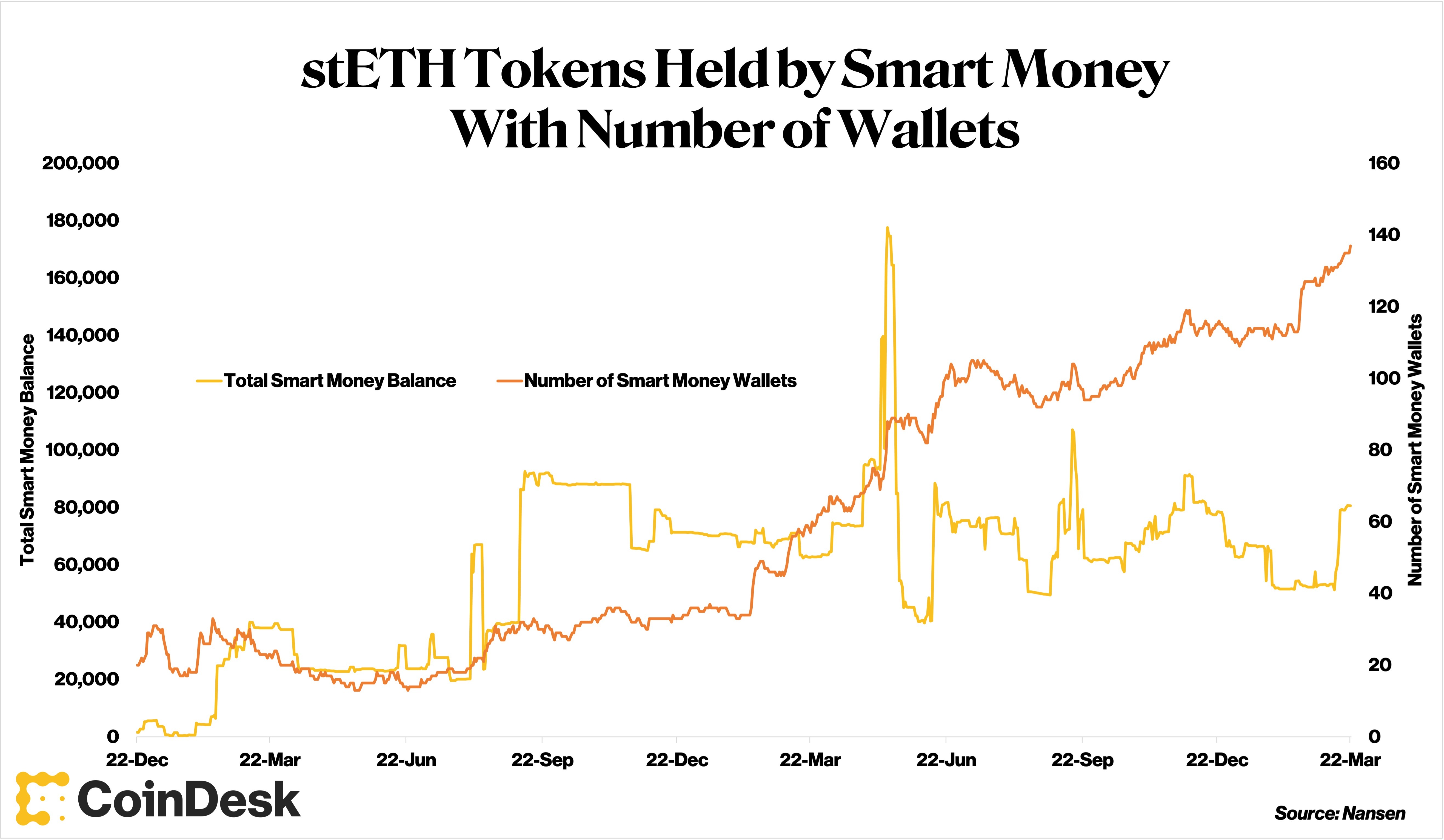

Instruments particular to ether (ETH) and altcoins can present extra layers of knowledge. Platforms equivalent to Nansen and Arkham Intelligence assign “good cash” labels to wallets primarily based on each capital and investing habits, and might present real-time appears into their exercise.

For instance, I’ve lately discovered that three cash with vital motion into “good cash” wallets over the past 30 days are liquid staked ether, Aave interest-bearing USDT and Binance USD (BUSD).

(Sage Younger/CoinDesk)

Taking a look at particular person funds, I discovered one whose largest recognized holding was UNI, an outlier from different bigger funds.

Filtering additional exhibits the fund’s acquisition of UNI occurred greater than a yr in the past, with little on-chain exercise since that point.

Two years in the past, UNI’s worth was $32 in comparison with $6 at the moment.

A fund holding an asset all through a downturn of that extent might point out vital long-term perception within the coin itself, a need to take part in Uniswap governance, or that the fund could reduce losses if and when UNI strikes increased.

A transparent reply will not be available, however traders can not less than see the chances, serving to them make knowledgeable selections.

Different current “good cash” strikes that stood out embrace:

-

A bigger fund eradicating wrapped ether (wETH) from exchanges, whereas depositing USDT, chainlink (LINK), and wrapped bitcoin (WBTC)

-

During the last seven days, there have been 4% and 27% declines, respectively, in stablecoins USDC and USDT held in good cash wallets; WETH held in such wallets elevated 12% over the identical time interval

-

Whereas the online circulate of BTC from whales to exchanges has been optimistic, it has additionally been trending downward since February

Figuring out and analyzing good cash strikes can devour hours, and might’t be utterly coated in a single column. However traders who take the time will improve their digital analysis.

A standard finance (TradFi) analogy could be a real-time dwell stream of 13F filings disclosing hedge fund positions in equities – laborious to maintain, but additionally laborious to look away from.

And whether or not an funding resolution leads to revenue or not, contemplating it from its inception is useful.

-

Making crypto historical past: On March 21, Coinbase made historical past, showing within the very first crypto case to go earlier than the U.S. Supreme courtroom. Nonetheless, the case wasn’t about digital property per se, however as an alternative how courts ought to deal with disputes about arbitration, non-public trials the place a impartial particular person (referred to as an arbitrator) listens to either side and comes to a decision. Briefly, Coinbase argued that if the courtroom says prospects can go to courtroom as an alternative of arbitration (despite what was outlined within the consumer settlement), then firms like Coinbase ought to be capable to put the brakes on the courtroom case till they’ve an opportunity to enchantment that call. Though this case could not have a direct impact on digital asset companies, it might have vital implications for Coinbase and different crypto firms in future conflicts with their shoppers.

-

A scathing critique: The Biden administration’s “Financial Report of the President,” revealed on March 20, took a swing at crypto, stating that varied points of the digital asset ecosystem are inflicting points for customers, the monetary system and the atmosphere. The report analyzed cryptocurrencies’ position as funding autos and fee instruments, in addition to their potential use in fee infrastructure, and claimed that “lots of them shouldn’t have a basic worth” whereas noting different points with the sector. The report, extra substantive in its therapy of digital property than different areas of monetary providers that wreaked havoc in current weeks, was a scathing critique that made their coverage place clear, leaving many within the crypto business feeling uneasy in regards to the future regulatory panorama.

-

Bitcoin discount? Bitcoin’s Community Worth to Transaction (NVT) ratio has decreased by 60% this yr, regardless of BTC’s worth growing by 68%. It’s because transaction exercise has outpaced worth development, indicating bullish sentiment and suggesting that bitcoin is presently undervalued. The NVT ratio measures an asset’s market capitalization in opposition to its community switch quantity and is used to look at the price of a digital asset. Equally, ether’s NVT ratio has decreased by 68% since January, whereas its worth elevated by 51%.

-

QE expectations: Bitcoin’s rally to $28,000 9 days precipitated Crypto Twitter to have fun in anticipation of an finish of financial tightening, an onset of a brand new quantitative easing (QE) and the daybreak of a brand new bull run. However the reason for this bullishness is much extra advanced than the simplistic causes that the “QE is again!” refrain would have you ever imagine, as Noelle Acheson, former head of analysis at CoinDesk, writes. What’s clear, nevertheless, is that considerations round banking and the debasement of the greenback have led to rising curiosity in bitcoin as a possible insurance coverage asset. This might trigger many funding managers, who had been watching from the sidelines, to recalibrate portfolios.

To listen to extra evaluation, click on right here for CoinDesk’s “Markets Each day Crypto Roundup” podcast.