Ethereum worth evaluation for in the present day reveals ETH has been buying and selling inside a slender vary above $1,700. Ethereum‘s worth has been fluctuating between $1,733.89 and a excessive of $1,821.46. Ethereum is buying and selling at $1,726, down 3.70% from the 24-hour excessive.

The cryptocurrency is being pushed by market sentiment as merchants await additional steering from the Federal Reserve, which meets later this week to determine on its newest coverage and outlook. The U.S. central financial institution might increase rates of interest as inflationary pressures construct within the economic system, one thing that would put a damper on Ethereum’s worth.

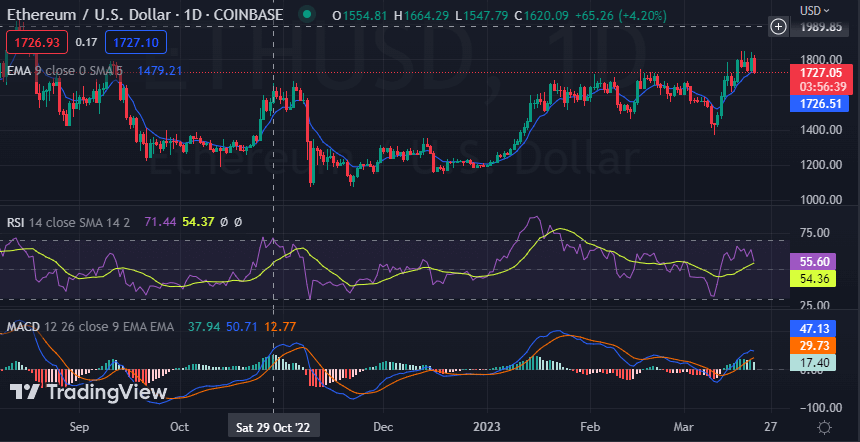

Ethereum worth evaluation on a every day chart: ETH consolidates above the $1,700 mark

The Ethereum worth evaluation on a every day ETH chart exhibits the cryptocurrency has been consolidating inside a slender vary for the previous few days. The assist stage is round $1,733.89, the place the worth has discovered some footing after hitting an intraday low of $1,732.87.

In the meantime, Ethereum’s relative energy index (RSI) is presently hovering on the 50 mark, indicating that the coin is buying and selling in impartial territory.

Ethereum has fashioned a descending triangle sample on the chart, which might result in an eventual breakdown if the bears acquire management. ETH worth has confronted a minor pullback close to the Fibonacci 0.786 retracement stage, which might act as a assist within the close to time period. The bearish sentiment painted by the favored momentum oscillators might trigger the Ethereum worth to maneuver decrease and retest the SMA 50 assist at $1,716.

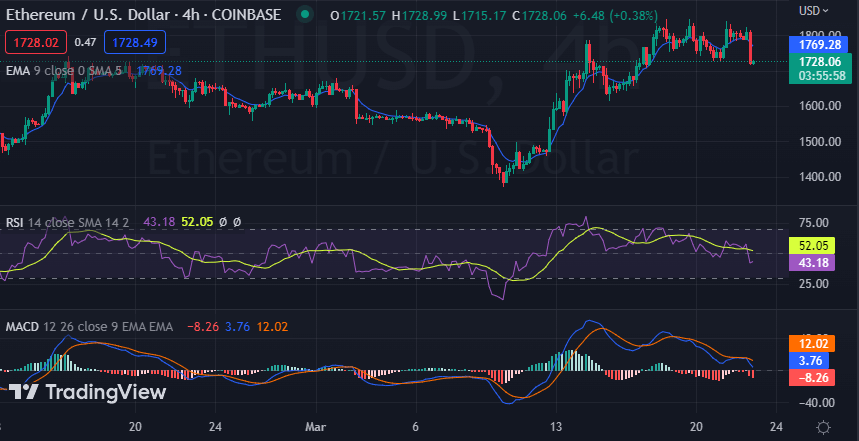

Ethereum worth evaluation on a 4-hour: ETH retraces from the intraday excessive

Ethereum’s 4-hour chart paints a bearish image, as ETH briefly touched the $1,821.46 stage earlier than retracing decrease. The MACD is trending within the bearish zone, whereas the RSI has dropped to 43.18, indicating that bears have taken management of the market. The cryptocurrency has fashioned a bearish flag sample on the 4-hour chart, which might result in additional draw back motion if it fails to interrupt above the higher trendline. The EMA50 and EMA100 resistances could act as sturdy limitations at $1,728.02 and $1,728.49, respectively.

The Fibonacci retracement ranges additionally level in direction of extra draw back motion, as ETH might drop to the 61.8% stage at $1,706.47 within the close to time period. In a bullish state of affairs, Ethereum might break above the higher trendline of the Fibonacci and type a bullish flag sample.

Ethereum worth evaluation conclusion

Ethereum’s current worth evaluation means that the coin is prone to transfer decrease within the close to time period. The bearish momentum painted by the technical indicators might push ETH to retest the $1,700 stage. Ethereum remains to be buying and selling inside a bullish zone and is prone to stay supported above the $1,700 mark within the close to time period. The important thing resistance ranges are round $1,750 and $1,800 if the bulls try to interrupt greater. If the bears acquire management, ETH might transfer decrease towards the $1,700 stage.